Stefan Ytterborn started building companies when he was just 19 years old. He has now been at it for 30 years. He has launched, grown, funded, and exited. His first venture POC was acquired by Investcorp and his second startup, Cake Bikes, has attracted funding from top-tier investors like AMF, Creandum, and Headline.

In this episode, you will learn:

- The future of transportation

- The vision of Cake

- Stefan’s top advice for other aspiring entrepreneurs

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

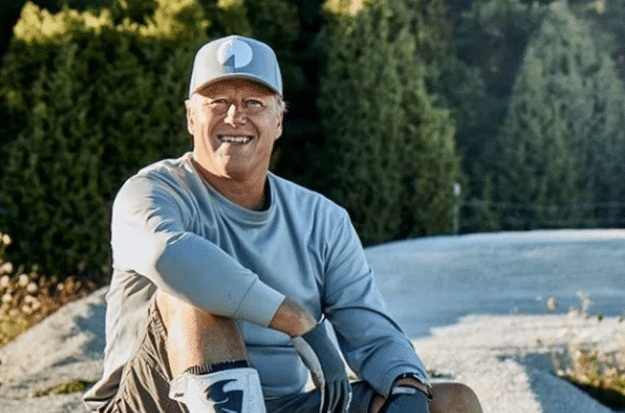

About Stefan Ytterborn:

Stefan Ytterborn has been building on a long background as an entrepreneur, promoter, and strategist within contemporary and industrial design and communication, covering all segments of the value chain when being responsible for developing more than 2,000 consumer products. His current work combines previous experiences with interests that matter to him and that he is passionate about.

Stefan founded POC in 2004 with the mission to ”save lives and reducing the consequences of accidents for skiers and gravity sports athletes, by developing better and more accurate protection”. Committed to high-end product development from day one, POC at this point is one of the strongest brands within its markets, present in 45 countries worldwide and currently having 85 employees.

After raising the initial funding of USD 12M, Stefan also led the first acquisition of POC made by Black Diamond at USD 45M in 2012, as well as the second acquisition made by Investcorp at USD 65M in 2015.

Stefan’s next venture is CAKE, an exciting ride on the journey toward a zero-emission society. The company develops high-performance electric off-road motorbikes, launching in 2017.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Connect with Stefan Ytterborn:

Read the Full Transcription of the Interview:

Hey, guys. Today’s episode is brought to you by Zencastr. I remember back in the day when I was looking at putting together Zencastr. I was looking for a solution that would help me in putting things together. Essentially, this is what allowed me to bring DealMakers to life. Basically, Zencastr, what it is is an all-in-one solution where you just send a link to the person that you’re looking to interview. They would plug in their computer with their video, with the audio, and then you are good to go. You would piece everything together, give it to your audio engineer or even edit it yourself, and you are off to the races. Now, if you’re looking at getting into podcasting, you should definitely check Zencastr out, and you could also get a 30% discount, and this is the discount code that you will be able to redeem by going to Zen.ai/dealmakers0. Lastly, I was very much blown away when I found out that investing in wine has been one of the best-kept secrets amongst the wealthy. This is now not the case anymore. I came across this solution, which is called VinoVest, and they are a great solution that allows you to diversify investing by implementing or including wines into your portfolio. Take a look at this: wine has one-third of the volatility of the stock market, and yet it has outperformed the global equities market over the past 30 years with 10.6% annualized revenues. It’s a really good way to diversify your portfolio, and you could also get two months of free investing by just going to Zen.ai/dealmakers, and by going there, you will be able to redeem your discount.

* * * * * *

Alejandro: Already hello everyone and welcome to the dealmaker show. So today. We have a founder that has been building and scaling companies since he was 19 years old and we’re talking about 30 years of back-to-back building scaling financing. Exiting his last company. He exited twice. So really incredible journey. So I guess without further ado. Let’s welcome our guests today Stefan Ytterborn: eaterborn welcome to the show. So originally you were born.

Stefan Ytterborn: Thank you so much nice to be here.

Alejandro: And raised outside of Stockholm so give us our walkthrough memory lane. How was life growing up there.

Stefan Ytterborn: Well, if family brother um had a lot of you know, um, like most kids I guess went to school was heavily into sports um anything from athletics to soccer to. Little of skiing in my life that later turned me towards starting Poc and I spent you know life in in Sweden until it was I was 15 years old moved to to Brazil for a couple of years and then went back again and my mother potentially you know. Guided me towards sports in in ah in a you know, evident way being a a a gymnastic teacher and she brought this to to different you know activities since we’re tiny tiny babies and um she had a strong influence on me and. Then I’d realized you know after having been through through you know Twelfth grade that that ah my I was too impatient to actually continue my academic I’d say you know my academic potential career going forward and started my own business built on passion. And passion has always been the reason for starting different different businesses on my site.

Alejandro: And you got started at 19 But even before that at 15 you moved to Brazil I mean that means new friends new environment, a ton of uncertainty that I’m sure shaped up who you are today. So how was that for you

Stefan Ytterborn: Yep.

Stefan Ytterborn: No I think you’re you’re right? and for many years I think the brazilian experience was very evident to my personality and and my approach but I think that I gained a few things of course on the social kind of palette. Just. As you say meeting new friends. Ah and and getting acquainted in a new culture with whatever that means but I would say that that um I’ve always done global businesses and I never ever kind of limited my own initiative to a restricted area. It’s always been. You know. For everyone everywhere and and the hesitation that sometimes is is something that I you know I experience with others by by starting smallest in your your own kind of safe zone or context was never anything I ever considered and I think that’s thanks to my presciion experience. That kind of opened up everything and I was like you know it it with it borders and and and and cultures and geography was not a limit so that that has played a strong role.

Alejandro: Now in your early years as an entrepreneur I mean you you did 2 companies that that really got you going. You know one wasn’t importing the other one was in exporting so the first one was cnbi and then the other one was Cbi.

Stefan Ytterborn: Um, yeah, yeah, no basic you get. It’s a it’s a long story actually for some strange reason I really got into a seventeenth century architecture and and style and design.

Alejandro: So very similar. You know the name still but but what were you doing there. What what? What was exactly what you were doing.

Stefan Ytterborn: And I had a super fast journey from those you know, um from the from the late 16 hundreds until the early nineteen eighty s and you know just just absorbed everything I could read and and understand and visited castles and whatnot. Um. And that that process went on for maybe half a year but it was a true learning process that I’ve been able to utilize throughout my career later in life to try and grasp. What kind of shapes preferences during different times in history and applying that to today and to tomorrow. And you know again realizing that we’re we’re all kind of we’re victims of our times. It’s not ourselves creating the preferences and so forth, but the kind of changes in in anything from from from political cultural innovation industrial and so forth aspects and how they kind of are. You know, bonded together and creating. You know the the space for different ideas to to become relevant during different times and that is something that I’ve been able to capitalize on throughout my whole career and I ended up in the early nineteen eighty s and realized it’s it’s with the contemporary design um scene and what was going on there. Where I had my biggest passion and I kind of moved on from there starting businesses.

Alejandro: So now what did you really learn from these you know 2 first experiences.

Stefan Ytterborn: Well I Um, you know I think that it gave me the kind of confidence to actually ah let my my my mind and my heart lead me lead myself in terms of of of of you know. Not being afraid of taking risk just getting into it and kind of building. Um something organically or dynamically as as as even though that you know I’ve been increasingly better at that defining targets and so forth of course but moving to jump on Board. Ah. On something a vessel that has a certain direction not knowing exactly how to navigate but being able to promote the idea of of of you know, um, not forcing every challenge or what would the obstacles that always come but just getting on board and and and going with the flow. And then dealing with the issues and problems as they they they show up I think that gave me at an early stage some kind of a um willingness and maybe you know the exploration of of of not knowing exactly how this journey will will develop which is exciting and and it gave me the ah. The nerve and the satisfaction to really enjoy what I was doing.

Alejandro: Now in this case I mean after having done it a few times you already knew and and as they say once an entrepreneur entrepreneur always an entrepreneur. So I guess in your case, why did you decide to go after the second experience or the second journey as an entrepreneur. Why did you go into consulting. You know on on on branding and and communications why you not going at it again. What? what? What happened there.

Stefan Ytterborn: Um, yeah, yeah, know that there was really interesting I had this experience at the time at the time I was I was I had come from. You know, working with international contemporary design and suddenly with the. Economic collapse in the early 90 s everything changed in terms of of values. Um, from a global perspective and um, you know against the the the kind of aspirations of the the late eighty s what was it was all about you know it was luxurious and expensive and complicated. And suddenly due to the economic situation values change towards durability and simplicity and functionality and smartness and so forth a number of topics that are associated to scandinavian design in general. So I kind of used that insight in terms of how changes actually changes values and aspirations. And decided to export swedish contemporary design instead of of of importing international you know or pretty much central european design to Sweden so the opportunity made me go to Ikea telling them that that hey guys. Um, this is the greatest opportunity to kind of reclaim your independence of not you know. Leaving aside what has been the story of of Ikea being a copycat not being independent enough bringing along a a new generation of really talentful young swish designers and you know serve a platform and start developing. Ah you know, ah independent swedish design from an Ikea perspective. And I convinced him and I got the the assignment and on par with that I was doing my own furniture collections that I was exporting but the the the leverage of with with Ikea and and what could be done with that you know type of investments with you know again. What I was doing was not very industrial and and small scale. But with Ikea I could develop ideas of you know, injecting, plastic or or doing complex metal molding stuff and so forth that there was no chance that I’d be able to finance myself so it was a learning process for me. Where I got into a an environment where there was you know tons of capacity and really working industrially with with with product development projects with the idea of you know there were ideas in in you know, philosophical ideological. Um. Innovative and so forth associated to that. But that was how I kind of went from small scale business into large scale business with the resources needed to really make you know a difference in terms of impact and and and and true to you know, innovative products.

Alejandro: So then let’s talk about Poc because Poke is really the next company that that you came about So how did the idea knock on your door and how did you decide that it was the right one to execute on.

Stefan Ytterborn: Yeah, so so basically I had been doing this consultancy business for a number of years. Ikea was the starting point and then I worked a lot with with Finland and scandinavian glassware and and and pottery and and stuff like that. Super exciting. But I got to the point where my my the comment denominator throughout my career has been purpose. So so I felt like I’m not really you know using my time to to do the best I can I can in terms of bringing purpose and. Throughout my career and again I started out ah as a kid being really a lot into sports and I was skiing skiing and ski racing a lot so that was really you know close to my heart and when I had my first 2 sons Carl and Nis um I you know took them to the slope and I was back there you know? ah. Training and and and and and and and raising gates ah with them and and being a father in that sense I was really nervous about the fact that they were training giant slam at high speeds passing huge trees just to meet their way and so forth with with protection that was far from you know. Level of of of of what they are these days. Twenty years later anyhow that was one of the main triggers that hey you know I know product development I need to do something to you to to to to like you know to to decrease my stress for for my my my kids and their friends skiing and. Um, part with that a number of things happen in society I’d say that still and for another fifty or one hundred years the most vital trend in society among consumers is is the fact that we’re all looking to for for for you know. Well-being health safety and stuff like that and that’s running a number of different businesses whether it be gated communities or insurances or health food or whatever and what happened was that when the carving ski made its entry on the ski side fifty years ago people started skiing on. You know. And and with the ability of carving and the the average speed on the in the slope increased by 30% or something and therefore people started crashing. It was evident that there was a risk in actually running into shutter on the slope. And the third aspect that there are a few others too. But you know that are vital to mention is the fact that the whole x-games community was evolving thanks to the alternative olympics with people you know on snowboards and skis jumping you know crazily and and in that sense if they crashed they needed the the protection to survive so that kind of.

Stefan Ytterborn: It influenced the whole generation. You know wanting to use the helmet to be part of that that that culture that said those parameters were all pointing towards the fact that everyone you know would use a helmet on the ski slope but in 10 years from then back then. And when I was trying to raise money with you know the Vc firms when I started this business telling these guys that this is what I’m doing these are the clear science. It’s actually going to happen and it’s going to happen fast. The current protection in the market is really poor because the only one using protection or helmets is either kids or downhill skiers. So there’s no no real market to trigger the level of of of quality in now sounds and people were like hey I’m never gonna wear helmet. Forget it and so forth and I can tell you that that my level of pride these days when I meet these patronizing a little older guys than me that did say no in the beginning and and you know waiting for to to get a lift. Chair in in wherever it might be and in the best of cases they they are using helmets by in the best of cases wearing a poke helmet is truly satisfying so that’s how I went into that and the mission ah of Polk was was still is. To do the best we could to to possibly save lives and reduce consequences of accidents. So we started developing the product product from scratch and my my my philosophy in that sense is the proof is in the pudding make sure to to don’t make any you know shortcuts or or don’t cheat make sure that you do it the best you can. And from there we together with competence in in anything from neurology to to spinal you know medicine and so forth we were able to actually bring the level of protection to new levels and that was the reason to for for ah, an eventual global success.

Alejandro: And in this case I mean you’re talking about global success I mean we’re talking about over 45 countries I mean incredible growth. But 1 thing that that is true here is that in this company with polk you were able to have access to the full cycle as an entrepreneur entrepreneur I mean you.

Stefan Ytterborn: Yeah, yeah.

Alejandro: Um, you know did the whole rodeo the whole road show with the money raising money and then also with the acquisition but not only once twice I mean that’s like you don’t come across that often. So so tell us about the acquisition process. What happened the first time why did you? How did you come up. You know again with a second acquisition and most importantly, what did you learn from going through a process like that. So.

Stefan Ytterborn: Um, yeah.

Stefan Ytterborn: Yeah, so in the first place we didn’t really you know, um, a plan to 2 2 2 to to to sell the company. It was a bit painful. You know. I went to the bank every year super happy about the fact that we had grown the but the business another 50 and the bank was increasingly disturbed by the fact that their risk when it comes to supporting our working capital needs were going. You know skyrocketing so ah. And and together with that our our investors were a little too shallow in terms of of of of you know, ah cash accessibility to promote you know bridge loaning and and and and dynamically moving us forward and it’s kind of interesting I mean we’re talking about 2000 and you know 8 9 ten eleven here. And you know in total we only you know, raised 10,000,000 used donors establishing a market share globally of 10 % and then also entering the cycling side of things which is now actually the majority of sales with with with Poc. But anyhow we got to the point where we didn’t have enough cash in the system. And at the same time big companies started knocking on our door and we had a number of huge you know from from consumer lifestyle and fashion to sports and we ended up selling to to black diamond uah-based back countryuntry you know, climbing company. And I think that we we truly had this this mutual respect for each other. It was all about you know, safety and quality and on their side making sure that people wouldn’t fall off you know, fall off the cliff and in our sense you know, but on the ski and and cycling side. What happened was that they were a nastaq ipo company and I think that that ourselves having been independent and being super transparent about what we’re doing and the pace of innovation that we’re doing and and and opinion making and Pr being. You know, key aspects of our our traction going forward and and creating interest and and aspiration was totally shut down by the the publicly traded climate that we went into so you know it went on for a couple of years and and we got to the point where we you know both realized that. They were holding us back and we felt that we were being held back so we decided to try and find a new owner so I was assigned again to to lead the the the the next round and spent.

Stefan Ytterborn: Spring in 2015 of of of you know pitching po and evetries selling it to a company named Investorp which is a London based i’s a luxury premium brand portfolio company and I would say that turn out really? Well even though I’m not with poke anymore. Have a much better you know investor backing the company to promote the the dynamics of of poke. So in the end that came out as a beautiful kind of solution to something that ended up not really being perfect

Alejandro: So I guess same after ah going through the acquisition with the same company twice right? What have you learned that if you were to do another M and a process or another M and transaction. What would you do differently or what would you? Absolutely you know treat us a must to implement.

Stefan Ytterborn: Um, yeah I think that that what I’ve learned is is is a number of different things that that um, 1 main thing is that that that I think that that um I would say I am. There’s this this this I hate wasting money I’m I’m I’m I’m kind of trying to be smart about the spending and so forth and not to stupidly exaggerate. But I think that. Ah if I had the kind of toolbox in between you know. Banks investors and ourselves being the operation. Ah these days I will have been able to keep the company much longer and promote the additional investments from investors together with with a much more lubricated kind of relation with the bank. And therefore having you know, been able to to to stick. Yeah hang along to to to ah to ah our business another whatever, 3 4 5 years before getting to a point of of of a a um, a larger kind of of. Acquisition by someone else and therefore having been able to accelerate the the success of po even further. So again I think it’s it’s it’s it’s walking the walk and talk in the talk and I do that much better these days that I did in the beginning because I had no experience I had never sold the company before. Ah. So so I mean what? what? What may be defined as intuition is is something based on on on experience and my intuition based on experience again, make me um, a lot more confidently these days. Um. Before deciding on on on on topics in relation to mergers or acquisitions and so forth. So again I’d say experience makes you you know it’s it’s it’s worthwhile listening to to what you’ve been through because it it will. You know, support your level of efficiency and relevancy.

Alejandro: And obviously I mean the outcome on the second trust section it was 65,000,000 so I mean building a company from nothing to to an xit of 65000000 is is really amazing. So in this case I mean you you keep going. So so what happened there with cake because cake is the next baby. So.

Stefan Ytterborn: Yeah, yeah, yeah, no, what happened was that ah you know I’m not the motorcycle guy myself but I happen to be in the motorcycle space right now and I’ve learned to ride motorcycles and I love it. But you know normally I would be someone who’d be walking in the street being disturbed by someone roaring by you know I’m like don’t disturb me. So there was never ever and any romaning. But what happened was when when we were exhibiting with cake or with pokin in in in munich I ran into an electric bike for the first time maybe ten years ago and I was absorbed by you know the idea of getting out there without disturbing or without polluting so I got one of those bikes and. 2 summers later I had 10 of those or 15 really or those bikes in my garage at my country house and just enjoying it with no intention of starting a business. It was like a lot of fun I had friends riding these bikes and and you know it’s it’s cool to realize that whether it was a you know. World champion Emig sky or or a young woman for the first time trying these bikes. They all kind of loved it from different perspectives the the the pros went back and said hey stuffan it’s amazing. It’s more like skiing powder in the woods without the need for snow or or or a slope and young women. You know. With without the need for for clutching or changing years and just dropptling and keeping balance and without the scary noise. Ah they jumped on these bikes and and and drove away really you know cautiously and got back to me after 10 minutes sliding in front of me with the biggest smile saying hey Stan this is the most amazing thing I’ve done in my life and then I realized that this technology is going to flip the whole modcycl motorcycling you know market upside down and then together with you know, additional, you know insights or or or in general. Just. Observing how urban transportation is changing um and you know 4 different reasons and what has been values and vision is now becoming policies and policies and law making regulations and the market for electric becauses is of course booming. And again when I tried to convince the the investor market in 2016 that was going to happen. They were like ah we’ll see we don’t need to convince anyone you know anymore and we have a dual track with consumer products and and business-to-bus products and I can tell you that the business-to- business side. Is growing super fast right now I’d say that we’re in the perfect store if I had this discussion with you six months ago I would have said that our business-to-business customer is a shorthold urban ah transportation company which has a strong sustainability orientation.

Stefan Ytterborn: Today I would say unless that same company has a for sale free solution within the next twenty four months they’re going to be out the business. So it’s not about values and and ambitions anymore. It’s about legislation and regulation Paris is ahead. Berlin is following all cities and in in Holland has decided to exclude the car. It’s not about diesel and gasoline anymore cars are simply being banned from the cities and then you can walk you can you can use an electric bicycle. Of course you can ride the bicycle you can use a mopid or motorcycle if it’s electric and so forth. So I think that. It’s not only going to be 2 with motorcycles andopus there’s going to be a vast but variation. But it’s the 2 wo-w wheeleler is going to skyrocket in terms of market growth in the coming years. So it’s it’s it’s really a new situation in that end we were expecting it to happen. We didn’t know when. But it started moving really fast doing 2021? Thank you? yep.

Alejandro: People and and and beautiful bikes as well I have to say now 1 thing that I wanted to ask you is how you guys have raised quite a bit of money. How much capital have you guys raised today.

Stefan Ytterborn: Ah, so we’ve raised about $75,000,000

Alejandro: And how does it work because typically you know for you know for the tech you know Hyperg Growthth you know that that maybe like the listen listeners are used to. You know it’s probablyly a different path I mean in this case is is’s probably capital intensive tool. So.

Stefan Ytterborn: Now.

Alejandro: How is it different from the traditional tech business to raise money for something like this stuff.

Stefan Ytterborn: I think that we we’re in a very interesting interesting parting when it comes to the focus of investments because until now the tech investments have been ah attractive because they’re low when it comes to to when there’s no real capex related to it. While ah, the investments related to what we do in building a vehicle industry is pretty much the opposite but I think that being able to promote promote sustainability both from ah a business perspective and from a and and um environmental perspective. Ah we can see how. Our space and and and associated spaces are now being promoted in a much better way I’d I’d say that the acceptance of of that within an era of investments where the companies are in need for a large capex is actually. Something that has occurred in the the last I’d say 18 to twenty four months and I think it has to do with with the obligation towards the environment to a large extent where we need to invest in in in anything from hydra to solar to to to to wind and so forth and the infrastructure. Surrounding that if we are to get rid of the coal and oil dependence.

Alejandro: Now Imagine Stefan Ytterborn: that you were to go to sleep tonight and you wake up in a world where you know the mission and vision of cake is fully realized what does that world look like.

Stefan Ytterborn: Yeah, yeah.

Stefan Ytterborn: Well I think that that world looks I’d say that and I must say that we would never pound our chest saying look at us. We’re sustainable because we’re doing electric There’s so many challenges going on. You know in parallel in terms of of of chemicals that. You know lithium and cobalt and so forth. We have the issue with oil and and and gas being imported from from from from to large extent from from Russia these days that would potentially promote the the aspect of elective vacas and so forth but to be honest, ah. And electriced vehicle is just as bad as a combustion engine vehicle today but due to the the pace of innovation and and competence being invested in this space in 10 years is going to be so ah, a vast difference and vehicles will be super clean in in comparison to what the situation is today. So I think that in the best cases we have inspired the market for a faster change towards for sal-free transportation and I’ll say that we will also have inspired the market where there’s our product or other products to actually leave a car or leave something else in terms of transportation. The transportation aside to actually. Use that the the the the the the fun, efficient and practical use of 2 wheel motorized electric vehicles.

Alejandro: Now if I was to let’s say put you into a time machine and I bring you back in time and I give you the opportunity Stefan Ytterborn: of having a sit down with that 19 year old Stefan Ytterborn: that is thinking about launching a business because that 19 year old is incredibly impatient and he wants to do something out of his own.

Stefan Ytterborn: Yeah.

Stefan Ytterborn: Yeah.

Stefan Ytterborn: Yeah.

Alejandro: Imagine you were able to give that younger Stefan Ytterborn: one piece of advice before launching a business. What would that be and why given what you know now.

Stefan Ytterborn: So I’d say that whatever your decision is in life make sure to Support. You know your passions and it doesn’t matter what you’re interested in because the beauty of passion is that. Your ability to to absorb and educate yourself in that same category of space is amazing So eventually from one day to another you wake up and you realize that I’ll become a specialist in my field just by the the eagerness and the passion for that topic or subject and when you establish that kind of position. You’re also much clearer in terms and sober in terms of how to navigate in that space and eventually do you get the ability of actually building a business if you want to meet you with develop a business. Um, and that’s not a must. You may become a a politician or a leader of an organization or whatever it might be., But sticking to your love and promoting that and so and and and and and being a bit stubborn in in in in with that and staying with it will open a world of opportunities so that would be my message.

Alejandro: I love it so Stefan Ytterborn: for the people that are listening. What is the best way for them to reach out and say hi.

Stefan Ytterborn: Ah, Linkedin I’d I’d say that’s that’s that’s my my most that’s where I spend ah at least 35 minutes a day just speaking to people from everywhere around the world and try to be as capable as I can responding in the most you know in a respectful and and and hopefully meaningful way.

Alejandro: So amazing. Well Stefan Ytterborn:. Thank you so much for being on the dealmaker show today

Stefan Ytterborn: Thank you.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments