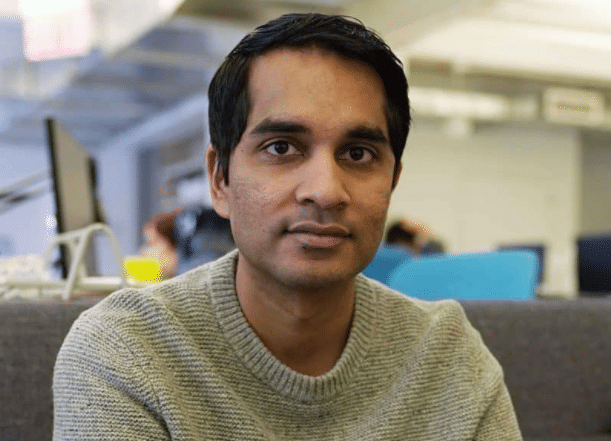

Zuben Mathews is the cofounder and CEO of Brigit which is a Holistic financial health app that helps Americans relieve stress, save for tomorrow, and guide them to a state of financial well-being. The company has raised to date over $140 million from top tier investors such as Lightspeed Venture Partners, Canaan Partners, DCM Ventures, CRV, Shasta Ventures, DN Capital, Abstract Ventures, and Sound Ventures to name a few.

In this episode you will learn:

- How to recruit your cofounder

- How to get a blank, uncapped term sheet when fundraising

- Reinventing how credit is extended

- Zuben Mathews’ top advice before launching a business

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About Zuben Matthews:

Zuben Mathews is the CEO and Co-founder of Brigit. He started his career at Deutsche Bank, where, over the course of 11 years, he created and led a principal investment and banking group, the Strategic Partnership Group, and focused mostly on financial technology and software companies. During this time, Zuben led equity, debt, and M&A transactions worth more than $55 billion. He became the Managing Director of Mergers & Acquisitions at Infosys. Zuben received his BA in Economics from the University of Chicago.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Connect with Zuben Matthews:

Read the Full Transcription of the Interview:

Alejandro: Alrighty. Hello everyone, and welcome to the DealMakers show. I’m very excited about our guest today. We’re going to be learning quite a bit, especially about growth, because the growth that they have been experiencing is unbelievable. We’re going to be talking about blank term sheets on cap notes—tons of really, really good stuff when it comes to the fundraising side. But I don’t want to make you all wait any longer, so let’s welcome our guest today. Zuben Mathews, welcome to the show.

Zuben Mathews: Thanks for having me. I’m super excited.

Alejandro: So originally born and raised in India, and also, growing up there with a single mom. So tell us about your upbringing.

Zuben Mathews: I was fortunate. My family, in this case, my mom and my grandparents, supported me quite a bit. They put education at the forefront in everything I wanted to do. Fortunately, they were very well-educated. My grandfather went to school, actually, in the United States and my mom in the UK. They wanted to make sure that, above anything else, I had a platform to hopefully succeed, so I was very lucky from that front.

Alejandro: Yeah, because in India, there’s a lot of pressure towards education, so why is that?

Zuben Mathews: That’s a good point. I think at the end of the day, India generally being a third-world country and, obviously, progressing significantly economically in the last couple of decades, overall the country has always seen an opportunity to have education linked with overall success in someone’s life, and I think that has a lot to do with the importance of education in my country.

Alejandro: Let’s talk about you, as well, wanting to come to the U.S. Did you develop this desire for the U.S. based on what you had learned or what you had seen or getting inspired from perhaps your grandfather or your mother? You said, “I want to do that too.”

Zuben Mathews: Yeah, I think that’s a great point. I think it was a few things. One is the type of education that I was told that was in the United States was very different from India when it comes to college. It was a lot more, “We’ll prepare you for the real world and what comes in the real world going forward.” I think that was definitely a beginning, even as a 12 to 15-year-old combined with my family. Specifically, my grandfather, who had gotten his Ph.D. here in the United States, definitely had helped. Whether it’s myself or some of your other people you’ve interviewed, we’ve always used the same phrase, which is: the land of opportunity. Especially growing up in the ‘90s and coming to school here in 2000, the United States had the promise of saying, “If you worked hard, put your head down, got a little lucky, there’s an opportunity to do really well and make your mark.” And, here we are.

Alejandro: So you came here on a scholarship to the University of Chicago. How big of a culture shock was that for you?

Zuben Mathews: I traveled abroad, including the United States before, fortunately, but I think the biggest things about going to school in Chicago was, a) it was the first time living by myself; b) as I pointed out, the education was very different, and c) I think this was the hardest part: the cold.

Alejandro: [Laughter] That’s what I was going to tell you. I’m sure you were not used to dealing with snow and stuff like that.

Zuben Mathews: No. That was a true shock to the system. You’ve seen the movies. You’re going to have a good time. You’re going to study, etc. but no one prepares you for how cold it is on your fingertips when you step outside your dorm rooms trying to get to class. So that was definitely one of my interesting parts. It was a lot more, when you think about that, including how the financial system was, but that was the biggest shock to my system initially when I moved to the U.S.

Alejandro: In your case, you took a little bit of time off to develop this little idea, METROINDIA. What were you doing there?

Zuben Mathews: Yes, thank you for bringing that up. It seems such a long time ago. It seems like the entrepreneurial spirit in me happened to have been there when I was 19 as well. I did take time off, as you pointed out, from school or college, in this case, to start a company called METROINDIA. It was based in India. It was like the old version with CitySearch or Time Out version of India where we started off in Delhi, which is my hometown, which tells you what the cool restaurants are, we’ll give you reviews of some bars, at that time, what the cool theatrical events are, etc. and being able to search for this on a database. At that time, in 1999, where you had less than a million people in my city in Delhi, who are on the internet, just put things in perspective. 1999 was well before any social media platform ever existed, even here. So it was very early days, but we were fortunate enough to actually build up a theme, start up that company, and over a period of two years, actually sell that entity as well. It was quite a life-changing moment, at that point and time of the experience.

Alejandro: That’s amazing. What was it like doing the whole lifecycle of building, financing, and scaling? Did you guys raise any money for that, or was it all bully bootstrapped?

Zuben Mathews: It was fully bootstrapped. We were fortunate enough to get early advertisers and supporters in the company. Think of a company like Time Out. We were able to get advertising even before we launched, and that subsequently funded the company for the foreseeable future, and that kept inspiring us to get more and more ads. It was a premium platform supported by ads.

Alejandro: Then, let’s talk about the transaction. You were talking about selling this business. To whom did you sell it, and how did that come about. Tell us about that a little bit.

Zuben Mathews: We sold it right after the crash. Unfortunately, we were pretty close to selling it to a UK-based media company before the crash. At this point, I was a 21-year-old running around. But we transitioned the team into a content-based company, a media-based company in India, called All Content Goes. In all fairness, it was more of an acquihire by the end of it.

Alejandro: In your case, you went back to school, and I know that while you were there, you felt the financial stress and anxiety that we are all dealing with in what is one of the richest countries, if not the richest country, in the world. Why was that so upsetting to you?

Zuben Mathews: I think it should be upsetting for everybody living in this country, irrespective of where they come from. Let me explain why. As you pointed out, the United States is, even today, the wealthiest country in the world, and that just happens to be a fact. We also have the largest economy in the world throughout this country. I remember very clearly, especially when I first got to college, which was even before I started the company, I was trying to do everything correctly. I was fortunate enough to be on a full-tuition scholarship. My mom was sending me money from India. Remittances, at that time, would take a week. You wouldn’t know how much you would get or exactly when you would get it, and I was working a part-time job. Despite trying to do everything correctly, that level of financial stress that I just talked about continued to drive everything I was doing. I couldn’t understand why I would always be a little short of a little behind in my bills, and it was very clear. I was going to get money on day 14, but my bills were coming up on day nine. Either I would end up wanting to borrow money from my friends, and I was ashamed to do it simply because it wasn’t like I was overspending. I was budgeting effectively. I was just stuck in this perpetual pay cycle of saying, “If you want money, you need to borrow, and the only people who will give you money is an overdraft. As we know, one of the reasons we started Brigit is, overdrafts are frightfully expensive. That was what was failing me in the system. I couldn’t study effectively because I had so much stress, for no rhyme or reason of my own. One of the things that could have solved this was a credit card, but I was coming from India with no credit history, and the same problem mostly exists today, and I couldn’t get access to a credit card. So this circular problem that forced me to spend thousands of dollars in predatory fees, mostly overdraft fees, late payment fees, and that level of stress still lives with me today and is the reason why my co-founder and I built our company. It’s completely unfair for the wealthiest country in the world with these amazing banks, etc., put in place to help the everyday American is really not good.

Alejandro: As they say, ideas take time to incubate. In this case, it was an idea that was dormant for you, and instead of going at it, you decided that banking and the whole financial service, more as a nine-to-five employee was the way to go for you, at least at that moment. So you did a little bit of banking, and then from there, you went into M&A. I’m sure that M&A really helped you because some of the best entrepreneurs that I interviewed were either on the investor side or the consulting side or on the investment banking side. Having that experience on the M&A side, what did that open up for you, and how do you think that has helped you as an entrepreneur?

Zuben Mathews: Just a little bit of clarification—my banking was in investment banking, so it was not a nine-to-five job.

Alejandro: Okay, great—9:00 to 1:00.

Zuben Mathews: It was 9:00 to whatever. I was working in San Francisco doing software and fintech investment banking, and I would leave when the traders came in.

Alejandro: Okay, great.

Zuben Mathews: So initially it was a nine-to-five job. It would have made me happier. The combination of doing equity deals and M&A deals and eventually looking at a larger M&A role helps you think about it from an investor point of view and also structure your thinking in terms of what is the ROI or your return on time and money on any decision that you make? One of the things that investment banking and/or M&A did was to help you put on a more decision-making framework. Also, on the flip-side, I know you do a lot of deals, which helped me think about things as an investor if they would invest in a company. That’s a lot of thought process and a lot of education on that front, both quantitative and qualitative.

Alejandro: No kidding, and here you were, obviously, leading a team as well and probably making a killing when it came to the salary. I’m sure it was not an easy decision to make to say no to everything and to start your own business, Brigit. Can you tell us about the incubation process? What led you to say, “You know what? I’m going to give my notice today.” What led to that moment?

Zuben Mathews: If you spoke to my friends and fellow entrepreneurs, I think they knew that I had something bursting inside of me. There are two things I’ve done in the past. One was METROINDIA, as you pointed out. The other one was actually built to the investment bank I used to work at, Deutsche Bank. They were great to me, including some of the board members there. They gave me an opportunity to build a unique investment banking group within Deutsche Bank itself. It was similar to an entrepreneur because it was like, “Here’s an idea that’s on a piece of paper, and I’m going to go build it. Give me a budget to go build it.” Think of that as an investment committee, etc., and actually going and executing and growing it. I had that first. I think, in many ways, it probably took me too long to say, “I’ve understood the banking system from the inside out. I’ve understood software companies and financial technology companies from those who used to be my clients. I’ve had this theme in my mind where the same country that’s Deutsche would gain me well, and I’ve developed some level of saving. I want to use all that background and that theme, as you pointed out, that might have been incubating for well over a decade. That tells you how slow I am in making it understood, fortunately. That finally led to say, “How do we help build an enduring company that can hopefully help people at the same time?” I think that was the hardest challenge that I set forth eventually with my co-founder to do was, can you actually build a business that truly improved everyday Americans? It’s not easy to be rich. It’s easy to be well-looked after when you’re rich. Banks today will give you so many extra services for free if you’re in an ascending bracket or a wealth bracket. Yet, if you’re the median American, they will take advantage of you with late payment fees, ATM fees, any way that they can extract value from you. So there is that fundamental difference of how people are treated. A long story short—sorry; I get very passionate and angry about this at the same time. Let’s build a product that helps the median American and be aligned to their incentives. So we created a financial help bank called Brigit, which actually helps people budget more effectively, borrow money between paychecks so they don’t have to spend money in overdrafts, build their credit scores and actually get to a point where they can earn more as well. That same process, as we just talked about, is aligned to the history, as in your words, that incubation period and the problem that I was trying to solve, the problems that I and also my co-founder in his journey, have suffered growing up.

Alejandro: And how do you guys make money? What’s the business model?

Zuben Mathews: We have an aligned business model, which is everything in the app that I just mentioned, which is helping you save, the auto-saving feature, build your credit score, get money between paychecks, get the budgeting features, all of that for a flat $9.99 a month subscription fee. The difference here is, unlike a bank or a traditional lender, people want them to borrow more. If you’re a federal building product, you want to make sure you save. We’ve gone the opposite approach, which is everything in the app is completely transparent, and the alignment center is really important. We know people don’t want to borrow. We know they want to save. We know they want to build their credit. So as they improve their own financial lives, our costs are lower, they benefit, and we benefit.

Alejandro: In this case, for you to recruit your co-founder, it took you three months. Why so long?

Zuben Mathews: Honestly, to recruit my co-founder, Hamel Kothari, took me well over three months. I think the point that you’re trying to make is, the first time a friend of mine contacted him, he said no. He wanted to make sure that he was getting into the biggest possible idea that he could, and he could leverage his experience. Fortunately, I was able to talk to him three months later. I brought in a full-on presentation as an investment banker obviously would, and you know a lot about that. The second he saw, he understood that his personal journey of growing up in a not-well-off family and seeing [16:25] his family and extended family going through today, the same problems as Hamel, he had resonated with them. It hits right here. Combine that with his experience, his unbelievable experience—he had worked at Palantir doing cash flow underwriting in Brazil for his clients there. He worked at Two Sigman, which is one of the world’s most wanted data and the most interesting big data hedge funds. So he was able to use his personal experience combined with his work experience to say, “This is a problem worth going after.”

Alejandro: And that was validated, especially with third-party reports on the impact that you guys have been having. What kind of impact are we talking about?

Zuben Mathews: In the first two years of our launch, the numbers that have been published and that we have helped save our users over a quarter of a billion dollars. And 91% of our users feel less financially stressed because of using our product, which is great.

Alejandro: That’s incredible.

Zuben Mathews: That, to me, if there’s anything that I feel proud about, keeping aside the great team that I get to work with, is that.

Alejandro: Yeah, no kidding. In your case, you were very lucky when it came to fundraising, which we’re going to be talking about right now in just a little bit, but also in how you were able to nail it so fast on product/market fit. We’re talking about one of the greatest growth stories, not even in Lemonade or Revolut or any of those. It took you about $5 million in burned money to get to $20 million in annual recurring revenue. How did that happen?

Zuben Mathews: A lot of luck, as you pointed out, and a lot of research. We were able to get fortunate; it comes back to the same ingredients. You, as an investor, VC, and a dealmaker, know this, which is, we had a thesis. We had a very strong thesis, which said: we need to be able to help these individuals in a certain manner. Today we have multiple products, but we started off with making sure we could bridge people’s income gaps so we could predict when someone needed money, put money into their bank account, or press a button and have money so they would avoid overdraft. We didn’t use FICO. We had to build technology that hadn’t been built before, which is our underwriting and prediction engine, which only uses cash flow data. So we look at the information in your bank account to analyze who you are, can we send you money, when should we automatically send you money to avoid an overdraft, all automatically. Going back to my core use case when I was at college—remember, I didn’t have a FICO score or a credit score; I wasn’t able to get that. We were able to build, with the right team, the most targeted product that we possibly could. We were able to market it in an efficient manner with all luck and hard work—that’s all it takes with the right team, and over and over again, and integrate as fast as we possibly could. The fact that we were being able to predict when people need money and pre-fund their accounts was something that helped us push our first 100,000 views in the app store and get to our first 5-10 million.

Alejandro: Let’s talk about, as well, capitalizing the business. How much capital have you guys raised to date?

Zuben Mathews: In equity, we’ve raised a little less than $40 million. But overall, we, fortunately, have access to the credit, or in this case, debt financing of well over $100 million.

Alejandro: Got it. So debt and equity, $140 million. In terms of the equity side, I know the Series A was especially quite interesting. Tell us about the Series A, and more importantly, getting a blank term sheet when it comes to valuation. I mean, that’s crazy.

Zuben Mathews: Yeah. You talked about some numbers. At that point, we hadn’t reached our Series A. In 2019, we had gotten to $10 million in recurring fundraising, and quite quickly with a very small amount of spend. This was well less than $5 million in spend. What we raised before was $5 million in seed. I think the investor communities, specifically in San Francisco, understood the value of what we were creating, which was cash flow-based underwriting cash flow-based prediction and had found some product/market fit. Investors like to act fast. One of the most interesting parts of our fundraising ever was getting this term sheet, as you pointed out, which said, “Fill in your numbers and let’s talk.” We didn’t know what to do. We thought it was a joke. It turned out not to be a joke. That individual is not a lead investor in our company of that firm but is a very valued investor and board advisor to us as well. We worked things out. But we were a little taken back by the blank term sheet.

Alejandro: Also, the round that you guys did last year, where you did a note, typically when you’re thinking about convertible notes or whatever it is, whatever that flavor is, the investor would want to have everything covered. Especially, they look at the valuation cap, which establishes the ceiling so that you can’t go over that because they’re just going to convert at that cap. For example, for the people that are listening, if I’m raising $5 million with a valuation cap of, let’s say, $20 million, then If I’m doing a round 18-24 months after that, where the valuation is $40 million, I’m converting at 20, not 40. Then, also, people want to have the interest, so the interest where over the course of a 12-month period, they’re getting a certain amount of interest on the money that they’re investing. In your case, just to set the context and for our listeners to follow us here, you were able to raise a completely uncapped note with no interest there? I mean, how do you do that?

Zuben Mathews: Yeah. The truth of the matter is, we were fortunate in our Series A; we were well oversubscribed, and subsequently, even our larger investor, which is Lightspeed, obviously a great shop, and Jeremy Lu, who is on the board of many companies, including he is on our board, he and some of the other investors noticed something quite interesting from their point of view, which is we had pre-COVID and post the start of COVID—we had reached $20+ million in runway very quickly, showed product/market fit, and [23:23], and we had managed the pandemic in terms of how we had managed our team, managed the subscription model and continued to help our customers without burning any money during the pandemic, or at least the initial part of the pandemic. We had proven from an investor from their point of view, I should say, not from my point, is, good and high growth rate, as you gave some great examples, including revenue, pre-pandemic, and unit economics, whether it’s contribution margin, payback periods, and/or just ARR at the ratio of this less than 50 people is seemingly efficient numbers post that. And they wanted a larger ownership in the company. They and some other investors initially came to us and said, “We’d love to invest. Can we do a price round?” I said, “No—too much work. We don’t need the money.” “Okay,” as you pointed out, “Can we do a cap note,” as the example that you gave. I’m like, “Nope, don’t need it.” A long story short, in order for them to get more ownership in the overall company, I offered them to do an uncapped note, knowing that they probably wouldn’t do it because, as you pointed out, they’re exceedingly rare. But we got that note.

Alejandro: That’s amazing! And Jeremy Lu is the investor that discovered Snap Chat. We’re not talking about just anybody. He’s one of the giants, one of the greats. So how do you manage to get investors like that involved with the business?

Zuben Mathews: We try to be as honest as we can in terms of where our heart is, in terms of what we’re trying to build. We want to build an aligned business model to help people improve their finances. The people we help are the median Americans. We don’t do things like try and have them over [audio skips 25:10]. We’re focused on making sure that 100 million Americans who are living paycheck to paycheck have money, so they don’t spend money on paying Jamie Dimon’s million-dollar bonus. JPMorgan’s, WellFargo, and BOFA each make $2 billion in overdrafts. And most of that doesn’t come from you and me; it comes from this user who literally is living in the state of financial stress, who I was when I came here to college, who I was even in the beginning part of my career. That’s who these large banks are unfortunately exploiting money from. So how do we help the median American, the heart-blood of our economy, to truly progress? Our point of view is to make sure they have money between paychecks, so they don’t pay late fees, predatory fees, or overdrafts and get to a point where they can build in some kind of savings. Forty percent of the country doesn’t even have $400 in their savings account or access to an emergency account—build their credit score because once you have a credit score, you can actually get good credit. Remember, credit is not bad–*** credit ***, etc. That is how we’ve designed our entire product. Our point of view is, how do we truly get to a point where we align incentives to the user to get them better?

Alejandro: In that case, let’s talk about this for a minute. Imagine you go to sleep tonight, and you wake up in a world where the vision of Brigit is fully realized. What does that world look like?

Zuben Mathews: There’s a lot of work to do. It really comes down to if you look at two things, again, that I pointed out: our north star is the following—and this is where the world would anchor. I really hope we will get there sometime. It’s going to take a lot more than us, and that’s the truth. It comes down to making sure people have money in their bank accounts and they’re less financially stressed. The point being, someone who should never have to open their app—and this happens to our users—open their banking app before they go to McDonald’s to see if they have any money. Get that stress where their debt message popped up, “You’ve been over-drafted. Here is your fee.” The mental state that goes through someone’s mind—because, at that point and time, they can’t spend time with financial literacy because they’re under such a level of stress. They can’t spend time budgeting. In an ideal world, for us, the median American—a median American today only earns $45,000 a year, which is the bulk of the population—never has overdrafts or has a reason to overdraft, is earning more money, and never hits that level of financial stress. So instead of worrying about where their next money for their meals, phone bill, and gas is coming from, they can use that time and help them understand more about financials and get to a point where they can save. That is a place that I want.

Alejandro: And that will be a beautiful world, let me tell you, Zuben. Now in terms of COVID, I think that COVID since March 2020, as we’ve been dealing with this thing, it has definitely increased the uncertainty, and perhaps also the financial stress and anxiety of many people, not only around the world but mainly here in the U.S. where you guys are focused and servicing customers, have you guys experienced a nice boost from riding this wave to a certain degree?

Zuben Mathews: Look, the boost that really excites us, and this is the truth of the matter is, how much we can impact people, how many credit scores we can improve with our new, better building product, and how much money we can save. The reality is, some of our business is seasonality, which is that people want to improve their credit scores, generally, and save more because they want to get to the mindset. The reality is also that they’ll probably spend within their means, but a little bit more than they would normally in times of the holiday season. So there is seasonality that’s up for now and up for later. But at the end of the day, what we want to do is, we want to make sure that whoever needs the app and that we can service them—we also have a cash flow underwriting engine, which means we can support all people who might need income smoothing, for example. So the reality is, there has been somewhat of a boost because of the uncertainty, but if people are requiring access for smoother income, we can’t necessarily service all of them because they might have different risks.

Alejandro: You’ve had an incredible journey. You’ve had your first baby, and now you’re having your massive giant baby with Brigit, which is a rocket ship. Imagine if you had the opportunity of going back in time and having a chat with that younger Zuben that was at the University of Chicago studying, and you were able to give your younger self one piece of advice before launching a company, what would that be and why, given what you know now?

Zuben Mathews: Be patient, be patient and continue to hire the best people you can find and treat them well.

Alejandro: Why being patient? Would you say that sometimes as entrepreneurs, we want to get stuff done, and we want to achieve success very quickly? Is that it?

Zuben Mathews: Yes, and sometimes, we don’t give all of our decisions due process, and sometimes you might end up being able to drive directions or push people’s thinking in a manner because you’re giving them time in a way they require, which is why it comes to be patient and make sure you continue to hire the best people and make sure you treat them well.

Alejandro: I’m right there. When you were saying this, for me, I really understood the importance of not getting there but the journey of getting there because, at the end of the day, it’s all about the memories that we build.

Zuben Mathews: That’s a great way to put it. We’re over three years old now, and we’ve got a number of people who basically joined the company since day one. We were spending time reminiscing about this office or that dinner that we had together as a team, or the other office that we had, which is really small, or the even smaller office where the water wasn’t working. Yeah, good memories.

Alejandro: Good stuff. Zuben, the last question that I have for you is: a book that you wish you would have read sooner?

Zuben Mathews: It’s my favorite book. It’s got nothing to do with business. It’s just got to do with life, Catcher in the Rye. It resonates in a manner that makes you think of the bigger world that’s out there. It also reminds me of the non-financial, non-business world that’s out there as well.

Alejandro: I love it. Zuben, for the people that are listening, what is the best way for them to reach out and say hi?

Zuben Mathews: We’re hiring. Email me at any point and time at Zu***@****it.com. I promise that I will respond.

Alejandro: Amazing. Thank you so much for being on the DealMakers show, Zuben.

Zuben Mathews: Thank you so much for having me. This has been a lot of fun, especially with us on the brief chat talking about one of your stories. Those were more fun than me talking about mine. So thank you so much for your time.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments