Having an exit strategy in place is an essential part of any business plan, which is why entrepreneurs should understand strategic vs. financial acquisitions. When considering a potential sale, you’ll focus on the buyer’s objectives for acquiring your company.

Evaluate offers by considering not only the pricing and valuation. But also if the buyers’ goals align with your future vision for the startup. Start by understanding the key differences between strategic acquisitions and financial acquisitions.

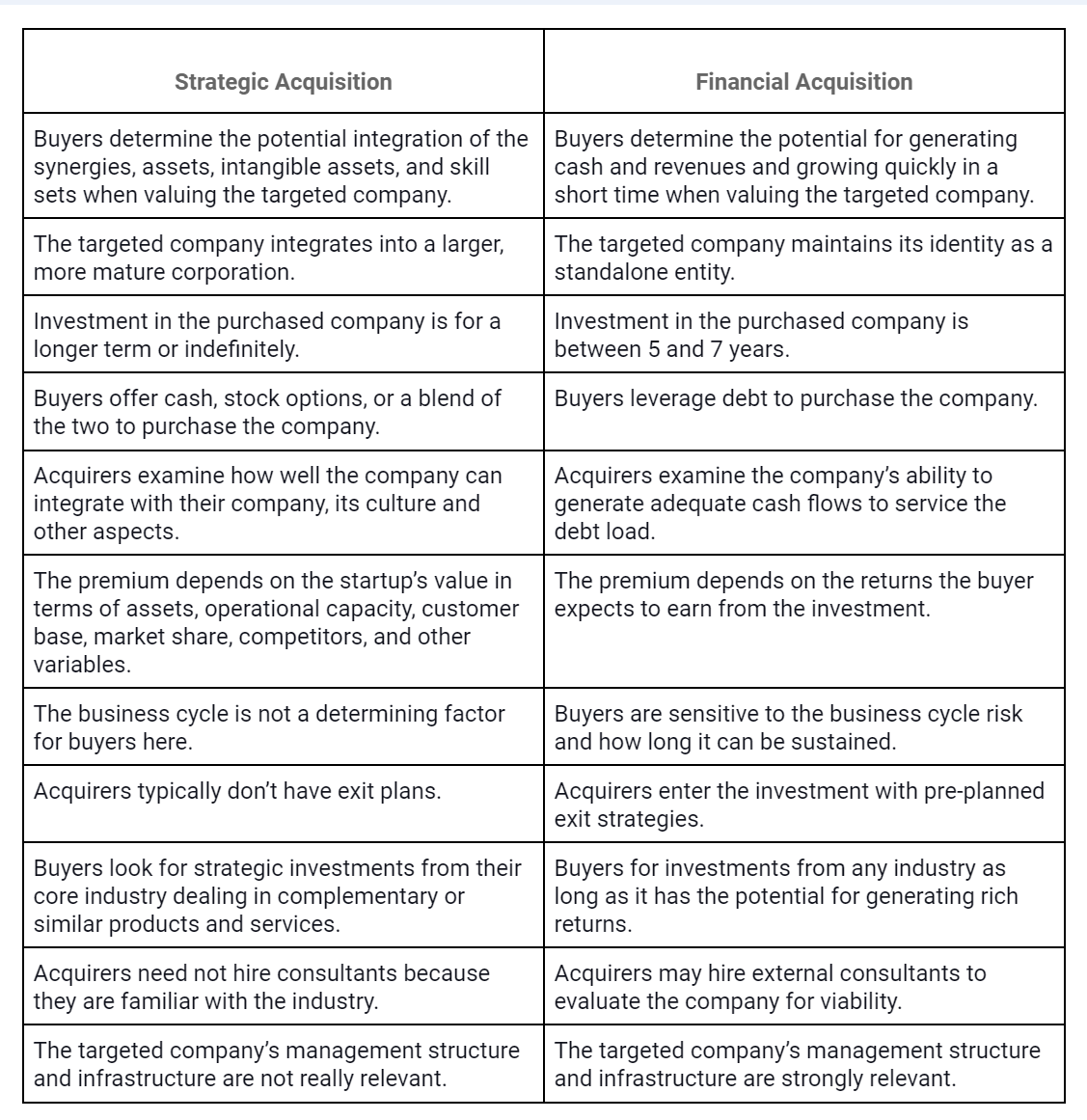

Essentially, strategic buyers are interested in the specific assets they’ll acquire and the market share they can develop. On the other hand, financial buyers are mainly concerned with the monetary returns they can generate from the transaction. Read ahead to understand more in detail.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Understanding Strategic Acquisitions

As a rule, in strategic vs. financial acquisitions, strategic buyers are open to paying a higher price for the company. While they may have multiple reasons for making you an offer, their objective is likely integration.

- Vertical integration is when the acquirer is looking for rapid expansion within the same vertical or adjacent space. They intend to accomplish this goal by taking over your customer base, vendors, and any other business partners.

- Horizontal integration is when the acquirer is looking to expand to other verticals. By absorbing your company’s synergies, they hope to develop new, competitive product lines. And explore new markets across state lines or the border.

Strategic acquisitions are mainly about eliminating competitors and bridging the gap in the targeted company’s weak points. Buyers recognize the economies of scale that will likely benefit the merged company, mainly because they can eliminate duplicating efforts.

Strategic acquirers estimate how well your company can integrate with their business structure and the resulting synergistic advantages. The higher the potential for alignment and rapid growth, the higher will be the price they are willing to pay. Raising their shareholder value is also an incentive.

Other than the customer base they can potentially serve or the geographical market they can capture, buyers focus on other benefits. These may include intellectual property, intangible assets, and a specific skill set they lack. Interestingly, strategic buyers may also be entirely unrelated to the industry and looking to diversify into your vertical. And, thus, grow their revenues and profits.

The premium acquirers offer during a strategic acquisition will factor in this value. They may also add up future or estimated synergies in addition to the current positives. These estimations may come from the auctions you organize to invite the highest bids possible for the startup.

How Strategic Buyers Compensale Owners

Strategic acquisitions are typically initiated by large and mature corporate establishments that have access to high amounts of capital. They could be top-tier clients, competitors, or vendors that have been consistently working with your company.

Such acquirers are typically open to offering you compensation for the venture in different ways. For instance, they might offer to purchase the company stock and pay cash. Or you may get stock offers or a combination of purchase prices.

A key difference in strategic vs. financial acquisitions is that acquirers tend to retain most of the existing workforce.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Understanding Financial Acquisitions

Financial buyers view startups as viable investments. Their objective is to sell the company around five to seven years down the line and make satisfactory returns. Such buyers are open to investing in a broad range of business verticals, including industries entirely distinct from their own.

When evaluating startups for investment, financial buyers examine financial statements, cash flows, and other metrics. They’re looking for consistency, steady revenues, sustainability, and potential for future growth.

More than the company’s current performance, they are concerned with the maximum returns they can get by reducing expenses and creating economies of scale. As long as they remain vested, they also want to increase revenues and maintain cash flows.

When acquirers are ready to exit the investment, they’ll consider taking it public with an IPO or Initial Public Offering. Or selling it outright at a premium. However, these buyers are unlikely to support the expansion or growth of the targeted company. They only want to keep it running.

Another key difference between strategic vs. financial acquisitions is that financial buyers are likely to maintain the structure. Key personnel will continue working, but not in the case of strategic buyers. Talent and skill sets are quickly assimilated and integrated into the surviving company.

How Financial Acquirers Finance Deals

Financial acquirers are typically private equity firms, hedge funds, family offices, venture capitalists, and angel investors. Angels may be high-net-worth or high-income individuals. These financiers utilize close to 80% of debt funding to acquire the target company.

This is why they have large amounts of capital to invest. When paying for the company, their objective is to calculate the rates of interest at which they can borrow money. Or the lending rates. Next, they work out the money they’re spending to sustain the business and the bottom line they can sell the company for.

Strategic vs. Financial Acquisitions: A Comparative Analysis

Strategic Investors Conduct Extensive Due Diligence

In strategic vs. financial acquisitions, strategic buyers are likely to conduct extensive due diligence to assess the viability of their purchase. Expect to answer queries about product ideation, market share, and the product-market fit you’ve achieved.

You’ll talk about the customer acquisition strategies you developed and the best techniques for target customers. Buyers will also want to know about the economies of scale they can tap into. Also, expect to disclose complete information about the intangible assets, copyrights, and trade secrets the company owns. Especially, if the company’s valuation factors them in.

Acquirers may also want to know about any PII (customer, vendor, third parties, or partner) that they should secure. They may need to enter into fresh agreements and contracts to continue using the data you share.

Financial acquirers are typically unconcerned with such due diligence. Their only objective is to ensure that the company continues to run, generate profits and revenues, and scale quickly.

Strategic and Financial Acquisitions Are Not Always Clearly Differentiated

Making a clear distinction between strategic vs. financial acquisitions is not exactly iron-clad. At times, strategic investors might choose to allow the targeted company to maintain its identity.

If the brand name is well-known in the market, has a robust customer base, and has potential, it stays independent. Buyers may only choose to invest in its growth and continued success and benefit from the revenues it generates. Without necessarily integrating the brand with their own.

On the flip side, financial acquisitions are not always about exiting the investment in a short time. Buyers may be interested in owning a startup within their vertical and may consider making strategic add-ons for long-term growth and profitability.

For instance, they may invest in product ideation and development, advertising to grow the market share, and improve other efficiencies. These are essentially strategic investments in the startup they will eventually sell.

This factor is especially true for industries that are unpredictable or highly regulated. Or discretionary sectors producing high-value and non-essential products and services. These may include couture, fashion, collectibles, automobiles, travel and leisure activities, and consumer durables.

Since these industries are volatile and unpredictable, financial acquirers can choose to buy stable startups to offset their risks.

Infrastructure and Management Play a Critical Role

Strategic vs. financial acquisitions, the management and infrastructure you have in place are of critical importance to buyers. Infrastructure typically comprises your IT personnel, legal and taxation team, advertising and marketing, customer service, and more.

In strategic acquisitions, buyers may have an existing infrastructure with a panel of top-notch talent and executives working for them. In that case, they may choose to bring some of your employees on board and let the others go.

Duplicating teams would be a waste of resources, so you can expect job casualties during the final integration phase. In financial acquisitions, buyers need the management to remain in place and function as before. If needed, they may also choose to invest in bridging any gaps that can affect its stability and scalability.

Keep in mind that whether in fundraising or acquisition pitches, storytelling is everything. In this regard, for a winning pitch deck to help you here, take a look at the template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

Remember to unlock the pitch deck template that is being used by founders around the world to raise millions below.

The Seller’s Objectives: Identifying Your Goals

Entrepreneurs looking to exit their company want to sell it for the highest possible price. But they also need to get their objectives clear from the sale. Strategic vs. financial acquisitions–what would be your choice?

Maximizing Returns from the Startup

As a rule, strategic buyers are likely to offer you much higher premiums for the startup than financial buyers. If your objective is to maximize returns, you’ll go with the former. When approaching potential acquirers, you’d reach out to companies operating within your sector.

It’s not unusual for founders to look for better offers after being contacted by financial acquirers. Don’t hesitate to be aggressive with the valuation and look for the best bids you can get. Or, try a better strategy.

Organizing an auction is also a great move. You’ll invite bids from buyers in the open market and accept the highest offer available to you. Auctions tend to drive premiums higher because of the anticipated FOMO. Or Fear Of Missing Out when multiple buyers are interested in the same deal.

Staying on the Board of Directors

Accept an offer from a financial buyer but retain a percentage of the company’s ownership. In this way, you could serve on the board of directors and have a say in its operations and growth. You’ll offer your hard-won expertise and in-depth knowledge to sustain the company and take it forward.

In exchange, you can earn a robust salary as one of the top-tier executives. You can also enter into an agreement with the acquirer and earn a premium. That is, if the company achieves pre-determined milestones within a timeline.

By the time the buyer is ready to sell it five to seven years later, you’d again stand to make profits from its higher valuation.

Sale Subject to Certain Conditions

Sometimes entrepreneurs are ready to sell their company but need assurance that the buyer will continue their missions. Or, they may have concerns about what happens to their employees or other assets.

After evaluating strategic vs. financial acquisitions for a better fit, you may want to lay down certain conditions or covenants for the sale. While the conditions may be acceptable, you may have to make concessions on the asking price.

The Takeaway!!

Strategic vs. financial acquisitions–both have several pros and cons, and founders can choose the best option for the startup. You’ll start by identifying your own and the acquirer’s objectives from the purchase.

Both entities must have an in-depth understanding of the business ecosystem so they can make an informed decision. However, if they lack the expertise and direction, it’s best to hire a professional M&A advisor for assistance.

Trust the right people to guide you through the process of vetting buyers. They will assist you in choosing the right acquirer to take your startup forward.

You may find interesting as well our free library of business templates. There you will find every single template you will need when building and scaling your business completely for free. See it here.

Facebook Comments