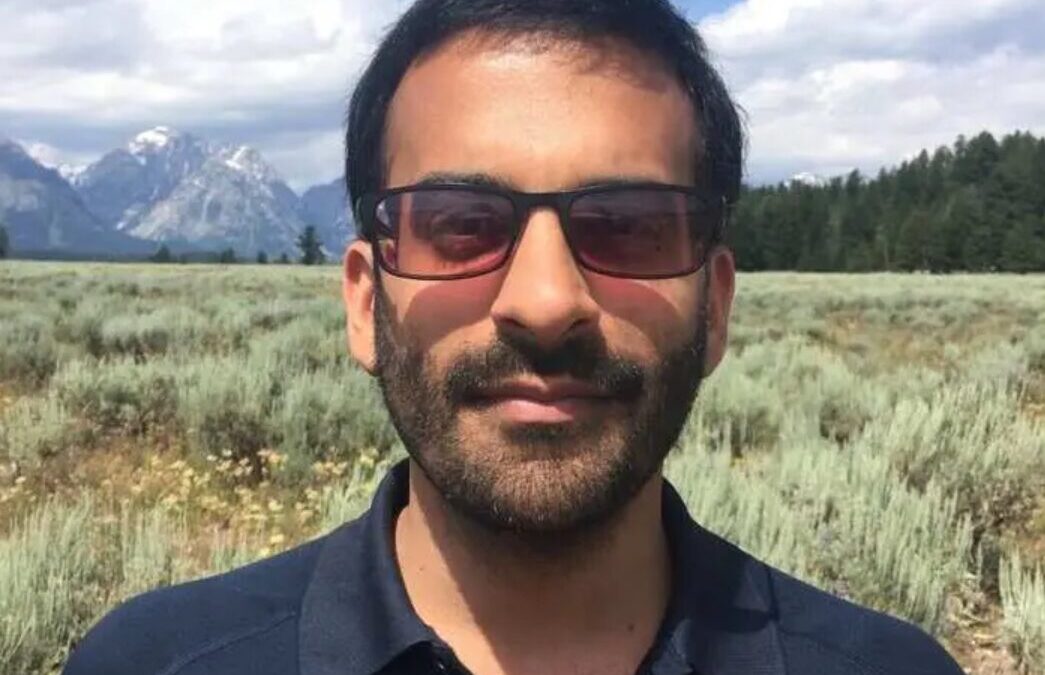

In the dynamic world of tech entrepreneurship and venture capital, few stories capture the essence of resilience, innovation, and determination quite like that of Zal Bilimoria. From his humble beginnings in Indiana to his pivotal roles at tech giants and eventually carving his path as a solo venture capitalist, Zal’s journey is as inspiring as it is instructive.

Zal’s VC firm, Refactor Capital, has funded projects like Astranis, Granza Bio, Bedrock Materials, and Rubedo Life Sciences.

In this episode, you will learn:

- Zal’s upbringing in Indiana, immersed in his father’s multiple ventures, laid the foundation for his entrepreneurial journey from a young age.

- His tenure at tech giants like Microsoft, Google, and Netflix provided deep insights into product management, influencing his approach as an investor.

- Leading the redesign of Netflix’s iPad app underscored the impact of user-centric design and metrics-driven decision-making in product development.

- Transitioning from Netflix to becoming a partner at Andreessen Horowitz highlighted his pivot into venture capital, where his product background became invaluable.

- Zal’s approach at a16z emphasized treating founders with respect and professionalism, which is evident in their Net Promoter Score system for interactions.

- Embracing the solo capitalist model allowed Zal to focus on early-stage investments, leveraging his expertise in identifying visionary founders and nurturing startups.

- Reflecting on recent market shifts, Zal highlighted challenges in fundraising post-COVID, emphasizing the importance of adaptability in venture capital.

SUBSCRIBE ON:

Keep in mind that storytelling is everything in fundraising. In this regard, for a winning pitch deck to help you, take a look at the template created by Peter Thiel, the Silicon Valley legend (see it here), which I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About Zal Bilimoria:

Zal is the solo partner at Refactor, a seed-stage firm focused on bio, climate, and hard tech investments.

Previously, he helped launch the Bio Fund at a16z, and, prior to that, he spent 10 years in the product at Google, Netflix, and LinkedIn. He is an alumnus of the University of Pennsylvania.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Connect with Zal Bilimoria:

Read the Full Transcription of the Interview:

Alejandro Cremades: All righty. Hello, everyone, and welcome to the Deal Maker Show. so Today, we have a really amazing you know founder turned investor. Well, I would say a employee corporate America, then turned founder, then turned investor, and now what he’s doing is pretty remarkable. so um So again, we’re going to be learning quite a bit. We’re going to be learning from his time at Netflix, some of the successful initiatives that he pushed. I mean, he’s worked at some of the best companies that you can think of. I mean, Microsoft, Google, ah LinkedIn, Netflix. I mean, talk about resume there. And then we’re going to be talking about his time

Alejandro Cremades: while he became a partner at Andreessen Horowitz, how he went about investments, ah treating founders, and then also what really pushed him you know into now having his own gig, you know which is basically is a solo you know ah capitalist. right i mean He’s just himself, and he already has like $225 million on their management, which is unbelievable. Again, brace yourself for a very inspiring conversation. And without further ado, let’s welcome our guest today, Sal Billimoria. Welcome to the show.

Zal Bilimoria: All right, thanks Alejandro. Thanks for having me.

Alejandro Cremades: So originally born and raised in Indiana, ah but they obviously, you know, like parents, say immigrants parents, which I’m sure it was incredibly inspiring for you, you know, immigrant parents from India. So give us a walk through memory lane. How was life growing up?

Zal Bilimoria: Yeah, I mean, life was amazing. I was so lucky to have my parents you know migrate here 50 plus years ago from India. We settled in Northwest Indiana a one hour from Chicago. The reason was my dad was a metallurgical engineer. So he actually worked at a steel company for 25 years. But we also had a computer business growing up where we built and sold computers in our basement, initially at people’s homes, doctor’s offices, libraries.

Alejandro Cremades: you

Zal Bilimoria: We did the entire school system in our in our area. And I was basically conscripted child labor from age six onwards, believe it or not. And so that’s how I got into hardware software and coding at a young age. But it was great to be near a big city like Chicago, but also have that small suburb feel growing up in Indiana.

Alejandro Cremades: And also your dad was an entrepreneur, so I’m sure that that was quite impactful you know for you and played quite a role on the choices that you ended up making.

Zal Bilimoria: Yeah, I think that was also his third company that he had started. He had started two small storefronts before. And this was his kind of first move into technology. And even after that, he did two other startups after that, during quote unquote, retirement. And so he’s been a founder of five companies.

Alejandro Cremades: By the way, Sal, we’re going to have to restart this because for some reason I’m hearing like there’s like um the sound is not coming nice from your end. There’s like some boom, boom, boom, boom, boom, like all types of stuff.

Zal Bilimoria: Okay.

Alejandro Cremades: So I’m wondering if, let me just say, a stop the

Zal Bilimoria: Mm.

Zal Bilimoria: Yeah, life was was really interesting. you know we It was nice being next to a major city like Chicago. My parents you know moved here over 50 years ago from India. And the reason we picked Indiana or they picked Indiana is because my dad was a metallurgical engineer. So he worked at a steel company while we were growing up. But we also had a computer business as well on the side where we would build and sell computers initially to people’s homes. But then we did doctor’s offices, libraries. We did the entire local school system as well. And I was conscripted child labor from age six onwards helping my dad. And so I got into hardware software encoding at a very young age.

Zal Bilimoria: And it was just an amazing experience. so um Yeah,

Alejandro Cremades: I know that they also your dad was an entrepreneur. how So how do you think that shaped you, who you are, and then also the choices that you ended up making?

Zal Bilimoria: yeah absolutely. I mean, actually, that was my dad’s third business as a founder. He had started two other companies beforehand and then did two other startups after in quote unquote retirement. but So he’s ah he’s a repeat founder himself. but you know that’s why I chose Penn in terms of the Wharton undergrad program because I thought I wanted to be an entrepreneur just like my dad and I wanted to follow in his footsteps. And so had an opportunity to go there, realized that a lot of my classmates at Wharton would go into banking and consulting. And so I did internships in both and I actually hated both of those industries. So I was very lucky that Microsoft came to campus and recruited me to be a product manager, which started my 10 year career as a PM.

Alejandro Cremades: Now, in your case, i mean you’ve been in some of the biggest companies that one can think of. right i mean You’ve been at Microsoft, then you were at Google, Netflix, and then obviously you know like the more they venture side of things. so i guess What would you say you know were some of the biggest things that you learned from being at a Microsoft, or at a Google, or at a Netflix? What do they have in common?

Zal Bilimoria: Yeah, I mean, a lot of these companies, you know they all have PM functions. They all have product manager functions. And for our audience audience who don’t know what PMs do, right? The PMs are responsible for working with the engineers, the designers ah internally, as well as external parties, like the sales team, for example, or or user research groups, et cetera, marketing teams, to be able to build and launch new products and then iterate upon them to to make them more efficient, make them better in terms of the core metrics.

Alejandro Cremades: you

Zal Bilimoria: And so the PM can be considered kind of a like mini CEO inside of a product organization, helping kind of steer the ship, setting the strategy, prioritization, and execution for a particular product. Now, each of those companies that I worked at thought about PMs in very different ways. So at Netflix, it was a very PM-centric organization, which means I had a lot of control and a lot of authority to decide where we spent our time, how the product would look, and and you know how to marshal resources toward that goal.

Zal Bilimoria: um I’ve never worked at Facebook before, but my understanding is Facebook is on the opposite end of that spectrum, where the engineers are really the ones that are kind of the guiding force, and PMs are mostly in support of what the engineers want to do.

Alejandro Cremades: you

Zal Bilimoria: Google was somewhere in the middle, whether it was YouTube, Google, et cetera, where PMs still had a significant amount of authority, but it was relatively balanced with the engineers. And so to answer your question, I think Having spent those 10 years building products, I got to see how different organizations thought about product development and execution. And I think they all had their own stripes of of awesomeness when it came to launching successful products.

Alejandro Cremades: So then I guess say in this case, too, I mean, with Netflix, you were part of the um one of the most successful initiatives that they pushed, you know which was I believe it was their their app. So so walk through what walk us through why it was so successful and and and and how did you guys go about planning it you know to to be the way that it turned out to be?

Zal Bilimoria: Yeah, no, it was an amazing experience. So I ended up joining in 2011. Steve Jobs had just launched the iPad and Netflix’s first iteration of the iPad app was just taking the desktop experience with the white background and like, you know, all the elements that looked like a point and click using a mouse and keyboard. They shoved that onto an iPad screen where there was no mouse or keyboard. And so it wasn’t really mobile responsive. It didn’t look like an iPad app. But admittedly, nobody really knew what an iPad app was going to be at that point in 2011. And so we used a lot of iPhone and mobile-related principles when redesigning the phone. And we actually did a couple of focus groups um while you know designing this product. And one actually, we came down to Mexico City

Zal Bilimoria: because we were just launching for the first time outside of the United States and back in 2011. Because before then, people don’t remember this, but before then, Netflix was just a US-centric company that was only available in the US. And so Mexico was one of our first launch countries. And so we did a focus group down there where we showed them three very different iterations mockups of what we think the the iPad app could look like. And of course, the one that won was going to be the most mobile responsive You could flick through the various rows and the titles, and you really got to get an immersive experience. um The way that PMs are geared at Netflix is on two dimension on two metrics. One is retention and one is streaming hours. So my goal as a PM, I’m trying to keep people continuing to get them to pay the $10 a month for the subscription, right? It’s really hard to move the needle on retention.

Zal Bilimoria: in ah in an AV test at Netflix, just because the the numbers are so massive and it’s really hard to move month to month. But but the most highly correlated variable to retention was streaming hours, meaning the more minutes and hours that you stream on Netflix, the more likely you were to retain as a member month to month. So I could potentially design a system that got you into a video, a TV show or a movie, as soon as you open the app. That was my goal as a PM to make those really great titles pop up at you. So then you have all these recommendations. You have this really great um system to kind of see all the stuff that you were watching. And so it’s very it was a lot easier to kind of move streaming hours as a metric. When we launched the iPad app and usually these AP tests, by the way, they run for about three to six months.

Zal Bilimoria: before you turn them on for the whole population. So you only have, you have two cells. You have a control cell, maybe a hundred thousand people, and then you have an experimental cell for another hundred thousand people. And you turn it on for maybe three to six months and you see what the data says, and then maybe you can turn it on to the entire, at that time, 30 million population. The iPad app was so successful in moving the needle on both streaming hours, but also retention after the first month. Reed Hastings, the CEO at the time, allowed us to turn it on to everybody almost immediately. And so that was just like such a rare instance of moving both of those metrics and in such a short period of time.

Alejandro Cremades: And by the way, I can see that, you know, the color her red, and yeah you know, you got a little bit from from Netflix for those that damn that are not able to to see this, you know, like right now, it has a background that is that is red, you know, beautiful background. But but in any case, one thing that tim that I’d like to ask you to is. for those that i are wondering, like, what about Sal, you know, with his say entrepreneurial, you know, path and, you know, especially having, you know, been exposed, you know, at such an early age with his dad, you know, what about him? What did he think about that? So you also, you know, went at it, you know, before before actually Netflix. So you went at it. But unfortunately, it was not the desired outcome. And as they say, you either succeed or you learn. So what happened there? And what was the lesson to be taken with you?

Zal Bilimoria: Yeah, you know, I was I was at Google ah at an amazing time, 2007 to 2010, and a bunch of my friends and fellow PMs ended up starting companies. um So Kevin Systrom from Instagram sat in the cube next to me. Dan Soroker and Pete Kuman from Optimizely were in the other cube over on the other side.

Alejandro Cremades: you

Zal Bilimoria: um I mean, you and then Ben Silverman from Pinterest, he was just on the other other side of the floor from us. So there was something in the in the in the water, Alejandro, at Google, right around 2009, 2010. And everyone thought, oh, I can leave Google and start a company and raise a few million dollars. And so I kind of wanted to really be a part of that movement as well. So I grabbed my my best friend from Microsoft and my lead engineer from YouTube, and the three of us co-founded a company called Sniply, which was rebuilding Google Reader after it had shut down.

Zal Bilimoria: You know that RSS Reader that was really popular?

Alejandro Cremades: Yep.

Zal Bilimoria: They had shut that down. and That was right when Twitter was starting to get going. And we thought we could use Twitter as an amazing distribution engine to get the news out there in snippets. We call this Snipply because we’re like, let’s get the snippets of the news out there so people can understand because most people don’t actually read articles. They just read the headline and maybe the first two sentences of an article. And so we wanted people to be able to say, let’s snip certain quotes and content within a piece of an article or a piece of content. so that people can actually see what’s going on in those write-ups.

Zal Bilimoria: But it was extremely challenging to get distribution because Twitter was just literally taking that and like they had that built into their platform from the beginning where you can write 140 words and create your own snippets and get that out there.

Alejandro Cremades: you

Zal Bilimoria: And so um we were able to build a product in a mobile-friendly way, but getting distribution was super challenging. We actually had an offer to um raise $2 million dollars in our seed round back in 2010 And um I had it all, I was fundraising. We’d gone through an incubator. I had all the paperwork in front of me and I had a sit down with my founders who we realized were like, it’s gonna be really tough to build this product and build this business. And we actually declined the money. And we said, you know what, we were gonna shut down the business. And so all of us kind of actually i ended up going back to corporate jobs, which I think really kind of underscored maybe some of us aren’t meant to be founders of startups and some of us are meant to like really be amazing people

Zal Bilimoria: working at at other companies.

Alejandro Cremades: So obviously, in your case, you ended up and landing on Netflix, as we were talking about, then LinkedIn, and then something really interesting that is not the typical, you know, um event that happens, if if if I may. I mean, all of a sudden you land into becoming a partner at a venture capital firm, and none other than the nutrition Horowitz, A16C, I mean, one one of the best VCs out there. So how did this happen? Because, I mean, that’s quite a sexy move there.

Zal Bilimoria: Yeah, I was surprised myself. um you know i I actually got a cold email from Andreessen Horowitz and they were looking for people that had my phenotype, former product managers and former founders who could come be a part of the investment team and help the general partners source and evaluate companies and then work on those investments after writing the check. And if you actually look back at the history, so Chris Dixon, Ben Horowitz, even Mark Andreessen himself, They were all PMs in their own careers. They were building products and they were launching them at a regular cadence and they really liked the PM phenotype there because the PM were ones that like I had mentioned before are the ones that technically understand how to build products but commercially understand how to sell them as well. And so when you obviously look at startups and you evaluate them

Zal Bilimoria: You have to understand both the building and the selling, obviously. And so it was actually a really great background that they were recruiting from. And a lot of my colleagues on that the the investment team at A16Z had product background. So let’s just say I was lucky at the right time that they were growing. At the time, they only had like 50 people. I think today they have over 500 individuals at the firm, which is just insane. But I got in at a perfect time to be able to start my venture career. And it’s been a blast ever since.

Alejandro Cremades: So how was that you know um like when you guys were like now investing in companies and and how did you go about treating founders too? I mean, that that was quite a steep learning curve for you as well.

Zal Bilimoria: Very steep learning curve. The first day on the job, I still remember. So Mondays is when we have our partner meetings, right? And first day, 9 a.m., we walk in, and three sets of founders, 9 a.m., 10 a.m., 11 a.m., are pitching their final pitch to the firm, and then we make a decision on whether we want to invest or not. And so everybody’s around the table. You’ve got, at the time, I believe there were seven general partners, and there were seven of us on the investment team. So about 15 people or so in the room. And then there was the founder and his team presenting to us at that time. And they got to basically share the summation of their life’s work in that one hour. And then we would break for lunch and then we would spend the next three to four hours discussing those companies and all the other companies that were kind of high priority. And it was a marathon of a day because you’re just going through teams and technologies and ideas and markets.

Zal Bilimoria: And it was just intellectually so stimulating that at the end of that day, I realized I wanted to be an investor for the rest of my career. Just imagine figuring out how to do that was was my goal. And so, yeah, how we treat founders was so amazing as well. um I think I’ve talked about this on on on on on other ah podcasts, but there’s something called the NPS score, right? The Net Promoter Score. Each one of us at A16Z, the general partners, as well as all the investment partners, had an NPS score. And what that was was after you meet with a founder for the first time and you’re obviously passing on like 98% of companies, um, they get sent an email and it only has one question in it.

Zal Bilimoria: How likely are you to recommend a 16 Z based on your interaction with Zoll one to 10, right?

Alejandro Cremades: My God.

Zal Bilimoria: And we were all scored and all of our numbers were published and we had to actually make sure that founders really liked our process, even though we were passing and saying no to them. It was crazy.

Alejandro Cremades: Wow. So um i guess I guess in terms of, um you know, Andrews & Horowitz is one of those firms and and for those that have had the opportunity of reading the book, the hard things about the hard things is like how well they did about building the infrastructure and the value for founders. now And I’m sure that that’s something that you have taken with you, you know, as a, you know, as a lesson learned, you know, as you’re now on the investment side of the table. But How do you think, you know, andusian was and A16C was able to accomplish getting at the top of the top on VC, like at the same level as the tier ones like Sequoia, Kleiner that were for decades before they were even in the picture, how they were able to do it so fast?

Zal Bilimoria: Yeah, I mean, when I when I joined, we were on fund three, it was one monolithic, $1.5 billion dollar fund, everything from seed to growth, crypto to health care, SaaS consumer always shoved into one fund. And our entire team managed all of those those those different sectors and stages from seed to to growth round series D, etc. And, you know, I think at the time, the their most venture firms did not to your point have operating teams. So we had, I think, five operating teams at the time. We had an executive talent team, technical talent, marketing team, corporate development team, and a regulatory affairs team, I believe. And so the executive technical talent team are are are fairly clear, but the executive talent is director, VP, and C-suite, and they help you kind of fill those those positions inside of your company after we make an investment.

Zal Bilimoria: And obviously, the marketing team is helping you tell your story, how to engage the press, how to deal with crises. And Margit Wenmacher is a legend. She had her own agency called Outcast. And then Margit met the minister to come and build that internally at A16Z. And she has been one of the quiet, awesome, amazing stars at that firm and helping really create that brand and getting A16Z on the map. And then, of course, the the corporate development team as well. on which is all about future fund raisings and financings. The 15 was not the regulatory fairs team, it was the market development team. And what that was is they have something called the EBC, the egg Executive Briefing Center, where the Fortune 500 companies of the world would come into our offices and want to meet five or 10 different startups during a day’s time. And so it was literally a matchmaking service

Zal Bilimoria: for enterprise and startups to come together so that the startups had an opportunity to sell their products to these Fortune 500 companies. And that still has been one of the biggest assets for the firm. And so not just the investment team, which is what Sequoia, Benchmark, all the ones that you mentioned before had, we had this entire operating apparatus that was able to kind of help our companies succeed.

Alejandro Cremades: That’s amazing. Now, it sounds like you were at the top of the game when it came to a segment that you were enjoying. So tell us about branching on your own. At what point did it become evident that you wanted to go at it on your own?

Zal Bilimoria: Yeah, you know, I think um ah the average tenure at the firm for an investment partner is a few years. And they want you to go and help if they want to be an investor, they’re going to go and help you kind of get get started. And I was really grateful to have their support. And I connected with an old friend of mine, David Lee from SV Angel. ah He and I were at Google a long time ago. And the two of us were both consumer guys that were getting into bio and health among other areas at our firm. And at our respective firms. And he had just left SV Angel and was looking to start something new. And the two of us started brainstorming together and decided to start this as the first, as the fund won in back in 2016, which was a $50 million dollars fund to go after the intersection of biology and healthcare and and and technology. And so um that was great. You know, I started with David and David, by the way, has an amazing track record if you don’t know. so

Zal Bilimoria: He helped run SV Angel with Ron Conway. He invested in Twitter, Snapchat, Stripe, GitHub, Slack. um I mean, the list goes on. It’s just amazing what companies he’s been involved with. And he wanted to leverage that track record into building a new fund, a new firm. And so he was in l LA. I was up here in the Bay Area. We were the GPs on the first fund and then He ended up retiring, and then I ended up kind of becoming a solo GP about seven years ago, when frankly, it really wasn’t in vogue at that time. A lot of LPs were like, you how are you going to do this solo? That’s crazy. um And I was just like, you know what? I know the types of founders I want to invest in. I want to spend a lot of time with them. I want to create a concentrated portfolio of 20 to 25 companies every fund, and really put all my effort into making those companies successful. and

Zal Bilimoria: um that That fundraise fund 2 for factor 2 was extremely extremely challenging but fast forward a couple of years later when I raised fund 3 that was done in five weeks and I just completed fund 4 which is done in and in a similar amount of time and so It’s kind of just been great to have that my own track record now Really demonstrate that I can actually do this solo and do it successfully

Alejandro Cremades: how How many companies have you invested in so far and what are the assets on their management?

Zal Bilimoria: Yeah, so including all of the funds and all that I’ve done a few SPVs as well as special purpose vehicles where I raise those to go after certain investments. um It’s about $225 million under under management. And the current fund size is $50 million dollars fund across eight and a half years and four funds I’ve invested in just over 100 companies now.

Alejandro Cremades: Wow. Now, in your case, you’re doing it alone. How is that? And how is that possible you know like with all those funds under management and all these investments? i mean how how how i mean I know that this is kind of like a new trend of the solo capitalists, where you don’t need like the big firm with the big infrastructure, the big upfront cost. Why did you you know go in this direction? you know why Why? And how do you are you able to to to do it?

Zal Bilimoria: Yeah, so I think, to be very very frank and honest, you know I had a chance to manage people in my operating career. And i I just did not enjoy it, to be honest. I did not have a desire ever factor to build a large team of principals and associates that would be working and trying to help me create something um you know um in terms of like sourcing and and but sourcing and evaluating companies. um i I’m investing in health care, biology, deep tech, climate tech. There’s just so many categories to cover. I’m almost a little bit of a generalist when it comes to planetary and societal health. And so if I really wanted to hire somebody, I’d probably need to hire a whole cater of folks to be able to help me evaluate these opportunities. But at this at the same time, I realized um that would also make me having to raise a larger fund because then I would need the management fees to actually go

Zal Bilimoria: and so and and pay for those really smart people because they’re not going to be cheap. And so a larger fund size at seed stage is going to be really challenging because the larger the fund gets, as you know, the harder it is to create fund returners and get get a multiple from that. The very best performing funds are sub $100 million dollar funds in in the last 10 years, right? um Maybe maybe there’s a few there’s there’s a few exceptions to that. But um the the smaller the fund, the faster you can get into carry, right? the The profit of the fund. And so I realized I really wanted to spend time at seed stage. I didn’t want to creep up and start doing Series A and Series B investments because I really liked that initial stage of a couple of founders and a couple of employees getting a product off the ground and getting their first sales. I think I’m very good at kind of rinsing and repeating that on these hundred plus companies that I’ve invested in.

Zal Bilimoria: And of course I obviously invest at the A and the B in those businesses, but that’s for my reserve checks. I spend my time at that that really early stage. And so if I came back and I said, okay, I can actually do this myself because so much of the evaluation is on founders themselves at the seed stage. Are they technically and commercially gifted? Are they going to be magnets for three types of people, customers, talent, and investors? And if they can be, and That’s something that I can actually help with my gut. Having met thousands of founders over the last 10 years, I can actually make that decision and make that leap on my own. Instead of getting overburdened with all the technical diligence and the market diligence, of course I have to do that to make sure that the product has a chance to be real and to be scalable. Make sure a founder’s not pulling like the wool over me in terms of you know a particular metric or something like that or an opportunity. But it’s all about founders and picking the very best ones.

Alejandro Cremades: So when it comes to, for example, trends, you know, especially what you’re seeing now on fundraising, you know, crazy amounts being raised in COVID now, you know, there’s like some type of a reset, you know, kick that has kicked in. What are you seeing now, you know, out there?

Zal Bilimoria: Yeah, I mean, the last two years have been actually fairly challenging for startups to raise capital, because when the bubble burst in early 22, the public market started retrenching and lower going down in price. That created a whole cascade of events where LPs, limited partners, are the ones that are investing in these funds, like mine, started seeing that the value of their investments were going down, both on the public side, but also eventually on the private side. And so there was a lot of downward pressure And so they weren’t feeling as flush and as liquid as in 2021 when Jerome Powell was flooding the market with QE, quantitative easing capital, which created obviously not only inflation, but also just a lot of jobs and a lot of opportunity post-COVID. And so when that happened, um venture investors didn’t know when they’d be able to go raise their next fund because the LPs were feeling a little bit more skittish because they weren’t feeling flush in late 22 and obviously most of last year in 23.

Zal Bilimoria: and so people had to extend their funds. They had to spend a little bit more time ah investing out of that fund. And um and then the next fund raise took a lot longer as well. So you just started seeing the number of deals being done year on year to climb. And it just became on across stages, by the way, seed to growth, but especially the growth rounds, because nobody wanted to look silly in front of their investment committees and price a company incorrectly, especially when there were no IPOs happening in their And the IPOs that were happening, the companies were cratering with within three to six months on the market. Right. And they were getting so much downward pressure as people were looking for liquidity from any source they could. And that was from a public investment, a public stock. And so private companies suffered. VC-funded companies suffered. Now it’s starting to come back, which is good. The last six months,

Zal Bilimoria: Starting from January, I’ve just felt like there’s just been this new energy, whether it’s in biotech, climate tech, or deep tech, which are the areas that I spend the most time in today at Refactor. But obviously, AI is white hot. It’s getting a lot of interest. And there’s a lot of inflate evaluations probably on that front as well. But I have seen it come back a lot in the last six months, which has been really positive.

Alejandro Cremades: So then, I guess, say you know let me put you here into a time machine, and I bring you back in time to that moment that you’re thinking about starting your own business, coming out of Google. And let’s say right as you’re coming out of the you know Google office after giving you a notice, you’re able to stop your younger self right there on the spot. And you’re able to give that younger self one piece of advice before launching a company. What would that be and why? You know what you know now, you know after dealing with all these founders and seeing all these investments, making mistakes yourself, you know what what would you say?

Zal Bilimoria: I would say even before I gave my notice, I would have said, OK, let’s make sure that we understand what the commercialization and distribution model is going to be for our company. And maybe even think about building a different product that we knew how to build and we knew how to sell it. And so I think relying on on advertising revenue, which I had known from YouTube and Google, and was kind of the old style business. Now people are willing to pay for high quality content and people are willing to um pay out of pocket for a lot of different products and services. so I would say let’s have that commercialization talk first before we have the product talk.

Alejandro Cremades: I love it. So Sal, for the people that are listening, you know for those founders that are like, oh my God, I would love to have a chat with Sal you know and and reach out. you know what What is the best way for them to get in touch with you?

Zal Bilimoria: Yeah, so ah you know i go to my website, refactor dot.com. It has my thesis on there of the areas that I’m very excited about. Like I mentioned, biotechnology, health care, climate tech, anything deep tech, IP centric. as maybe coming out of you of a university or spinning out of another company, or just a couple of smart founders that have found a really new and novel way of being able to leverage an old technology in a new and different application. Those are the founders that I want to meet. And so there is a forum on our website. Feel free to fill it out and send me your deck. I’d love to, I respond to every one of those that come through. The only person that sees that is me. And so I get a chance to review that and decide which companies that are really, which companies and teams are really exciting. and

Zal Bilimoria: um ones that I think could be a good fit for my thesis.

Alejandro Cremades: Amazing. Well, hey, Sal, thank you so much for being on the Deal Maker Show today with us. It has been an absolute honor.

Zal Bilimoria: Thank you so much, Alejandro. I really appreciate it.

*****

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments