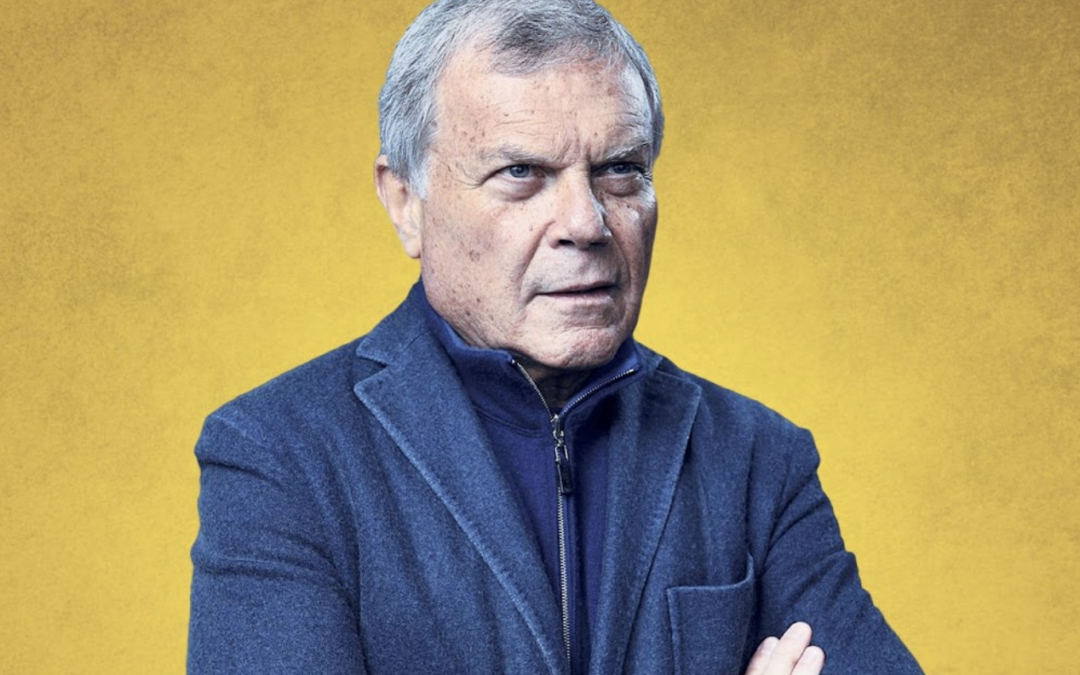

Sir Martin Sorrell, is the mastermind behind the success of WPP and S4 Capital. He has charted an exceptional journey from his birthplace in London to establishing two thriving advertising and marketing services firms. His newest venture S4 Capital has invested in companies like MightyHive, Firewood Marketing, Circus Marketing, and Maverick Digital.

In this episode, you will learn:

- Sorrell’s journey from London to the University of Cambridge

- His early career at Saatchi & Saatchi

- The journey with WPP

- The founding of S4 Capital

- His global approach to business and team building

- The future of S4 Capital and its impact on the advertising industry

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About Sir Martin Sorrell:

Sir Martin Sorrell is the entrepreneurial founder and former CEO of WPP. Under his leadership, the company has become the world’s largest communications services group, with over 200,000 people (including associates and investments) working across some 150 companies in 112 countries.

Sir Martin is one of the most respected global industry leaders whose views on business and the world economy are widely sought. In 2016, WPP had revenues of over $19 billion and billings of $74 billion.

Sir Martin actively supports the advancement of international business schools, advising Harvard, IESE, the Indian School of Business, the China Europe International Business School, and Fundação Dom Cabral Business School in Brazil, among others.

In 2007 he received the Harvard Business School Alumni Achievement Award. He was awarded the 2014 Hugo Shong Lifetime Achievement Award in Communication by Boston University’s College of Communications.

In May 2017, he was elected to an Honorary Fellowship of Christ’s College Cambridge in recognition of outstanding achievement in the field of commerce. In October 2017, for the second year running,

Sir Martin was ranked Britain’s best-performing CEO and was named the second best-performing CEO in the world by Harvard Business Review.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Connect with Sir Martin Sorrell:

Read the Full Transcription of the Interview:

Alejandro Cremades: Alright, hello everyone and welcome to the dealmaker show. So I’m very excited about the guests that we have today you know it is an incredible entrepreneur. Very successful his last company I mean over one ah hundred thousand employees and counting and now he is up to you know some really interesting stuffs. We’re going to be discussing so really an inspiring journey and I and I find that they were quite honored to have his presence here with us and also to have him sharing with us his own journey and his own words so without further ado. Let’s welcome. Our guest today. Here Martin Sol welcome to the show.

Sir Martin Sorrell: Thank you Alejandra you’re obviously easily impressed to halejandra but.

Alejandro Cremades: so so Incredible incredible journey that you have Martin you know that’s for sure so give us a little of a walk through memory lane. How was life growing up because obviously you know I’m sure that you learn quite a bit from your dad too. You know who was also you know in the electronics.

Sir Martin Sorrell: Yeah, you know I all yeah I did it was in radio radio and television retail. He ran. Um, what was then in the uk the largest radio and television retail operation had about 750 stores around the country. It was that. Division of an industrial holding company a conglomerate. It wasn’t his business but he treated it as though it was so I did learn a lot from him actually but I was the the spoilt only child of um of a jewish family in Northwest London. Um, born and bred in sort of gold as green and millhill and I was spoilt because I had an elder brother who died at birth a year earlier in 1944 I was born in 45 so my my father and ah mother as a result doted on me and that probably made me. Maybe maybe awful as ah as a child and maybe even beyond. Um, so I was very lucky because my father and mother didn’t have any education they left school when they were 13 because being the the. Son and daughter of immigrant parents from Eastern Europe from Ukraine as best as we can figure out from Poland and Romania they they had to earn a living from 13 onwards and my father was very keen that I got a very ah first -class education which I did at haber ashes that.

Sir Martin Sorrell: At Cambridge and then at Harvard. So I I was extremely fortunate and that was my my background but my father was um, not an entrepreneur. He was a managing director of ah somebody else’s business. But as I said most importantly, he treated it as though is.

Alejandro Cremades: And.

Sir Martin Sorrell: It was his own I think my one regret or I have a couple of regrets one he he didn’t have his own business and I think he would have been even more successful if he did and secondly we tried to work together but it it proved to be impossible that we we did give it a go. Ah, but it just didn’t work although we were immensely close I mean I was talk talk to him I’m not exaggerating. This is before the days of mobile phones I used to talk to him. Maybe I’m not not exaggerating at all 5 to 6 times a day and I would talk to him about business problems and I think. Or business opportunities and um I think it’s really important that to have somebody like that who could be a sounding board and who has your personal agenda at heart has no agenda other agenda. You know if it’s somebody inside the business or a professional advisor they have their own agendas. Really want somebody who’s going to think about you and your your your personal objectives to advise you and help you. So I think very really important.

Alejandro Cremades: Um, and it sounds like a Harvard business school. You know was saying what gave you really the structure to really go head on into business.

Sir Martin Sorrell: I I don’t know I did I struggle with economics at Cambridge I got ah a lower second as we call it a 2 2 and today with grade inflation. It probably would be a 2 1 or even a minor first I’m exaggerating. But. Make the point at Harvard Harvard was a trade school I felt much more comfortable at a trade school um in the sense that it was much more practical I went in I was at Cambridge from 63 to 66 and then went straight to Harvard business school 66 of the height of the. Vietnam war and the Vietnam Draft so the the class was the youngest actually when I say was the youngest it was one of the youngest de nathos who was the admissions tutor at Harvard business school said we were the most naive class at the at the business school. We. Probably average age going in was about 23 24 coming out 25 26 which is really what the the business Mba degree had been built around them and the idea was originally you know sort of it was a deal with Mckinsey and Goldman that you would. You would go to them for 2 years Go to Harvard business school for 2 years so you come out of university twenty one go into b school twenty three to 25 and then come back to them. Ah now what’s happened now is that the inbound age has got much greater. So probably.

Sir Martin Sorrell: Think at london business school. It’s as much as 26 27 maybe even at Harvard’s that level and I and I think that’s missing a trick because I think whilst I think going straight from University To B School as I did is probably not the best thing was you lack experience I think having longer than 2 years out you probably get locked into a career if you’re doing well and the opportunity cost of dig a businessre is that much greater. So but in any event the trade score was was better for me I enjoyed classroom participation and not everything was on the end of term exam. So I found it very good. My mother thought it was the worst thing I ever did was go to harvardor business school. But um, but but there but there hangs it. So I think you know you’re probably right I think Hbs was a hothouse I remember ah Bruce Wasserstein who was one of the first. Financial advisorrs we have at that time he was at Wasastein Perella before he read it. He it was bought by what was it ah where he was a credit suit’s first Boston then he had wasosthem parella and then he he sold out to to was it dresden a bank I think it was in the end one of the german banks. Um, and Bruce used to say you know Hbs was a hothouse and I think it was I think it was a a 2 wo-year compression compressed course which was a greenhouse or a hothouse in terms of business development. So I owe the b score I went back for my.

Sir Martin Sorrell: Fifty fifth reunion just just recently a few weeks ago and you know I owe owe the business school a lot.

Alejandro Cremades: Now in in your case, you know after you um, got your degree in economics and you did your Mba you got into the ah professional world and it sounds like I mean you you did a few radios but definitely you know something that was ah pivotal. Moment in your career was when you were involved with satchi and satchia there as the group finance director is that right.

Sir Martin Sorrell: I mean straight from b school I went into consulting Bend daying associates which are ironically ah a few years later when I was at to wpv. We bought the international operations of but it was a marketing consulting company. All x. AhP and g people involved in ah retail marketing wholesale marketing and marketing consulting I worked on Philip Morris and and Peter Paul that was a candy candy acquisition. Clairol on ah on a wavemaking machine in which we located in Phoenix ah Arizona which was probably the worst thing we we we could have done um, old people in phoenix not young people who go surfing but I was around hair products Heinz worked on hhjheinz but then I was. Actually threatened with the draft. My mother. My mother said I couldn’t go into the us army in those days the draft was so severe that even if you were a foreigner. You got an exemption I think it was nine months for every year of formal education. So I had 2 years at b school so it’s eighteen months but I could have been drafted. Um, not many people knew that or understood that the reasons for that but we were and my mother said no no way. So I came back to the Uk and I I got a job with Mark Mccormack Img now owned by endeavor and Ari Emanuel and

Sir Martin Sorrell: I worked with Mark I met him at business school. He was a subject of 1 of the case studies in management of new enterprises which was an entrepreneurial course and I met Mark and he offered me a job to run the international financial management which was the financial management part of img that looked after um. Their clients so Arnold Palmer Gary player Jack Nicholas Jeanle Kee Lee Jean Shrimpton and others Jackie Stewart looked after their finances as well as their merchandising and so I worked for him for a couple of years then I tried my hand with my father. Ah, as as I said that didn’t work out and then I I became personal financial advisor to ah ah a guy called James Gullivever a very successful food retailing entrepreneur. Um, and through him. I was really his I was meant to be his personal financial advisor but I really was his bad carrieer or personal gopher. Um, but he he took made investments in several small listed companies. Ah one was a sweet. Company up in Manchester called tudner Rutledge another one was say a confectioners a bakery company again in the North New York then we up north and then in a double glazing company called alpine holdings and then the fourth one was an advertising agency called Garland Compton

Sir Martin Sorrell: And Ken Gill who was the chairman of Garlan Compton had taken it public and he was very worried about the creative profile and so he he he acquired, but it was really a reverse takeover Sarin Sachi and Morris and Charles became the largest shareholders and. James was advising Ken Gill who was the chairman and Morris and Charles and we were advising. We did some consulting work for them as we did for the other companies have a rutish sayers and alpine and I got to know the sarche brothers and eventually Morris was looking for a finance director and. You know my dad had said his advice was find an industry you enjoy find a company within that industry that you enjoy too build a record and a reputation and in in that company and. If you want to go and do something on your own. Go off and do it and that’s what happened.

Alejandro Cremades: Now in this case with a satchi and satchi also um, you know you were as they would say often refer as the third brother and you know in this in this. Yeah and I I hear you I hear you but but here you know there’s something.

Sir Martin Sorrell: Um, yeah, that’s a really top approach and Tim Bell who sadly know longer went was yeah.

Alejandro Cremades: Something really interesting that I like to ask you about Martin and that is you know the? um basically what what the practice of the earnout so tell us about what was this? Ah what? what was this? You know the practice of the earnout and how did you guys use that for scaling.

Sir Martin Sorrell: Um, well that’s I mean.

Sir Martin Sorrell: Yeah I yeah I think people said you know we ah but we almost invented or I almost invented and as rubbish I think the Rothschilds probably used it like they used pigeon post at the battle of Waterloo so it was always there but in a service business. It does make sense to base the consideration not just on current performance but future performance and the model that we used at sarchi and ah Wpp was the earnout model usually could be 3 4 5 years earnout the the problem with the earnap model is that. Integration doesn’t take place firstly because the vendors want to make sure that that that unit is not integrated or or bastardized by merger and integration and they can clearly see the profitability. Because there a lot of their consideration is based on it but it does lock people in for a period of time. The problem is after the earn out period and what you have to do is to try and integrate as effective as you can within the earnout period otherwise you’re in danger of being left with an empty bag. So. I think it is a good method of buying service businesses. But you know with with S4 which is our latest iteration I had 3 lives in advertising and marketing one with sarchi.

Sir Martin Sorrell: Which was about globalization then with wppp which was the continuation of globalization and the the birth of the internet and development the internet and now with s 4 which is very technology and digitally focused. So in those 3 iterations we viewed in the first two we’ve used the earnout model. In the third we’ve used the merger model we’ll come and discuss that no doubt but it’s very a different approach where we integrate and we don’t have separate brands and we have consideration based half in the merger model half in cash and half in stock rolling your stock into the. The parent vehicle or the merger vehicle but the earnout method is good in the short to medium term the issues around. It are ah more the long-term issues about continued continued participation.

Alejandro Cremades: So then let’s talk about the now W P P you know the idea of W P P you know comes knocking in 1985 so tell us about how this how did everything you know come about.

Sir Martin Sorrell: Um, yes, well I was forty years old and my dad had said to me, you know when you’re 40 you look at your first twenty years in those days, you know you thought about retiring at 60 um. Look at your first twenty years and then look at the next 20 s ah 40 was a dangerous age probably still is a dangerous age when people are looking back I mean Jeremy Bullmore who was on the board of Wpp the ex-chairman of J W T in the uk used to say we should put a flag on everybody’s computers when they’re. Forty years old because that’s when they’re thinking about what they’re going to do in the future and you know my dad had said look you build a reputation as I said and if you want to go out and do something on your end. Do it. So I chose to do it with a partner in in 1985 we bought into a shell company. So not. Not a sp but you know it’s ah, almost a quasi sp or a spak is a quasis shell. It was a small manufacturing company had a market capital of about a million pounds and we bought you could you without havinging to bid for a whole company. You could buy 29.9. Um.

Sir Martin Sorrell: You could invest 29.9 but in 29.9 percent by them issuing new shares if you went above 29.9 you had to make a bid for the whole company. So a stockbroker and I stock brokeker preston rather and I bought into the w pp I had 16% ah, initially and Preston had 14 I bought I had bought a little bit more stock in the market at the beginning and we built we started to build the company in 85 we wanted to build it into a major multinational marketing services company and we made about 18 acquisitions in. First sort of couple of years mainly of companies below the line as we called it then or below the salt these were companies that were not fashionable design companies, sales promotion companies companies that the advertising agencies thought were beneath their dignity to to involve. You know. Shelf wobblers. We used to call them the the designs for supermarket shelves and and sales promotion. This was very much regarded as being not the um, what the french would call the cuis de Jupiter jupiter’s thigh this wasn’t the classy bit of advertising the above the line. This was the. Down and dirty part of that but which but which over that time started to become more and more important and then in 1987 two years in we had I think we got the market cap up to about one hundred and fifty million pounds we made ah what was regarded then as a very audacious hostile bid.

Sir Martin Sorrell: But company 13 times our size um which we eventually purchased for five hundred and fifty million pounds and funded by a rights issue half rights issues sho share issue for about 275000000 and then debt for the other 275 which was eventually paid down or much of it was paid down by the sale of a ah building in Tokyo which was in the bank balance sheet of jwt and which the defending bank Morgan Stanley with the defending bank. Valued at $30000000 we sold it for two hundred and seven million dollars um they valued it at $30000000 for the defense purposes which with the benefit of hindsight was quite amusing but the management management really didn’t know the value of the the Tokyo building that was ah that was a different era.

Alejandro Cremades: Um, mao.

Sir Martin Sorrell: So we we were. We knew there was a freehold property there because in those days used to depreciate freehold property on a balance sheet by two and a half percent a year you wrote it off to nothing over 40 years and there was a lot of asset stripping in those days. Jim Slater Jimmy Goldsmith were all people. Lord Hanson were all people who bought companies that discounts and their asset value and liquidated the assets mainly property assets because they weren’t they weren’t valued at market and so you found a lot of hidden value and we stumbled across it in the case of jwtwo I thought it was the. Building in London in Berkeley Square but it turned out to be Tokyo quite interesting. Actually we got into the company. Ah Robert Lowell art finance director at the time and myself. Ah, but walked into the jlo offices after we had had a 2 weekek hostile. We started at $45 in the first week went to 50 at the end of the first week and went to 55 and had an agreed deal after two weeks and we we go into the company and I said that Robert ah take a look at the fixed Asic register to find out where the property was was it in London. Came back about 15 minutes later and said no no, it’s not in London it’s in Tokyo so ah, he said you know we’ve got a couple of japanese banks in our banking syndicate. You know I’ll send them in that letter and we’ll get them to take look at I said no, don’t do that call them up.

Sir Martin Sorrell: Tell them to go down and take a look at the building and tell us what they think it’s worth remember that we’ve paid 550000000 or whatever it was for the business so they went around took a look at the property and came back about 2 hours later this is on the first day and said um. We will lend you $100000000 on it. Anybody who’s dealt with a bank will know they want twice times coverage so it was worth 200000000. We sold it for 207000000. We had to pay 50% tax but we sold it for two hundred and seven million about six months later at the peak. The japanese property market and that’s when the the imperial palace and the site around it was worth more than many countries gdp anyway, but ah, interesting times. Interesting days.

Alejandro Cremades: No kidding I guess for the people that are listening to really you know, get grounded into what WP you know, ended up becoming you know what ended up being the business model of W P P and how are you guys making money. Yeah, so that the people listening you know, understand it.

Sir Martin Sorrell: Um, ah, but we we believed in the globalization of advertising at Warren Buffett probably the shrewdest investor on the planet was buying into ipg and. Ogilvi I think at that time because he said advertising was a royalty or agencies were a royalty on the growth of globalization he was dead right? That was Ted Levitt Ted Levitt was a professor at the Harvard business school in marketing and he wrote an article in October of 1983 about globalization what he said was to cut to the chase was that consumers would consume everything in the same way everywhere now that he overend it to make a point we did a 20 year of freeze of that article at business school and the business school in 2003 and it was sadly just before he died. But. He did say at that conference that he had overe the pudding to make make the point but the point was valid just like we see now a bit of a reversal in terms of globalization and fragmentation geographically then you know when I was a b-school in my class was the son of the president. Harb of prop and gamble and in 1966 to 8 Howard Morgans Jim Morgans was in my class his father Howard Morgans was Ceo and I think I’m write in saying that p and g was regarded as being a global company with only 10% of its sales coming from ah markets outside the Us.

Sir Martin Sorrell: So now it’s probably almost 50%. So yeah, this was a different era in the era of globalization. Um, um, what advertising was Buffett understood this you know we used to work on 15% of billings or seventeen point six five on on production costs so 15% on the gross and what it was was a ah royalty on the growth of global business. So when propter for example, launched pampers as as we did launch pamppa for them. They spent four or five years testing it in paper and making it and testing it in paper mills and in America. But when they launched in the Uk and Europe which we handled what they used to do is they would spend um money to get to a certain market share. So they would say we want to have 10% of the diaper market or 15% of the dive market and what they used to do was to spend until they got there. And our commission rate was 15% so we didn’t get. We didn’t get commission in the development phase but when they launched you know we made out like bandits and it was also the time of significant inflation like we’re seeing now and clients fixed their budgets on net. Net revenues and if that was inflating because of inflation then we we benefited as well because we were getting 15% on an uplifted figure through inflation so we did very well. Um, it was inflationary time so in real terms. Maybe not as well as we saw in later years but we built.

Sir Martin Sorrell: Sarches into the world’s biggest agency as we we did again with with WP p so at.

Alejandro Cremades: I mean obviously for the people listening you know what? you guys did you know, remarkable over 100000 employees market couple of close to 9000000000 so

Sir Martin Sorrell: Um, yeah um yeah I got a wvp if we included the companies which we controlled we had 51% of and and more than you know, ah 51% ah of and then we included the associates who we had anywhere between 20 um, 49 we had it in total about 200000 people we had that I think on the peak we had about one hundred and thirty thousand in controlled companies. Um, so we did. We did very well but I’m very proud of the fact that we we had those 3200000 people you know people talk about purpose.

Alejandro Cremades: Um, wow.

Sir Martin Sorrell: And you know our purpose is to try and build a company where people and their families can can enjoy ah a decent standard of life from from a continued employment. So I would say you know if somebody said to me, what’s our purpose. Our purpose is to provide employment. Which is is interesting at a time when Ai you know is there’s a lot of controversy or a lot of discussion as to whether ai is an existential threat to to jobs. Yeah, whether Kate John maynard keynes the famous economist wrote I think in the 1933 automation would destroy jobs and we’d all be on holiday more. Well maybe ai is the dawn of the era where he will be proven to prove to be true.

Alejandro Cremades: Yeah, now in 2018 obviously seeing things you know like you know took a shift there and then you got going on s for capital following a finding of a similar you know, strategy of what you had used back in the day in 1985 with Wp P so tell us about.

Sir Martin Sorrell: Yeah, yeah, well say you were polite about the the it was somewhat controversial I exited WP I chose to to resign and to to start something new.

Alejandro Cremades: This transition. How did it happen when did it happen and and and and yeah, whatever you can share.

Sir Martin Sorrell: Ah, connected with a private company called Mivit Media monks which we bought into using a private company I put about £40000000 in as an equity investment and ah had brought in some institutions for £10000000 as core core investors. So had a capital base of 50000000 and then we did a private rights issue to acquire or merge with media monks which was a production company content production company based in amsterdam but but the gone ah global and we use that as the base. With 4 fundamental principles. Firstly, we’ would be digital only because that’s where the growth is in terms of the advertising market. Secondly, we’d be data-d driven sort of ah a loop of data driving creative being pumped out through digital media looking at the results and then. Re re re reframing the content in that continuous loopu we call it the holy trinity of data media and create or data creator. The media and then the third. The third principle was going to market as faster better cheaper. We thought that was the way to do it and then finally ah, the the we would have one 1 p and l so not a multi-branded model like with wpp where you have.

Sir Martin Sorrell: Brands in a way competing against 1 another but bringing together the brands as one so those were the four basic principles digital only data driven faster better cheaper and one pnl and we we then added to media monks in the so mediaia monks was in content. And then we we brought in mighty hive which was a ah data and analytics and digital media company that was also in 2018 and over the period 192021 22 we added about 15 companies to. The content side and around 15 companies to the data and digital media side and then in 22 we we broadened our ah capabilities. Ah, in addition to content and data and analytics and digital media. We added technology services. Which is digital transformation so over the last five years we’ve now got to a position where we have revenues of about a billion ah a billion pounds we we have the the consensus we just saten down for the we’ve just reduced for the the company but the consensus forecast This year is for about. Ah, hundred and forty million one hundred and fifty million of profit and we have 8600 people in 32 countries in 57 offices. So we’ve grown fast. We’ve had our had our ups and our downs and a strong very strong growth rates in the first year

Sir Martin Sorrell: 40% organic growth second year twenty in the year of covid twenty twenty and then in 21 it was I think about 40% 43% and 22 we should just close 26 and we’re forecasting this year we’ve taken our guidance down. Slowed to about 2 to 4% top line. So we’ve grown rapidly. Um, our client base is very technologically based but the big clients Google is our biggest client alphabet second biggest is an nda. Telecoms client the most valuable company on the planet so you can guess who that is thirdly is Meta Meta Fourth bmw Fifth mondolez Sixth hp Seventh ah an falsonda and fmcg company major 1 in sort of luxury cosmetics or cosmetics. Um, and then ah first american and american trust company finance company and that’s the the top 8 um and then beyond that another 5.

Sir Martin Sorrell: Disney Walmart amazon t mobilebile and paypal those are the top 13 clients they count for about 55% of our revenues and tech is about 50% so we’re heavily dependent on the growth of tech. Ah it geographically with about 70% north and South America great believer in that that pillar you know which is I think becoming increasingly important 20% in Emir with a very strong growth in Middle East an opportunity there and then the remaining 10 percent in Asia I’d like long term to see that. Probably 602020 from ah from a practice point of view content is about 60% of the business data and digital media is about 30% and tech services which is fast as grown for us at the moment 10% I probably like to see that fifty Twenty Five Twenty five because of the say tech is growing. Growing tech services and digital transformation coming forward. 1 other thing I would say I think the world has changed so the world that I knew at sarches and at Wpp was very much about globalization and the birth of the internet now it’s about fragmentation of geography. Unfortunately because the tensions in the world. The the lack of relationship between the us and China the the war with Russia which is likely to continue for a long period of time at making Europe you know, less attractive and then finally um.

Sir Martin Sorrell: Ah, the Iranian Nuclear threat all this means that the world is a very more volatile place as you can. We can see every day and therefore I think north and South America becomes very important Middle East and Asia and if you have a big position in China you probably are nervous about. Taiwanese situation and whether you should go further. You have a ah small position in China you probably want to build it bigger. But asia is going to become more and more important the balance of power is shifting and by 2050 if you look at the gdp predictions.

Sir Martin Sorrell: Ah, China will be the biggest economy us second India Third fourth Germany maybe and fifth Indonesia or maybe Indonesia fourth and Germany fifth. So it means that asia will be 1 3 and 5 or one 3 and 4 in terms of. And terms of countries of country size. So asia is going to become more and more important. So. That’s you know the world that I see it on the geography side on the tech side because gdp growth is going to be less than we’ve been used to and because. I think inflation will be greater than we’ve been used to and I don’t think we’ll get it down to 2% as the central banks will say they want to do and as a result interest rates will be higher I think clients are going to be very focused on efficiency and cost and therefore digital transformation and Ai. Becomes increasingly important so that we’rere we’re going to embarking on and a new era in my view where geographical focus is going to be very important and focus on digital transformation is going to be important.

Alejandro Cremades: So Martin I have a 1 last question for you and I want to bring you back in time I want to put you to a time machine and I want to bring you back in time to that moment where you were in harbor business school.

Sir Martin Sorrell: Short.

Sir Martin Sorrell: Um, sure.

Alejandro Cremades: You know, perhaps learning about business. You know having you know those say chit chats you know with classmates and and listening to your professors and case studies and let’s say you had the opportunity of having a conversation with your younger self and be able to whisper you know in your ear and give yourself.

Sir Martin Sorrell: Um, sure.

Alejandro Cremades: 1 piece of advice before launching a business. What would that be and why given what you know now.

Sir Martin Sorrell: um um I think I think you always be more ambitious um than you than you think possible. You know I think when when you see trends you know I think I think. We failed to do or have failed to do is when we saw trends developing we didn’t go big. We were always or I was always conservative. Um, um, should have gone bigger. So if you spot something I think. Going. But you know being more aggressive on it is is probably the best thing to do I mean we obviously have to be right about the trends. But you know if I think about globalization if I think about the internet if I think about ai um if I think about metaverse now and blockchain I think. Those things I’m not so much about about the crypto and not so much about and Nfts. But I think you know if you if you see something go big. don’t be don’t be shy the other thing I would say you know I regret not being ah ah as versed in code. As I should have been I certainly regret not speaking chinese and maybe and maybe spanish as well now because I think that’s going to become more and more important too. So you know the the inner advice would be code chinese and I would add spanish now because I’m a great believer. You know I think.

Sir Martin Sorrell: Latin America and the us yeah is the counterbalancing force and I think you know we’re going to see much more. You know we’ve got countries playing both ends against the middle like Saudi Arabia India Brazil. So the the world is going to become a much more um, much more nuanced world I mean the last forty fifty years with the cost of capital being so low. Certainly the last ten fifteen twenty years being so low. It was relatively easy. This is going to be a more difficult phase this is going to be where you know smarts are going to be really important in relation to geography and technology as I said and and I think going back in time I would say when you see a trend I mean I’ve I’ve witnessed at first high. Hand the growth of alphabet the growth of meta the growth of Amazon the growth of alibaba of tencent a byke dance of tesla of Nvidia of Apple of Microsoft we’ve seen it all at very close hand. And I think one was always a bit too cautious. One should have gone bigger.

Alejandro Cremades: I love that well Martin thank you so so much for being on the dealmaker show today. It has been an honor to have you with us.

Sir Martin Sorrell: Um, place up and you’re a lucky man you’re in Yorker enjoying yourself and I’m here sweating away along. Ah.

*****

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments