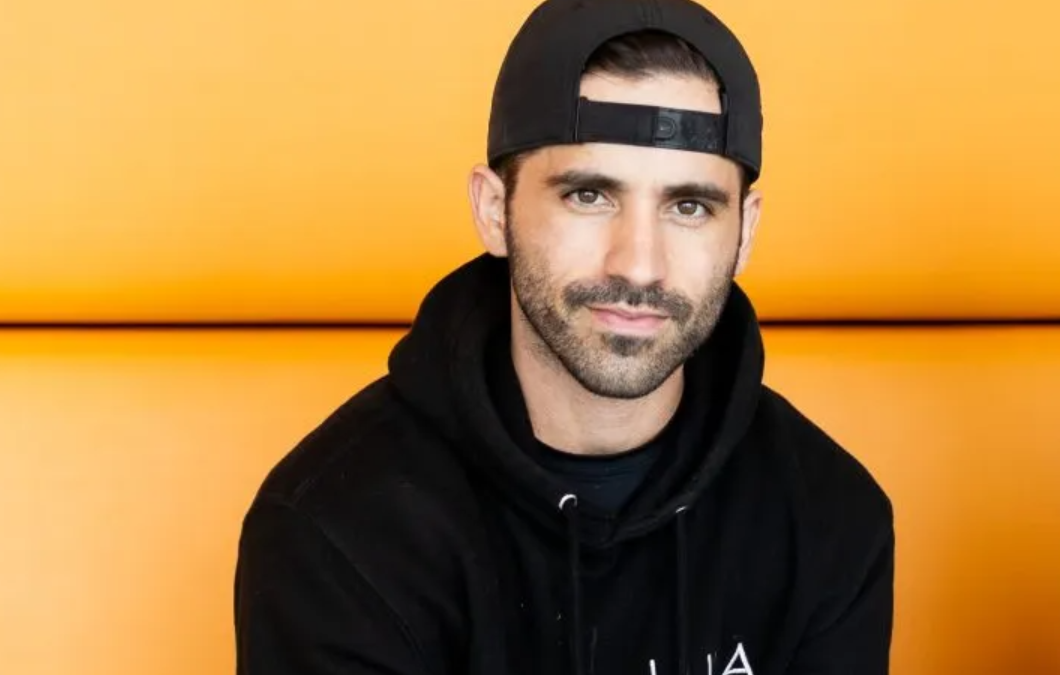

In the bustling landscape of entrepreneurial spirit and innovation, Michael Vega-Sanz’s journey stands out as a testament to resilience, adaptability, and a relentless pursuit of solving real-world problems.

In this blog post, we explore Michael’s challenges of Wall Street aspirations to creating Lula, which exemplifies the resilience and innovation required in the entrepreneurial realm. The lessons learned from the demise of the first venture became the stepping stones for Lula’s success.

With a relentless focus on solving customer problems and an unwavering commitment to innovation, Michael and his team are paving the way for a future where insurance is not just accessible but revolutionized by technology.

Listen to the full podcast episode and review the transcript here.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

A Childhood of Hard Work and Curiosity

Born to Cuban and Puerto Rican parents in Miami, Michael’s early life on a small farm laid the foundation for a unique perspective that would later drive his success.

Growing up in a first-generation American family on a farm with horses, chickens, and goats, Michael experienced a childhood that was far from traditional. Guided by loving yet strict grandparents, he imbibed the values of hard work and curiosity from a young age.

The emphasis on earning what he wanted and a relentless work ethic became integral aspects of his character. Michael remembers being encouraged to ask lots of questions and coming forward with any thoughts he had.

From Wall Street Dreams to a Tech Revelation

Michael’s initial ambition was to conquer Wall Street, fueled by a desire to overcome financial challenges. However, his trajectory shifted when he attended Babson College in Boston and got a scholarship.

The tech-oriented ecosystem opened Michael’s eyes to the transformative power of technology in solving real-world problems. The realization that technology could provide tangible solutions led him to pivot from the Wall Street dream to a new frontier.

The Pizza and Car-Sharing Revelation

A seemingly simple desire for pizza birthed an entrepreneurial spark in Michael. Unable to have Papa John’s delivered to campus, he envisioned an app that allowed college students to rent cars from each other. Michael and his brother created the app between classes over the weekend.

Launched for fun, the app became one of the top car-sharing apps on the app store. It also became the second-highest-rank car-sharing app in the country. Within a couple of months, they had cars physically available on more than 500 college campuses in all fifty states.

At one point, Michael imagined being the next Mark Zuckerberg. However, the harsh reality hit them—having a popular product doesn’t guarantee a successful business or that they could make good money from it. Eventually, they had to wind down the business.

The lessons from the first venture became the catalyst for their next venture, Lula. The focus shifted from just building a great product to creating a viable business model that could weather challenges.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Recognizing Insurance Challenges

Michael and his team identified a significant pain point as the shared economy faced insurance challenges. The cumbersome nature of purchasing and managing insurance plagued businesses, from car rental agencies to sharing platforms.

Michael likened the situation to visiting a restaurant and ordering food. While the restaurant does provide food, it does not offer utensils. Similarly, insurance companies provide coverage but ask you to manage your risk and have a strong claims process.

Michael also realized that their car-sharing business was not the only one affected by the insurance challenges. Platforms like Uber, Lyft, Airbnb, and trucking companies also had similar issues. Their research revealed that there were 12 insurance companies in the Fortune 100, a really large market but extremely fragmented with low NPS cores across the board.

Lula: A Stripe for Insurance Facing the Abyss and Rising Stronger

March-April 2020 marked a dark period for Michael and his twin brother, Matthew. Their first business collapsed, leaving them with negative bank balances and a series of challenges. Undeterred, they turned their attention to the insurance industry, initiating a journey that would redefine their entrepreneurial narrative.

Michael recalls having to sell their cars to make payroll with a negative $2800 in their bank account. Since they had withdrawn from school to build their business, they no longer had their scholarships and really hit rock bottom.

The vision for Lula emerged—a Stripe for insurance. Lula aimed to eliminate the need for businesses to build their insurance infrastructure. By outsourcing insurance-related functions, from policy purchase to claims management, Lula became an indispensable partner for companies navigating the complexities of insurance. By 2020, Lula was established and generating revenues.

Customer Obsession: The True North of Fundraising

Lula’s fundraising strategy took an unconventional route. Recognizing their dependence on customers for capital, they shifted their focus to being a customer-obsessed organization. Michael talks about how his brother, Matthew, believes in connecting directly with customers.

That’s how they developed the strategy of meeting customers personally and pitching their ideas instead of cold calling. Their initial target was a 5% conversion rate, but this approach worked so well that within a couple of weeks, they had 25 companies sign letters of intent.

Ultimately, 19 of these companies converted to customers, which worked extremely well. Michael talks about their successful first $30M in revenue with a sales team of less than 10 people and no marketing. They managed to build Lula largely based on word of mouth.

Lula’s Business Model: Simplifying Insurance

Lula’s approach is simple but impactful. With twelve-month contracts and a monthly subscription fee per asset, they provide businesses with accessible insurance solutions. Recently, Lula has come out with a consumption-based model on a per-seat or per-unit basis.

Customers only need to submit the first notice of loss when an accident happens, and Lula takes it from there. They provide end-to-end services, taking it all the way to settlement or payout. Business owners no longer need to manage claims, litigation, or third-party defendants.

From streamlining the insurance purchasing process to offering robust risk management tools and claims support, Lula has become the insurance infrastructure for small businesses. The emphasis on solving real problems, delivering exceptional experiences, and building a great product proved to be the best fundraising strategy.

Michael was able to raise $60M for the company from known investors like Founders Fund, Khosla Ventures, and Bill Aman, to name a few. His approach to fundraising is to focus 90% of your energy on the customer, product, distribution, and marketing. Funding will naturally follow through.

Storytelling is everything, which is something that Michael Vega-Sanz was able to master. Being able to capture the essence of what you are doing in 15 to 20 slides is the key. For a winning deck, take a look at the pitch deck template created by Silicon Valley legend Peter Thiel (see it here), where the most critical slides are highlighted.

Remember to unlock the pitch deck template that is being used by founders around the world to raise millions below.

The Future Vision: Accessible Insurance Powered by AI

Looking ahead, Michael envisions a future where insurance is not a luxury but a global necessity. Lula’s role extends beyond Earth, providing insurance solutions for space-related ventures. And that includes international space stations, satellites, starling Spacex, and multi-planetary rockets.

Moreover, he anticipates that artificial intelligence will power 90% of insurance transactions in the next decade, creating a more efficient and cost-effective landscape.

Advice to Younger Self: Focus on the Customer

In retrospect, Michael emphasizes the importance of focusing on the customer and their problems. He advises his younger self to spend more time understanding customer needs, solving real problems, and building a business with a strong foundation in customer-centric values.

Michael Vega-Sanz’s journey with Lula exemplifies the transformative power of resilience, adaptability, and a commitment to addressing genuine pain points. From the depths of adversity to the pinnacle of innovation, Lula stands as a beacon of inspiration in the entrepreneurial realm, reshaping the insurance landscape for businesses worldwide.

Listen to the full podcast episode and review the transcript here.

- Michael Vega-Sanz’s journey from a challenging childhood on a farm to pioneering Lula, a disruptive force in the insurance industry, exemplifies resilience and adaptability.

- Lula’s evolution from a failed car-sharing app to a “Stripe for insurance” underscores the importance of learning from entrepreneurial setbacks and pivoting towards solving tangible business problems.

- The critical shift from being fundraising-obsessed to customer-obsessed proved to be the key to Lula’s success, highlighting the significance of focusing on delivering real value to customers.

- Lula’s simple yet impactful business model, providing accessible insurance solutions with twelve-month contracts and a monthly subscription fee, simplifies the complex landscape for small businesses.

- Michael’s vision for the future sees Lula expanding its reach beyond Earth, providing insurance solutions for space ventures, and predicting that AI will power 90% of insurance transactions within the next decade.

- The unconventional fundraising strategy of depending on customers for capital instead of traditional venture capitalists showcases the power of building a strong customer base and delivering exceptional experiences.

- In hindsight, Michael advises his younger self to prioritize understanding and solving customer problems over networking and fundraising, emphasizing the importance of a customer-centric approach in building a successful business.

SUBSCRIBE ON:

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments