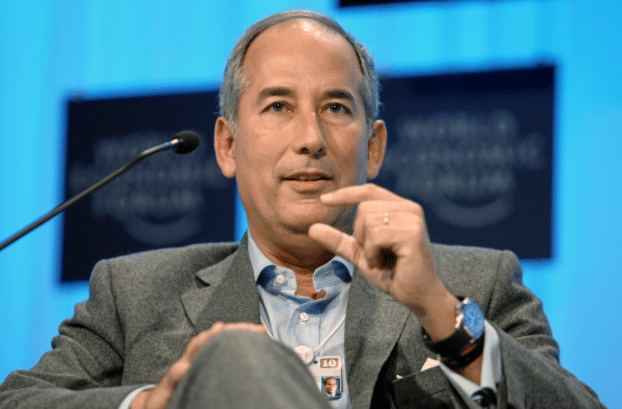

Tom Glocer was born and raised in New York City. After studying law, he moved up the corporate ladder to reach the highest levels as CEO for the largest multinational corporations before founding several businesses of his own. Tom’s latest venture, BlueVoyant has raised funding from top-tier investors like Temasek Holdings, Fiserv, Planven Entrepreneur Ventures, and Winton Ventures.

In this episode you will learn:

- How to transition from and grow on the corporate ladder

- How to take a firm through tough times

- Investment strategies

- How to navigate different laws when operating multinational companies

- Tom’s advice to those starting out

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About Tom Glocer:

Tom Glocer is the founder and managing partner of Angelic Ventures, LP, a family office focusing on early-stage investments in financial technology, media, “big data” and healthcare.

Tom Glocer is the former Chief Executive Officer of Thomson Reuters, the leading news and professional information provider.

Mr. Glocer joined Reuters Group in 1993 as Vice President and Deputy Counsel, Reuters America.

He held a number of senior leadership positions at Reuters, including President of Reuters LatAm and Reuters America, before being named CEO of Reuters Group PLC in July 2001 and CEO of Thomson Reuters upon its formation in 2008.

He is a director of Merck & Co., Inc., Morgan Stanley, Publicis Groupe, K2 Intelligence, a trustee of the Cleveland Clinic, a member of the Council on Foreign Relations, and a member of numerous advisory boards including, the Atlantic Council, the President’s Council on International Activities at Yale University, the Columbia University Global Center (Europe), the Social Sciences Research Council.

He is a former board member of Reuters Group PLC, Thomson Reuters Corp, Instinet Corp, The Partnership for New York and CFR, and a former member of the Business Council, the International Business Council of the WEF, the Advisory Board of the Judge Institute of Management at Cambridge University, the European Business Leaders Council, the Corporate Advisory Board of Tate Britain and the Madison Council of the Library of Congress.

Mr. Glocer holds a bachelor’s degree in political science from Columbia University and a J.D. from Yale Law School.

Mr. Glocer is married with two children and Simba, the Bullmastiff, and lives in New York City. Raise Capital Smarter, Not Harder

Connect with Tom Glocer:

Read the Full Transcription of the Interview:

Alejandro: Alrighty. Hello everyone, and welcome to the DealMakers show. I’m very excited about the entrepreneur that we have today. He is an individual that has a remarkable career going from corporate now to the venture world, being on the operator’s side and also on the investor’s side. So we’re going to be learning from both sides of the table on this show today. So without further ado, let’s welcome our guest today. Tom Glocer, welcome to the show.

Tom Glocer: Thank you, Alejandro. It’s a real pleasure to be here.

Alejandro: Originally born in New York City. You’re one of a kind, Tom, I’ve got to tell you because, in New York City, it’s like a really big United Nations, so you don’t see a lot of people born and raised in the City. So how was life growing up?

Tom Glocer: You’re right. Most of the friends I had growing up have long since left for California or other places. I think what makes New York such a special place is that melting pot of people from all over the world, whether it’s Madrid or Buenos Aires. These are your neighbors.

Alejandro: I think for you growing up with European parents, you probably had the go-getter mentality because of the inspiration of seeing your parents coming here as well and building a better future for the family.

Tom Glocer: Yeah. They were very grateful to the U.S. for taking them in during what was then WWII, and we traveled a lot because my father had an international business. We spent a lot of time in Brazil and Europe, which was great for me. It was a more modern childhood in the sense that they were globalists before it became popular to live lives and work in different cities.

Alejandro: And you didn’t go far away because you studied at Columbia.

Tom Glocer: Yeah, I often say I had the full urban education with four years up at Columbia and three years in New Haven, and after that, law school. I tried to encourage my kids to leave and go to some beautiful campus with green pastures, but they both went to NYU, so I was not successful in changing that in the next generation.

Alejandro: In your case, you fell in love with computers, but you thought that law school was the way to go. Why did that happen?

Tom Glocer: The honest answer is that it was a lack of imagination on my part. School was easy for me. I did well. I took a test. The test was good, and I had this idea that I wanted to do a double major or a double professional degree in MS and computer science and a law degree. I got into a whole bunch of places. I almost went out west to go to Stanford to do it, which would have maybe been the smart long-term thing to do, but I stayed east; I went to Yale and spent the good part of my law education there in the Yale Computer Science building working on gamifying various aspects of legal education.

Alejandro: You definitely implemented that because you went to Davis Polk and became an M&A lawyer. How much do you think all that knowledge and being on the dealmaking side, but more on the drafting and making sure things are buttoned up the way that they should be, how has that served you in terms of value for you and your approach toward dealmaking later on?

Tom Glocer: I think it’s helped a lot. When you strip out the superficial issues and look at what is the difference between writing a program and writing a contract? I always had an object-oriented view of writing contracts, a silly issue that everyone sees like the notice provision, which appears in a stock purchase agreement, a merger agreement, an asset purchase agreement. Why is that not, in effect, a subroutine, or these days, a microservice that gets called into a document composition program as opposed to an old-fashioned paper-based linear program? Just the act of debugging in the old days a piece of code you wrote is very similar in my mind to how you work through—how many times have I read an anti-dilution formula in a convertible offering for some young company, and it doesn’t work? The math doesn’t work, which is amazing to me. So I find it very similar, and it was training that helped in all fields.

Alejandro: It sounds like you were having fun being an M&A lawyer, and you studied hard for it because it’s not easy to become a lawyer, but why did you decide to switch careers?

Tom Glocer: I really enjoyed it. I’ve enjoyed most of what I’ve done, but there came a certain point—I’m curious by nature, which I think helped later in the venture and entrepreneurial activities, but once I had done several tender offers, I had done going-private transactions, I had done the range. I had taken companies public. I had the full toolset, but particularly in M&A, I started asking myself the question, how did the company decide which target to go after. Then, what happened afterward? Did it work out the way they expected it to? What about the social issues? Did the chairman and the CEO actually manage to build a bond and make it work? That drew me away from just being the plumber, where I used to call myself a deal monkey. You could come to me on Thursday night and say, “I need to launch a tender offer on Monday morning,” and provided I was willing to give up enough sleep over the weekend, I knew I could do that. But it became less interesting to me than what happened before and after that weekend.

Alejandro: Then Reuters comes knocking. What an incredible experience with Reuters. So you eventually switch careers; you end up joining Reuters. How did that opportunity come about, and what were some of those early days when you started there?

Tom Glocer: At the time, I really was looking at two choices, quite different. One was to join this unusual one, one might even say a peculiar, old English company that had been around 140 years, where it wasn’t clear what the career path was, but there seemed to be a lot of change in the air and possibility. The other was actually to join an investment bank of private equity weighing up an investment bank where I had an offer. My friends would have understood more easily. It fit an easier transition, perhaps, but I went for the more difficult one. Ultimately, Reuters proved to be a wonderful arena because it combined interests I’ve always had. It was and remains a very international company all over the world and relied heavily on a technology base, and news, information, and journalism had always been interesting to me, so those three elements, and I spent 19 years there at the end going through Thomson Reuters. It was a very happy home for me.

Alejandro: Tell us about that time where all of a sudden, you become the CEO. That’s very remarkable. Those are really big shoes to fill. Were you a little bit afraid of heights at this point?

Tom Glocer: I think in Spain, you might call that a [10:28]. They just didn’t have anyone better, they thought. I was 40 years old. I had never run a public company. I had only been running businesses, at that point, for maybe four years. So in retrospect, it was a crazy gamble that the board took. But they could tell that I cared deeply about the company itself. It was a mission more than just a—some people look for: I just want to be CEO of something. I didn’t care that much about being a CEO; I cared a lot about, what was the company? What was its purpose in the world? Reuters had fallen on harder times. There was tough competition from Bloomberg, and within six months of me taking over, the stock had fallen from an all-time high of 16 pounds to below a pound. I was scared to death. I didn’t know what I was doing, but we started trying to fix things. Eventually, we got enough of it fixed that the company lived to see a much brighter future.

Alejandro: People always talk about culture and the importance of culture. When you’re entering a situation like that where the stock has fallen so sharply, I’m sure that the morale was not at an all-time high either. How did you think about culture and also people and lifting up the spirit so that you guys could turn the ship around?

Tom Glocer: Yeah. That was a really difficult thing. I think a lot about culture in all the organizations I’m part of, and I usually think of it as what do people do around here when nobody is looking? Some people confuse culture with mission statements or posters that are on the wall in the cafeteria about flying high as eagles. To me, it’s the unwritten rules. When the lawyers aren’t looking, when compliance isn’t looking, do you have a good and ethical culture in your business? And it starts with having really good people. The good news is that Reuters attracted really good people, and through the most difficult period, there was something about the company that made people feel, “We’re going to help save this company.” I think we lost one person from the Top 50 at the company during the most difficult two-year period. I was very brutally honest. We laid off a lot of people. I started at the top with actually some of my closest colleagues and friends. We got through it. We sold businesses at the periphery and reinvested the proceeds to revitalize the core information and journalism missions of the company.

Alejandro: We’re going to talk about your venture chapter in just a little bit, but as we are thinking about also capitalizing on opportunities and identifying opportunities early. You guys were able to buy 2.5% of Yahoo for not much. Tell us about that story as well.

Tom Glocer: Reuters had always been an inventive and playful company willing to take chances on technologies, new ways to deliver information faster. There’s a famous story and a movie about Baron Reuter using carrier pigeons to carry information where there was a gap in the telegraph system in Europe. Back before I became CEO, at the time, I was running the business in Latin America. I worked closely with a good friend who is a friend today and an advisor in our venture company, John Taysom, who ran an in-house venture fund at Reuters called The Greenhouse Fund. There was a board meeting or an internal executive committee meeting that needed to approve this transaction. John didn’t want to fly over to New York just to do this, so he said, “Tom, why don’t you go and present this to the board?” I was presenting another transaction, which was a much larger one, which the board did not approve, which was a billion-dollar acquisition, which would have been the largest thing Reuters ever did. After they turned that down, I asked for a million dollars to invest in this company that they referred to in an English way as Yahoo! I suppose they were so relieved of the pressure of not even having to think about spending a billion that a million dollars seemed like small change. The deal went through, and Yahoo obviously turned into a really good business which funded a whole bunch of other venture investments to come for the Greenhouse Fund.

Alejandro: Wow, no kidding! As we’re talking about transactions and presenting things to the board, tell us about the acquisition, the transaction of Thomson Reuters.

Tom Glocer: Yeah, that was tough because Reuters had and Thomson Reuters still has a mechanism that sits on top of the company called The Founders Share Company, which has a golden share that’s meant to protect the independence, and importantly, the impartiality of the news service. Many people thought that Reuters actually could not be sold. The answer is, it could be sold provided the purchaser was someone willing to uphold the same principles. I was very attracted to a business called Thomson Corporation. They had invested in and bought a very interesting franchise in law and accounting, West Publishing, Westlaw, Albury, and a whole bunch of story brands there. I had this idea that Reuters 95% of revenues came from financial services and 5% from media companies. I was worried that after the difficult time I had in 2001, 2002, that if there was another downturn in financial services, we would be terribly exposed, and I didn’t think I could take the company through another difficult period like that. So the idea was to have a multi-vertical business, such as financial services, media, law, accounting, science, education, intellectual property, and so on. Then lay certain capabilities like journalism, art, machine learning, and other tech platforms across it as horizontal capabilities. The challenge was how to convince all the various continuances that this was a good idea. We thought it was a very good idea, and eventually, people went along with it, and so the business got created. Thomson was two-thirds, and Reuters was about one-third the size. I then moved the family back from London to New York and ran the combined company through the integration period for another four years.

Alejandro: That’s incredible. The press, at the time, reported that this was a 17-billion-dollar deal, so not bad. What a transaction! Tom, after 19 years of dedicating yourself to this company, then you decided it was time to turn the page, and that page actually led you into the venture world. And in the venture world, you started to do some angel investments. You had your family office going, and some great investments such as LendingClub, TransferWise, Coinbase, and now you have your own fund going on as well. But one thing that I would like to ask you, after investing in all these companies and having these great success stories, how do you think about opportunities? How do you think about those types of investments, and who are potential good winners that serve in your investments?

Tom Glocer: The first thing I should say is, like everyone else, I immediately think of the winning bets. I seldom talk about, “Let me tell you about the ten awful companies I invested in and blew up.” But I assure you, there have been many. But I have gotten lucky. This has been a period, say, 2013 to now, where your returns in venture capital should be north of three or four times invested capital because it’s been an amazing period, also a very innovative one. But turning to the question of what I look for, a lot of people talk about, “I want to back the right horse in the horserace. I actually think of two different things. The horse is important. You don’t want a lame horse, but I think about the jockey. Who is the founder? Who is in the founding team? Then, what’s the racecourse? The racecourse is really what McKinsey might call participation strategy. The racehorse is, what is the industry you’re deciding to play in? It’s a lot easier to play in a growth industry, so for instance, cyber defense, like one of the businesses I started, than it is to say, “I want to go in now and start a search engine since that day maybe has come and gone, although maybe not completely. I think of jockey and racetrack.

Alejandro: Very cool. Especially now, as you are thinking about the theses and the companies that you are excited about, what are the segments that you’re passionate about, that you think have the most potential, and that you’re going to be allocating capital to?

Tom Glocer: In our venture firm, we do mostly financial technology and marketplaces. It’s a company called Communitas Capital that I started with two good friends, Doug Atkin, who ran the Instinet Equities Trading Platform with me at Reuters, and Duncan Niederauer, who was first a difficult client to Goldman Sachs and later the CEO of the New York Stock Exchange. We focus on marketplaces, which don’t necessarily have to be in financial services. They can be last mile, cargo businesses, or obviously, it would have been nice to be in Airbnb or Hopper, which are different sort of marketplaces. But since we’re older guys, we have a lot of experience in pattern recognition, and we’ll often see and ask the sort of questions like, what factors are important in building a foreign currency, two-sided marketplace in financial services? What is the applicability in a new, say, industrial domain? You’d be surprised how many questions are quite comparable in terms of market strategy. Do you prefer a wider-spread smaller market or a very liquid tighter-spread market? What’s the role of information and analytics in price discovery, etc.? We invest in a broad range of companies. Before and between the fund, I still do some angel stuff. When angeling, I’m typically doing things around cyber defense, some financial technology. I’ve done a fair amount of stuff in crypto, which interests me, less so the coins per se and more the picks and shovels around that theme. That’s a summary.

Alejandro: Nice. One of the things that you were missing was the operator side of things, and you got involved again with the operating side. Now you are cofounder and Executive Chairman of two companies. One is BlueVoyant, and the other one is CAPITOLIS. Quickly, so the people that are listening get it, what is the business model of BlueVoyant and what is the business model of CAPITOLIS.

Tom Glocer: BlueVoyant is a cyber defense business, and we focus on two core problem areas in cyber. One is your supply chain. As everyone has seen in the last several years, attacks that come in via your supply chain, whether it was not Petya or SolarWinds, etc., is a huge stretch. So even if you have your primary cyber defenses in good shape, which, by the way, is not the case for a whole lot of folks, you need to now worry about third-party risk. That’s one big part of the business. The other is we run a very modern instance of a managed security service, completely in the cloud, focused on the latest Microsoft and Splunk applications in cyber defense. That’s BlueVoyant, the cyber company. CAPITOLIS is a core B2B fintech business, which essentially helps banks and other counterparties in trading markets optimize their balance sheet. In a way, it’s like the Airbnb of capital, and we help banks improve their profitability without increasing risk. In fact, what we do is we take risks off the balance sheet of deposit-taking institutions and distribute them more widely to portfolios that like the return and are better able to handle the risk.

Alejandro: And your main responsibility, obviously, there are many there as a cofounder, but one of them is definitely raising money, so how much money have you raised for BlueVoyant, and how much money have you raised for CAPITOLIS?

Tom Glocer: BlueVoyant required a lot of money. You should see what our cloud bills are because we’re continuously processing literally billions of data elements. So there, we raised something like $300 million, and we pretty much outgrew the venture. In our seed round, we raised $125 million at a 150 pre. So it’s not your conventional CVC who at that sort of valuation was going to play. CAPITOLIS was arguably a more traditional financing story, so the first round was Sequoia, the second was Index Ventures, then Spark, and most recently Andreessen, and we’ve raised just about $100 million there and a little bit more. It’s less capital-intensive than the cyber business, but we have a great group of investors who have been super supportive of the business.

Alejandro: One thing that is very interesting here is you have the experience from being on the corporate side doing acquisitions, investing out of a venture fund that the corporation had. Now you also have the venture fund where you’re investing and seeing who has the best racetrack or the best jockey that is riding the horse. And, also, now you have the operator role where you have these two companies that you have cofounded, so you’ve seen all the 30,000-foot views from every angle. For the people that are listening, how should they think about fundraising?

Tom Glocer: That’s a good question. I think of fundraising last, but this is an interesting conversation because they should probably have asked this question of you. You’re a much greater expert at fundraising. To me, all fundraising and all dealmaking begins with: what are you building? What is the substance of the business that is going to throw off, let’s hope, years and years of cash flow that you can then arrive at some idea of what this business could be worth in the future, even if it’s not profitable today, etc.? I’ve always been more focused on: let’s get the substance right as an operator, and we’ll figure out the financing. I’m the lead director at Morgan Stanley. Morgan Stanley is really good at this sort of stuff. So for the cyber business, rather than try and raise these hundreds of millions of dollars ourselves, my partner and I hired Morgan Stanley to do the raise for us. In CAPITOLIS, because we were more at the venture stage, and it’s pretty weird in the venture market to show up with Morgan Stanley to do your seed round. I don’t think that’s ever been done, perhaps. We did it ourselves.

Alejandro: In this case, too, you were alluding to it, and I’m wondering Tom, when do you sleep because, as you were mentioning, you also sit on the boards of Morgan Stanley, of Merck, and I think that also gives you a good handle on the strategic nature of companies and how those boards need to function well. So what have you learned about boards? We were talking about fundraising, and ultimately, fundraising is about bringing great people that can help you at a board level. So what does an effective board really look like?

Tom Glocer: Morgan Stanley and Merck or sort of special creatures because they live in heavily regulated industries, primarily, but not exclusively, the FDA in the case of pharma company and in the case of Morgan Stanley, a whole series of regulators, but starting with the fed, OCC, FDIC, SEC, not to mention the PRA and the Bank of England, etc. around the world. For a public company, a board has, I think, an additional set of responsibilities. Some come directly from listing standards like the New York Stock Exchange. You have to have independent directors. The audit committee has to be completely independent, and things like that. At base, the corporate law is the same in Delaware, whether you’re a private or a public company. You have a duty of care and a duty of loyalty to the company, but it’s quite different between—I serve on three public boards. The other one is [32:20], which is a French company under French law. I’ve also been a director of Thomson Corp., which was Canadian, and Reuters, which was an English PLC. So I’ve seen corporate governance under different jurisdictions and in different regulated and unregulated industries. But the core issue is, are you prepared to come to a board meeting and focus on what is in the best interest of this company? How can we make the pie larger for all stakeholders? I find it’s a really good balance in my life to have older, more established companies, 170-year Reuters, and startups that have only been around for a year, and they need different things out of their directors, but there are some commonalities.

Alejandro: There’s one question here that I typically ask the guests that come on the show, and imagine if I put you into a time machine and I’m able to bring you back in time. The experience that you’ve had, and now in the venture world, if I brought you back in time and you were able to have a chat with your younger self, maybe that younger Tom that just came out of that transaction with Thomson Reuters and that was thinking about getting involved in the venture world, more in the earlier stage level. What would be that piece of business advice that you would give to your younger self, and why, given what you know now about the venture world before getting involved with it?

Tom Glocer: It’s a really interesting question. I have a variance of that in conversations I have with younger people in established businesses, like a Morgan Stanley, as well as in early-stage companies. The core advice is: be the authentic you, even though that sounds quite trite. But the fuller picture of it is, I think many people, and I certainly made this mistake earlier in life. When you’re starting out in a business, you want to look and you want to sound like the role models you see. When I started at Davis Polk, I’m wearing a suit, and I worried about what briefcase I should be seen carrying into the office. For a year, I was wearing braces because a bunch of senior partners were wearing those old-fashioned suspenders. You hear it when younger people sometimes speak. What I’ll do with somebody younger in their career, like after they’ve made a board presentation, is, I’ll take them aside, and I’ll ask, “When you say things like, ‘We analyze this space in a proactive attempt to do market entry in a dominant way,’ and using all these buzzwords and whatever, I would say, “Listen. When you go home, and you talk to your friends, is this the way you really speak? Language is supposed to be a way of not creating barriers or showing off. The purpose of it is to communicate the thought, to rally consensus around the action you want to take. Have the confidence to speak in the way that you normally do to the people who you’re relaxed with, and don’t be some other fake self just because you think that’s what the role requires. That’s the advice I would go back and give the younger Tom, and it’s the advice that I actually often give people in other places.

Alejandro: I love it, Tom. So for the people that are listening, what is the best way for them to reach out and say hi?

Tom Glocer: to*@****er.com works just fine. I actually have always tried to answer all my own emails, which is how you and I found each other.

Alejandro: Amazing, Tom. Well, thank you so, so much for being on the DealMakers show today.

Tom Glocer: My pleasure, Alejandro. It’s really nice speaking with you.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments