Should you be raising money for your startup? If you are looking for capital, what is the psychology behind fundraising?

Without a doubt, raising capital is one of the most critical decisions entrepreneurs need to make for their business. Bringing in the wrong investors could be fatal as divorcing an investor is harder than divorcing your own husband or wife.

Moreover, the process of fundraising itself is a roller-coaster of emotions. In the morning you may feel like you are on top of the world while in the evening you may feel like the world is coming to an end. Embracing the journey and not accepting a no for an answer is what separates those that succeed from the ones that fail.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Storytelling is everything in fundraising where psychology is also present. For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash. Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400M (see it here).

Remember to unlock the pitch deck template that is being used by founders around the world to raise millions below.

By mastering the psychology behind fundraising you will have full control over the process. This will give you an edge and a clear advantage in order to close the deal.

With that been said, below are the critical factors to understand the psychology behind fundraising before prepping that pitch deck and getting ready for investor meetings. Don’t forget to share with friends on social media!

Here is the content that we will cover in this post. Let’s get started.

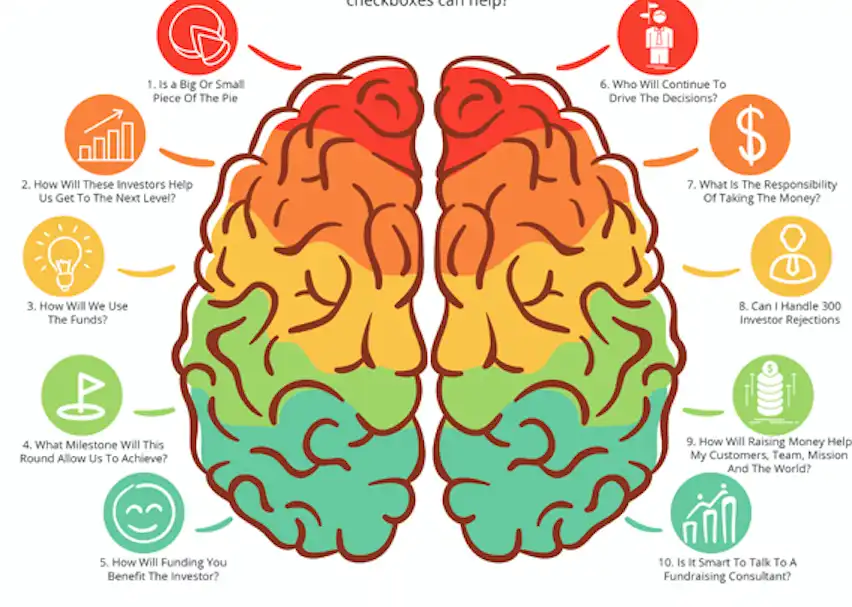

- 1. CLICK TO ENLARGE

- 2. Share This Infographic On Your Site

- 3. Is a Big Or Small Piece Of The Pie Better?

- 4. How Will These Investors Help Us Get To The Next Level?

- 5. How Will We Use The Funds?

- 6. What Milestone Will This Round Allow Us To Achieve?

- 7. How Will Funding You Benefit The Investor?

- 8. Who Will Continue To Drive The Decisions?

- 9. What Is The Responsibility Of Taking The Money?

- 10. Can I Handle 300 Investor Rejections Before Getting To “Yes”?

- 11. How Will Raising Money Help My Customers, Team, Mission And The World?

- 12. Is It Smart To Talk To A Fundraising Consultant?

- 13. Who Long Should I Bootstrap Before Taking Money?

- 14. How Will I handle Failing With This Investor Money?

- 15. What Will I Do After This Startup?

- 16. Are These Investors A Good Fit For Your Ideal Company Culture?

- 17. Should I Be raising More Or Less Money?

CLICK TO ENLARGE

Share This Infographic On Your Site

Is a Big Or Small Piece Of The Pie Better?

Is it better to have a bigger piece of a smaller company, or a smaller piece of a much larger company. At its core, this is often what the decision to fundraise comes down to. If you crave ultimate control, and care more about near term profitability than bragging rights or global impact, then maybe you are fine bootstrapping for now. If you need or want to be a giant on the map, or need speed, then raising is probably a necessity. After all, owning 100% of a $100M company, is the same in dollars as owning 10% of a $1B company, right?

How Will These Investors Help Us Get To The Next Level?

What introductions can these investors make to secure success in future funding rounds? Will their name being attached to your startup alone make it magnetic for more money? Do they have a pattern of follow up investments with other desirable investment firms which will be great strategic plays for your startup? Do they have relationships with strategic acquirers or international funds in locations you plan to expand to?

How Will We Use The Funds?

Are they funding team development, for product creation, scaling, international expansion or to park in the bank for a rainy day? Is there an immediate need or use for the money, or are you raising just because the market is good for it right now?

What Milestone Will This Round Allow Us To Achieve?

What milestone will this round fund so that you can prime yourself to raise another in the next 6 to 18 months?

It’s also worth considering in advance who the next round of investors will be at the next stage. Will they be angels, VCs, private equity or corporations?

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

At each round investors will be looking at different factors. In early rounds everything is riding on the founding team and the pitch deck. As you progress it will be about the milestones you’ve achieved, and whether you have product market fit, revenues or profits.

How Will Funding You Benefit The Investor?

Remember that everything in this business venture is about creating win-wins. That applies to customers, employees, acquirers and your investors.

What is this going to do for them. It’s not just about the money either. There is no shortage of other startups and entrepreneurs begging for it. How will it make the partner you are dealing with look like a superstar in their organization? How will it make the fund look awesome to their limited partners?

Who Will Continue To Drive The Decisions?

Who will join your board? How will your voting rights change? Is your new round of investors comprised of operators who will want to take charge? Or will they take an advisory approach and lend their wisdom and experience in the broader market, and let you continue to make the calls?

What Is The Responsibility Of Taking The Money?

Taking money for your startup is going to cost more than just the money and a rate of return. It is a responsibility. It will commit you (spoken or not), to certain future actions. Their fund may have deadlines for their investors. That can create pressure to speed things up, regardless of the long term costs. It will typically mean committing to future rounds of fundraising, and then sprinting for an IPO or exiting through a strategic acquisition. These can all be great things. Though not every entrepreneur wants those pressures.

Can I Handle 300 Investor Rejections Before Getting To “Yes”?

It may take 300 “No’s” to get to one check. Hopefully it won’t, but it could take more. The difference in the founders who make it and make it big are those who refuse to quit. They accept feedback gracefully. They see every investor meeting and rejection as an opportunity to improve their pitch and plans. You can’t take it personally and to heart. One day they’ll be knocking on your door, begging you to take their money. Just as long as you don’t quit. Fundraising is made to sound really easy in the media. Sometimes is can be, but the journey will be far more enjoyable if you prep yourself for a lot of rejection in the early days, months and years.

A better pitch deck can help, shortlisting the best fitting investors can help, and so can being sure you’ve been developing your capital network several years in advance of your need.

From a pure psychology standpoint, so can building your likability, relationship with investors and your positioning. Many investors were once founders themselves. Or they dreamed of following your path instead of the one they took. Use that association.

You’ll also be highlighting your problem and challenges in your pitch, but taking a page from Psychology Today, don’t forget to highlight how fun and amazing the ride is going to be too.

How Will Raising Money Help My Customers, Team, Mission And The World?

It’s not just about putting money in the bank and bragging rights to raising the biggest rounds. That alone may not go far to helping your startup last and grow into its potential. Can fundraising and leveraging more capital and partners enable you to do more for your customers, team and in accomplishing your mission and having an impact than you could hope to do without it

Is It Smart To Talk To A Fundraising Consultant?

Can a fundraising consultant make fundraising efforts more efficient and the terms better? Should you also be consulting a M&A advisor on the option of existing or a strategic merger instead of raising another round?

Who Long Should I Bootstrap Before Taking Money?

You may needs millions to develop prototypes or to make a marketplace work out of the gate. If not, bootstrapping for a while can have some advantages. It may feel more challenges at first, but it can pay off later.

It can help you focus on the business. It leaves you more time. It can leave you free to make your customers the priority instead of investors. It gives you more breathing space to test and make mistakes.

When you do get to raising money, you’ll have more equity and you’ll be in a much stronger negotiating position. You won’t have to give up as much to get more money.

How Will I handle Failing With This Investor Money?

It happens. You will make your best effort. You will prioritize taking care of this money even better than your own. Yet, things happen. You may need to hard pivot. You might find the world changes and the initial idea is no longer viable. How will you prepare and tell investors?

The good news is that if you do handle it well, they might be okay with funding your next venture anyway.

What Will I Do After This Startup?

It’s important to remember that this startup is not your identity. You are not this startup. The decision to fund you or not, isn’t a reflection of whether you are capable of creating a billion dollar company or not. Whether it succeeds or fails, you will live on. It is just a moment and temporary project. Keep this in perspective. It helps if you are already thinking ahead to what you will do next.

Are These Investors A Good Fit For Your Ideal Company Culture?

One of the most important things you can take time out to do is to write down and define your ideal company culture. What does it look like? What are the most important values you won’t compromise on? Do your prospective investors match this checklist? If not, can you keep looking and be okay with walking away from the money?

Should I Be raising More Or Less Money?

What are the advantages of raising more or less money in this round?

Do you even know what you competition is raising right now at this stage? Are you in that range? If not, why? What might that say about you to investors?

Should you be raising more in case capital markets dry up. Or even to raise on more attractive terms before money gets more expensive and you have fewer investor options?

Or can you really make enough good investments with the capital you are being offered? You are going to be under significant pressure to invest is for great returns. However, there can be situations in which you are given an offer you just can’t refuse. Like one of the founders I interviewed on the Dealmakers Show who was offered $1B or nothing. If he said no, that money would have gone to the competition.

Facebook Comments