Mario Schlosser’s story resonates with entrepreneurs navigating the complexities of building companies across different cultures, facing financial hardships, navigating board dynamics, and even being fired from their own startups.

Mario’s latest venture is Oscar Health that has raised funding from top-tier investors like Lakestar, Alphabet, Coatue, Baillie Gifford, and Reinvent Capital.

In this episode, you will learn:

- Mario’s transition from Germany to Silicon Valley revealed how cultural differences shape entrepreneurial approaches. His shift from a solitary, self-reliant coding mindset to a more collaborative, big-thinking American approach was pivotal in his success.

- Mario faced numerous challenges, including financial hardships, being fired from his own company, and failed ventures. His story emphasizes that resilience in the face of failure is critical for entrepreneurial success.

- Many of Mario’s early ventures were ahead of their time, such as his work on mobile photo-sharing apps before Instagram. This taught him the importance of launching products when the market is ready.

- Mario’s time at Vostu, where internal strife and a lawsuit with Zynga ended in him being fired, was a valuable learning experience. These setbacks prepared him for future ventures, including the launch of Oscar Health.

- Mario’s diverse background—from coding as a child to studying electrical engineering, linguistics, and business—allowed him to combine technical and business skills, contributing to his ability to innovate in sectors like health insurance.

- Mario’s time at Harvard Business School and McKinsey broadened his perspective, teaching him how to approach problems strategically and helping him transition from a technical expert to a business leader.

- The creation of Oscar Health leveraged Mario’s gaming background, using virtual economies and incentives to reshape how health insurance influences consumer behavior. This innovative approach, coupled with the rise of Obamacare, helped Oscar thrive in a challenging market.

SUBSCRIBE ON:

Keep in mind that storytelling is everything in fundraising. In this regard, for a winning pitch deck to help you, take a look at the template created by Peter Thiel, the Silicon Valley legend (see it here), which I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Remember to unlock for free the pitch deck template that founders worldwide are using to raise millions below.

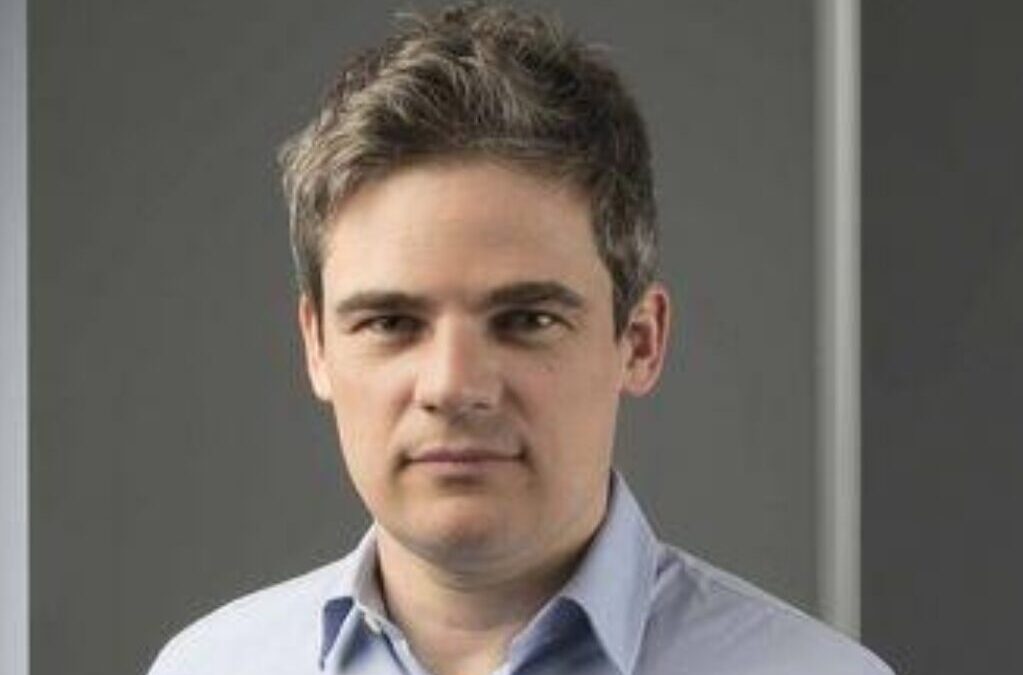

About Mario Schlosser:

Mario Schlosser is the Co-Founder & Chief Technology Officer at Oscar Health. In this role, Mario leads product and engineering, with a focus on building Oscar’s technology platform for the future and continuing to set the strategy for +Oscar.

Previously, Mario served as CEO of Oscar, leading the company from inception to serving over 1M members. Before co-founding Oscar, Mario also co-founded the largest social gaming company in Latin America, where he led the company’s analytics and game design practices.

Prior to that, Mario was a Senior Investment Associate at Bridgewater Associates and worked as a consultant for McKinsey & Company in Europe, the U.S. and Brazil.

Mario also spent time as a visiting scholar at Stanford University, where he wrote and co-authored 10 computer science publications, including one of the most-cited computer science papers published in the past decade, in which he developed the EigenTrust Algorithm to securely compute trust in randomized networks.

In May 2019, Mario and his co-authors, Sepandar D. Kamvar (Mosaic Building Group Inc) and Héctor Garcia-Molina (Celo), received the prestigious Seoul Test of Time Award from the International World Wide Web Conference Committee (IW3C2) for this work.

Mario holds a degree in computer science with highest distinction from the University of Hannover in Germany and an MBA from Harvard Business School.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

Connect with Mario Schlosser:

Read the Full Transcription of the Interview:

Alejandro Cremades: right Hello, everyone, and welcome to The Deal Maker Show. so Today, we have a really amazing founder, a founder that has done it you know multiple times. you know He’s on this rocket ship that today I’m sure many of you have heard. and We’re going to be talking about all the good stuff that we like to hear, building, scaling, financing,

Alejandro Cremades: We’re going to be talking about getting fired as a founder from your own company, Dynamics, you know with board, with co-founders, also coming from Europe and being here executing as ah as a foreigner, you know also perception and culture. I mean, it’s a little bit different. I’m a European too, so we’re going to have the battle of accents, which is another one. We’re going to be talking about running out of money, you know another big one, you know that every founder at some point experiences. And again, a lot ah a lot of good stuff. So brace yourself for a very inspiring conversation. And without further ado, let’s welcome our guest today, Mario Schlosser. Welcome to the show.

Mario Schlosser: but Yeah, hundredro great to be on. If you don’t have a European accent, you got to practice to have one, I think. But I do we think German accents beats Spanish accents. So I got you there.

Alejandro Cremades: Good stuff, good stuff.

Mario Schlosser: Namos.

Alejandro Cremades: So lets let’s let’s talk about that European thing, the the European roots on Europe and Mario. You were born not far away from Frankfurt in a small town there, so give us a walk through memory lane.

Alejandro Cremades: How was life growing up for you?

Mario Schlosser: come from a relatively small town, 18,000 people called Hochheim am Mainz. They call themselves the Gatestuber Rheingau. Rheingau is a Riesling area, so I made some money um picking grapes when I grew up. And it is an idyllic German town, like many plenty of German towns. I’m always amazed when I fly back from the US to Germany yeah how parceled up and manicured everything in Germany is. It really is a lot of people in a fairly small small place. Its own little medieval city wall around it and so relatively very very far I would say from the ambitions of Silicon Valley or the ambitions of New York. I mean I live in the Upper West Side of New York now

Mario Schlosser: have been here for 20 years something like that it was in the valley for quite some time as well and the kind of horizon extension you experience when you go to american institutions like harvard business school or whatever and they tell you you’re going to be the leader of the free the leaders of the free world is so different than when you grow up in germany and one funny thing actually when german’s apply for a harvard business school and you hire or you a tutor or you ask people how you do that they will tell you you have to exaggerate your resume because german’s will always understates what they’ve done and americans will always overstate what they’ve done and so that to me is just an incredible illustration of ah the differences between between the cultures there

Alejandro Cremades: And what about engineering? you know What cut your eye about engineering?

Mario Schlosser: My father is a middle school teacher um and he studied sports and religion, actually, and he also taught taught German and geography, whatever, all that stuff. And my mother is a NICU nurse, so is my sister, actually. So there’s not a lot of engineering in the family. My grandfather had some ah was a quasi-engineer, so to speak. He didn’t have a title, he fought in World War II.

Mario Schlosser: um and and some and just worked at a German industrial firm afterwards, but was a fantastic sort of craftsman, if you will. But I got a Sinclair ZX81 computer with one kilobyte of RAM when I was eight years old from a friend of my father’s and a bunch of like manuals that all had lots of coffee stains in them with a bunch of basic listings. I mean, literally listings in the program language basic and started typing those in. And that got me hooked on coding There is not a great environment of of knowing other people and so I tend to this day to be a fairly so solitary coder. I always notice this and get a big difference perhaps between Europeans and and American founders if you will. The American founders will always immediately think about how can I make other people do the work for me and maybe the Europeans sort of think I got to do it myself. But so it trained me fairly early on to just playfully figure out how to get something interesting out of the computer.

Mario Schlosser: and some and did not really have any formal training there at all. And in fact, later on, before i when when I went to university, then struggled with whether I should even go study computer science or engineering and didn’t do that ah initially. I won a bunch of prizes in a um German competition called Jugenforsch. Young people do research. I built an eye tracker in 1995, 96, putting a camera on the computer. It would film your face and figure out where you’re looking and whatever.

Mario Schlosser: um And so you would think that that would then put me on the path towards oh I should study engineering and even that I thought no no no this eye tracking thing I liked because it was creative and not just technology like it was interesting it was colorful it had something.

Mario Schlosser: to do with sort of you and computer interaction or whatever. And I thought that’s sort of my sweet spots, the combination of these different fields, not so much just writing algorithms, if you will, or designing chips or whatever else.

Mario Schlosser: But anyhow, that’s ah where the computer, the lust for computers got awakened with that ZX81 in early days.

Alejandro Cremades: Now, in your case, I mean, you you you studied, you know, I mean, obviously say you you you were into this. I mean, you were getting into eye tracking devices, computer linguistics, I mean, all types of like technical stuff. But he was a professor that ultimately gave you the chance that changed everything, which was to do an internship in Silicon Valley. So how did the um I mean, as a European, I’m sure that you’re like, my God, what’s going on in here now with all the innovation around you? So how was that experience for you?

Mario Schlosser: Yeah, I initially went to ah the University of Trier in Germany, and southwest of Germany, roughly, because they had a they ah computer linguistics course, so a mix of linguistics and computer science. And so I’m so glad I didn’t stay there because computer linguistics got completely reinvented in the in the early 2000s and went from rule space to then entirely statistics based.

Mario Schlosser: and so away from the sort of Chomsky grammar and space to then just essentially early versions of deep learning. And so one and now, of course, is all deep learning, really linguistics. And I had met a professor who was a chip design professor, like electronic design automation professor in the University of Hanover. And he told me, come up and just go study hardcore engineering, computer science, actually, electrical engineering, computer science, a combination of the two. And I just went and didn’t it went there and did some chip design, whatever. i had my My bachelor thesis was ah designing an algorithm that would read signals from the heart after cardiac surgery ah and would map them into a risk of atrial fibrillation and to design a chip for that. and what An FPGA to be precise, building sort of like an early version of ah

Mario Schlosser: chip design programming language and and then flushing up through that And that professional then gave me an internship in Silicon Valley, and as you said, it’s with a company called Infineon, German semiconductor company still exists to this day. and And it was a magical time for me because I landed in. in think SFO or San Jose airport, I don’t remember exactly, yeah and just remember driving down the 280, one of the highways, there’s a 101 in the 280 in Silicon Valley and into um San Jose at the time, so it must have come from SFO obviously then, and saw a sign for Stanford over the hills, and this mountain view on the signs, and some all these magical Spanish names I had never seen from close up,

Mario Schlosser: And I love that so much that I wanted to stay here. And then when the integer was over thoughts. Okay, what do I do next. And I called up a bunch of professors at Stanford’s who I thought were in fields I know something about computer vision and network switching design chip design and so on.

Mario Schlosser: And then a German professor who was at the time in a in and the database group at Stanford in the computer science departments invited me to come over and become a visiting scholar there. And that was a fantastic time then as well. I wrote a whole bunch of publications, I think 10 papers or so in and just about two years. ah One of which became a ah quite influential paper that then 15 years later or so won at the World Wide Web Conference the so-called test of time awards which gives gets given to papers that’s sort of into the test of time and the first paper that got that award was the Larry Page and sort of given Google paper and then I think two or three papers later it was this paper that

Mario Schlosser: me and my buddy had written ah so anyhow that was then that wouldn’t ever have happened I think if I hadn’t gotten somehow myself my my professor hadn’t gotten me over there and if I hadn’t gotten myself then to stay in Silicon Valley and find those connections.

Alejandro Cremades: But rather than going farther into the startup world, you know you you go into McKinsey, right which is totally unexpected. I guess from that time at McKinsey, where you were for a couple of years, what was your biggest takeaway about problem solving?

Mario Schlosser: Yeah. m i i don’ it’s ah It’s a strange thing. I think, um like many entrepreneurs, if I try to be a bit self-reflective, I have some combination of just incredible self-delusion of sort of playing my way through life, if you will. i’m In the best situations, I feel just incredibly excited and curious about doing something new and with complete reckless abandon for how successful I might be at it. And some and I think honestly, perhaps not having gone to Harvard undergrads or whatever and having been in the

Mario Schlosser: the sort of like hamster wheel ah that now my kids are in. I have a 10 year old and a 12 year old in the Upper West Side of Manhattan. and My wife’s Brazilian, I’m German. And so none of us ever really experienced growing up in in ah in a high powered US city. yeah But those guys, they’ve already gotten more rejections and by the time that they turned 10 years old than my kids. Then I almost had a life because you got to go and apply for schools and for kindergarten and all that kind of stuff and interview and testing and everything else.

Mario Schlosser: And so I hadn’t didn’t have any of that. and So for me, it was really all upside, if you will. And so the McKinsey thing, McKinsey, Germany at the time had a recruiting program to go to American top universities and find the Germans there and try to convince them to come back to McKinsey, Germany, for me was another one of playful things. So I thought like, Oh, yeah, should I love to See what these guys do they stay in five-star hotels have never been in the five-star hotel and never flown business class or any of those things Let me do that for three months. I think it was ah actually two months internship in in in late 2021 and some actually 22 so combination of that playfulness and then also um

Mario Schlosser: not really having particularly high confidence that any of these things will lead to anything, ah sort of thinking, well, what do I have to lose? I’m probably not going to be very good at it. I probably don’t know how to do it. and But whatever, might as well try and and so might as well see how far I get. And I think that the fact that I was able to talk myself into Stanford computer science gave me some confidence that some if you’re forced to randomness in life,

Mario Schlosser: It can go in your favor every now and then. you know And so I went there. And some in in in in what is very typical for me, I made no plans whatsoever beyond the two months. I didn’t get an apartment. I didn’t rent anything. I just literally had a sleeping bag. And I bought a suit. In the case of Germany at the time, you had to wear a three-piece suit. So a suit and then a tie and then a vest as well. i I don’t even really sell it anymore, that stuff. But I was at that time still very conservative.

Mario Schlosser: And I just bought those things and just crashed hotel rooms all the time. And that was it. And I moved back in with my parents for a while and slept in their basements. And I’m like, whatever, I can just travel around and go to Amsterdam on the weekend and fly to Rio de Janeiro with my friends of McKinsey for the weekends and come back again.

Mario Schlosser: um And that was an incredibly interesting life to have for a while, because at the same time I realized, you asked me a question about problem-solving, and that McKinsey had very, very different problem-solving muscles than what I had learned in computer science and at Stanford and so on. i mean Stanford was an incredibly high IQ place for sure, it still certainly is. I did not necessarily think that my German university in Hanover was that much less than that. so I think that even my German and you know physics classes whatever all had some had incredibly smart German engineers in them the difference is the people at Stanford go and start companies the guys in Hanover would go and work for a German middle science company you know like one of those companies in Braunschweig whatever or in Karlsruhe that are incredibly good at what they do but they built some weird computerized ball bearing whatever and they sell it to you know three other companies in the world and and some

Mario Schlosser: people there would never think that they could start that company themselves. So anyhow, McKinsey had a had an incredible sort of like look at the world from the top down and and decompose a problem into its constituent parts and and look at it that way. And I remember calling my Stanford professor after I’d been there for a month and saying, and and the thing I was impressed by was how quickly McKinsey consultants built Excel spreadsheets. and And I then actually remember also A year later, McKinsey sent me to a mini MBA. They used to do that for people who didn’t have a finance background. They would then give you sort of like an MBA in two weeks, whatever, or three weeks. And so that was the first time that I met hedge fund people and investment bankers. I’d never met investment bankers before.

Mario Schlosser: um And so and I was incredibly impressed with those guys because they were even they knew how to not only do excel but they use excel with with keyboard only I had to use the mouse lever they had all the keyboards or tricks right inside a new line or whatever and build a model very quickly and I just remember to this day I would that see into my brain how impressive I found that today I find this incredibly lame to build spreadsheets in excel and But the fact that I found this so mind-blowing was such an illustration of how foreign that was to me at the time. And it’s a very different way of problem solving. And it’s very impressive. And McKinsey, the sort of chutzpah of going into the CEO’s office and saying, I’m 21 years old, and will I will now tell you how to run your business, ist is a kind of good thing to learn at some point as well.

Alejandro Cremades: It’s really spectacular and I think that that probably gave you some perspective on maybe it was time to switch gears and to ah go to the business side and perhaps say that came you know with um going into Harvard Business School and that was a pivotal moment for you too because you were able to Meet, who ended up becoming your co-founder on a couple of startups, right?

Alejandro Cremades: And that was a Josh Kushner. And for those that day don’t know who he is, he found it to thrive and they just did an amazing, um they let the round of, if I don’t remember wrong, of chat GPT and open AI.

Alejandro Cremades: And that was like 150 billion valuation, 6 billion in a round, unbelievable.

Mario Schlosser: Yeah.

Alejandro Cremades: So what an amazing guy to know.

Mario Schlosser: yeah

Alejandro Cremades: So you guys meeting in Harvard and and that changed everything.

Mario Schlosser: Yeah. Yeah, and absolutely. I mean, um I went to business school, really. and and so i Remember when I went, when I said, a okay, i I should just go there. I felt almost bad because to me going to business school was a sign that I really hadn’t found anything interesting in my, in, in life to focus on. I thought that the people who go all in on risky bets and just go and fucking start their own company, whatever, those are the ones who are going to make it big. And here I was going to business school and I’m playing it safe and everything. But then I said to myself, I have two years to start companies. And, and I just started that summer of 2005. This is when I went to HBS.

Mario Schlosser: and croak programming again this is the early days of facebook and and my space and whatever in fact i have an email from sean parker from i think january 2005 saying hey mario we started a company called the facebook company you want to come in and and have a chat and talk about what we’re doing here and love to get you on boards And I looked at the site, and I saw it was written in PHP. And I thought, only script kiddies write websites in PHP. And so I said, no, don’t if I’m not interested. I don’t have time. Actually, I think it was in Brazil at the time for a McKinsey project. And like I like it too much down here. and But even at McKinsey, by the way, I took a summer off in 2004 and went back to the Valley and started with a friend of mine, who then later on became a professor at MIT, a startup that was about online

Mario Schlosser: uh purchasing online assets effectively so you could make a ringtone sell it to your friends or whatever um too early for its time friend of mine at the time was doing a mobile photo sharing company uh this is like six years before instagram whatever else and of course it flops now these were like the grainy small nokia photos whatever a early cameras in phones shows how much tiling risk there is to be any kind of startup um but the reason i mentioned is because I just always flittered back and forth so much between thinking, oh, I should try to go and I want to be in a big company, or no, I want to do my own company. yeah And some I almost looked at it ah as a bit of an A-B test, which one I like better. And I had various points in time where I concluded for myself, I will never do a startup again. And then it always happened again. And so ah finally for the better.

Mario Schlosser: ah But certainly for founders I think this means most the vast majority of what I did on the founding something sides went absolutely nowhere. um Either because you know friends of mine stopped like the people I was doing it with didn’t want to do it anymore or because I lost interest or because you know, we raised some money in and then didn’t use it properly, whatever. ah And that will just happen to you. I feel like the people who are lucky and for whom and lightning strikes very early on, are probably in the minority there. ah And so, but then lightning struck with me in the form of meeting great people at HBS and Harvard Business School. And yes, as you said, Josh was one of them. He was in the college at the time, actually, and through a friend of mine ah who was in my HBS class who knew him, we got together and we said that start a social network for Latin America.

Mario Schlosser: A friend of ours was from from Honduras actually and so he had he added the whole Latin America angle and I had been programming a social network because I had missed that Facebook thing you know and so and some and then we did that for a couple of couple of years but but also not full time after HBS when the Silicon Valley again raised a little bit of money for this thing stepped on floors um slept in the garage also in silicon valley and then financial crisis starts and i said okay let me take the one job that i interviewed for at hps which was with a very smart hedge fund called bridge world associates um and they were very much ahead of their time at the time and understanding what’s happening financial crisis deleveraging and some uh debt crisis and whatever and so that was super cool to be there for and then as is my once i had no plans no rents no um i wouldn’t very few clothes and just literally s slept on the air beds for

Mario Schlosser: the first six months and roads to Bridgewater through the ice storm of the winter of 2007 on a shitty old bicycle or whatever and bought a rental car for $500 or whatever ah um that then at some point just died and because i thought i’m going to stay there for three months and leave again and then i ended up staying three years and so just always getting slapped into something yeah

Alejandro Cremades: Wow.

Alejandro Cremades: But at the same time, you know you were doing Vos 2. And Vos 2, basically, you guys were able to grow that nicely in the US. I mean, you guys were calling it the Singa of Brazil.

Alejandro Cremades: Not for those people that don’t remember Singa. The video game that was attached to Facebook, too. And that’s how kind of like they blew up.

Mario Schlosser: Yeah.

Alejandro Cremades: But in your guys’ case, you became the Singa of Brazil until Singa came knocking with a lawsuit, which changed course. What happened there?

Mario Schlosser: Yeah. Vosto was an incredible story. yeah I mean, it was really a reminder of how viral growth can work. Actually, one funny story that I will tell very briefly, because I also think it goes to work and how as a founder you have to pay attention not just what you want your company to be but but what what the signals are you get from from the outside world so when Facebook opened their platform in 2007 that was the first in the summer of 2007 was the first time you could put apps onto Facebook which then led to Zynga in the next two years or so right Zynga blew up in 2008 2009 or so when games started running on the platform so right on that first day

Mario Schlosser: In 2007, I was in Silicon Valley. That was ah when I had graduated from from Harvard Business School, and we spent that summer there, as I just mentioned. so And there were all these ex-Facebook people, which is also, by the way, a great story. yeah Almost the entire first generation of Facebook people all quit two or three years after the founding.

Mario Schlosser: um And so they’re not really that known to history anymore for their being at Facebook, but they’re known for other reasons, perhaps. I started a company afterwards, but the value was full of people who thought Zuckerberg was a complete child, man-child, and a terrible CEO, and impossible to work for. And your shitty company got a business or whatever. I mean, it was full of these people who had worked at Facebook.

Mario Schlosser: and they just left. Many of them actually sold their stock then in secondaries in 2008, 2009, and for like 3 million bucks or whatever, which is a lot of money, but it could have been 3 billion dollars. They had to head on to it, not too many years later. But it just so goes to show that even Facebook, plenty of the early years, he would have gotten totally wrong if he had looked at the company in that development time. So Facebook opened their API in 2007. We were trying to build this Latin American Facebook.

Mario Schlosser: And I said, you know what, screw it. Let me put an app on Facebook. I’ll just do it. And I asked a friend of mine that designed 10 icons. And we said, let’s do a gifting app. These were popular um at that time. And we did an app called Sexy Gifts with three Xs because the one with two Xs was already taken or the one X was taken already. And you had like a a whip and a like i think it did over literally and like a like a blow up doll or whatever like you’d send to your friends like little icons and you would level up the the more gifts you send and you would have like weird levels you know that would be it i would incredibly um crude up frankly yeah but i put that thing online and it had like and i had a blackberry at the time and there’s a little website where i could watch the statistic the stats on this thing and then first day like two users me and i think three users me and my two buddies

Mario Schlosser: In the camp in the startup which had not raised money for at the time next day like for whatever users and the next day then five years and the day after 100,000 users and then in a week later and my server my server operator called me at the time there was no clouds right this is all like.

Mario Schlosser: Java, whatever, machines, or machines that some Java server ran on in some base basement basically. yeah That guy calls me and says, you’re completely blowing up my all of my traffic. um What are you doing? You got to pay me more. And I paid like 100 bucks a month for this thing. I said, oh, you know what? This is not worth it. I don’t want to be known for being the guy with a sexy gift app. And so I just shut it down. And and it was such an incredible, in hindsight,

Mario Schlosser: idiocy, because here we were getting an incredibly early glimpse of the insanity of of viral channels, programmatic channels, opening on a social network. And we just said, no, no, no, let’s build our own social network. It is the dumbest thing. And so Pinkus, Mark Pinkus, who was not as smart as we were and didn’t know how to code, and he’s like, oh, let me just put a poker on Facebook and see what it does. And that’s what became Zynga, I think it’s just the CEO of Zynga, who then sued us, whom we to this day still hates. Now he’s spouting bullshit on Twitter again. So I think I can still say this. And and so yeah, when we then eventually became super popular for our games in Brazil, which we then finally put on the Facebook of Brazil, which at the time was Urquhut, who happened to actually be a friend of mine ah from Stanford, my Stanford days, who had come to Google and built a social network called Urquhut, literally named after himself.

Mario Schlosser: at Google, um we were the biggest game provider on Oracle in Brazil and and had something like 30 million Brazilians playing our games um every month, which was a ah third of all Brazilians on the internet at the time, or even more. um and And then when that really started taking off and we called ourselves a Zynga Brazil, eventually Zynga Sudas for copyright infringements. And that thing got settled fairly quickly in an adventurous lawsuit that is almost too long to tell the story about.

Mario Schlosser: you know corrupt judges and in Brazil and then you know crazy fights between um you know US court and Brazil court, whatever, all that kind of stuff. ah But in that settlement time, all of us founders, we were at the time we have five founders or so in that thing, started fighting with each other about all kinds of stuff. um I didn’t talk to Josh for a while.

Mario Schlosser: um My other buddy Daniel Caffee was the CEO actually yeah of the business. I was only the chief researcher, um chief scientist, sorry, which was sort of game design and Linux, whatever. And we fought a bunch and we all made up again, but then the rest of the company was tired of us. And so the board stepped in and fired all the founders.

Mario Schlosser: And that was really the beginning of Oscar, actually. That was in March 2012. And I came back to New York. My wife was pregnant. Josh and I had a coffee and licked our wounds and said, what the hell do we do now? And Josh said, I’m going to start a venture fund.

Mario Schlosser: And I would like to start an insurance company. I said, OK, let me try to help you with the insurance company parts. And then that became Oscar.

Alejandro Cremades: Wow. So then so for the people that are listening to ah to hear, what ended up being the business model of Oscar Health? how How do you guys make money?

Mario Schlosser: It’s really a health insurance company in its core. So um very simple business model and very well-known business model. You take it a monthly premium and 80% of that premium will go out the door for healthcare costs. And then 20% go to administration and sales and marketing and things like that. That’s how every insurance company yeah ah health insurance really operates. But the particular flavor and idea behind Oscar was that, um and this there is a bit of a through line for me there.

Mario Schlosser: ah at Bridgewater in the Global Macro Funds, it was all about modeling the global economy and understanding how money flows throughout the global economy. and I really think what attracted me to the gaming world was we were building our own economies. I mean, I’m not joking. This is really, I had all these big spreadsheets, spreadsheets, there they are again, that simulated all these economies. You have to, as a game designer, you have to really figure out, okay, do you get, do I give you 10, 10 coins for this or 20 coins in a row? This is all work. How do you balance all this stuff?

Mario Schlosser: And that’s stuff I like the most, honestly. yeah And so when I thought about health insurance and health care, when Josh mentioned this to me, ah the biggest thing that appeared to me was, number one, the insurance company is the designer of the economy of the health care system, because it sets the reimbursement rates for physicians, and it sets the what it what it costs the members to navigate the health care system. That’s what the insurance can be determines. And the second thing is it can um it can incentivize members to do things differently. You know, it can make certain drugs cheaper, certain physicians cheaper, and all that kind of stuff. And so you had sort of control over this economy to some degree, these incentives. And that was the motivating factor for Oscar. And what we didn’t even know in early 2012, what became clear in the summer of 2012, was that some the so-called Obamacare reform or the so-called Affordable Care Act and was about to launch and on January 1, 2014.

Mario Schlosser: And that, for the first time, created in an individualized health insurance market in the US. So I don’t want to take this too far, but and very briefly, if you live in the US, you will have insurance either you will have insurance either from the employer or you won’t have it at all. that’s That was the case before Obamacare. And so 40 million Americans had no insurance health insurance whatsoever, which is hard to imagine for certainly anybody in the rich Western world or even not rich and the rest of the world that the rich country in the world has all these people that are insured and go going bankrupt when they get cancer or whatever. Obamacare created the market where as an individually good buy health insurance and we thought that means Oscar can for the first time be consumer brands and develop a real relationship between you and the end user and that that became Oscar health.

Alejandro Cremades: And for Oscar, how much how much capital have you guys raised today?

Mario Schlosser: And that’s a great question. I can’t even tell you exactly. So we raised probably about, some I’d say, 600, 700 million before our IPO, when public in March 2021. And before that 600, 700 million or so thereabouts. The biggest round we had was in 2018 when alphabets, the Google mothership, really from the corporate balance sheet, invested in Oscar.

Mario Schlosser: And a guy named Salar Kamangar, who was employee number nine at Google, he was the one of who bought YouTube for Google and ran it for a long time before Susan Wojcicki took over. and He was the one who ran AdWords for Google very early on and piloted that. And he was so excited about Asker that he wanted to join up with Word and got Google and Alphabet to invest. That was in 2018. That was a $375 million round, which today almost sounds small, but the time was like by far the biggest venture round, I think, in that year even for any company, certainly in health.

Mario Schlosser: healthcare care in the in in the US. And then in 2021, we were went in public and in in the IPO, we raised a billion and a half. So in total, I think capital in is probably about, um you know, 2.2, something like that.

Alejandro Cremades: Wow.

Mario Schlosser: And some yeah, then went public, I ran the company for the two years after the IPO, and the stock price went into the toilets for really that entire time virtually.

Mario Schlosser: yeah ah for all kinds of reasons. I mean, really sort of the public markets getting fed up with money-loosing companies, you know, we avoided the SPAC route, fortunately, we went to the real IPO, but that but was when all the crap came online or public with through the SPAC routes. And so the biggest thing there was profitability. And we then really, really, really ah painstakingly moved the company to towards profitability. And when we were very, very close to it, um one year ago,

Mario Schlosser: In April, 2023, I had met a guy named Mark Bertolini, who used to run one of the biggest US insurance companies called Aetna, who was retired, basically. ah I had met him in the IPO process. and I talked to him, end up talking to him once a week as a mentor, mentee kind of thing. We tried to get him to come on the board. He didn’t want to come on the board. And like, all right, let me talk to you at least once a week. And so I talked to him for two years, really, in a row. And I would always joke, come to Oscar one day. One day, he’ll work at Oscar. And then he eventually said like, yeah, maybe I should. and then as a as a founder to me it’s very clear you cannot share power for an accountability ultimate but accountability for running a company it just does not work never do co-ceos co-founders are fantastic but you have to have different roles it doesn’t work any other way and so when mark said i would want to come in

Mario Schlosser: and it would I know it would be extremely silly for me to try to say i’ll be the CEO or executive chairman or whatever and he does something else in the company under me that was stupid and and it was also going to be stupid for us to somehow be cozy or whatever and so i said i’ll become cto.

Mario Schlosser: ah running engineering, data science, products, security, and so on. And then he ah he’s the CEO, he’s my manager. And that’s worked, I think, for phenomenally well. And it’s really helped the stock price as well. The public market saw right away, and Oscar is serious about staying on this path of profitability and growing the business. and I think, hopefully, public markets also thought Mario’s still there to provide technology leadership and stuff like that.

Mario Schlosser: Um, and it came at a good time because language models blew up and whatever. And so I could do more in that space as well. So it’s been a credit.

Alejandro Cremades: Well, hey, in the last year, the stock has increased by like 94%. So you know I think that the the market is insane definitely appreciating that. I guess, question here, if you, 940%, oh my God, there we go, there we go.

Mario Schlosser: 940% 940. Yeah. They have almost a factor of 10. Yeah.

Alejandro Cremades: Not bad, not bad.

Mario Schlosser: So not only.

Alejandro Cremades: So now, not bad, not bad. Yeah, I was missing a zero there.

Mario Schlosser: Yeah.

Alejandro Cremades: So thank you for thank you for for pointing that out. Now, let’s say you were to go to sleep tonight, Mario, and you wake up in a world where the vision of OSCAR is fully realized. What does that world look like?

Mario Schlosser: I am think that’s… and the the real trade that should be happening in the US healthcare system is some for there to be an entity and that counsels you very early on in a very, very personalized way as to what you could do differently for your own life, given who you are, given how you live, and given where you live and all these kinds of things, to just keep yourself healthy and happier for life um and gives you incentives and very concrete action items to go and follow that. And if you follow that,

Mario Schlosser: you statistically very, very likely to be a happy and healthier person. And that entity can really only be the health insurance company because the health insurance is the only one that makes more money if you are healthier. If you to go to the emergency room less, if you take fewer drugs and all that, or if you at least you take the right drugs.

Mario Schlosser: and all those kind of things. and And so, and it is also very clear that great studies that show that if you’re 40 years old and you go work out twice a week, whatever, and you then look at the costs you incur once you turn 65 years old and beyond that, in all kinds of, and you can, you deconfound all that stuff, you will be cheaper for society because you’ll be healthier and you need less taken care of and all that stuff. And so we could take all those future savings and give some of those to you today and it means we could pay you to work out, we could pay you to go even healthier, we could so do all kinds of stuff to just make you happier and feel better and so on. It’s not a matter of money because the money is there, the future savings are there and that requires um a very very engaging and trustworthy brands in healthcare and consumer brands

Mario Schlosser: It requires a lot of machine learning and modeling and so on as to who you are and what’s good for you and so on. And it requires someone who can control the financial incentives in the healthcare care system. And all these three things are in some shape or form true for the health insurer. m Most health insurers have no idea how to do any of these three. But we built Oscar from the beginning to say that’s the infrastructure we want to have to be able to go and do that. And so what you I would think of Oscar as the the doctor in your pockets eventually and that will just constantly say, hey, Mario, you know what? You should really go and go take the weekend off, whatever. And I will give you $100 to go have a beer and because I know that that will make you much happier and healthier and more productive even. And I can afford it as the insurance company to pay you that because ah I am and know it’s going to

Mario Schlosser: because for me and you really that’s what it’s got to go to and so look maybe we’ll all be digital digital lives anyway in in five years and we solve AGI or whatever and and maybe that becomes a very different way of ensuring you know than people but for the as long as we aren’t this mortal play and of these physical bodies around us I think that needs to get built at some point. so

Alejandro Cremades: Absolutely. Now, we’re talking about the future. I want to talk about the past real quick here. And they if I could put you into a time machine, and I bring you back to 2006, that moment where you were thinking about starting something right with with, let’s say, with Josh, and you’re able to have a chat with your younger self and give that younger self one piece of advice before launching a business, what would that be and why, given what you know now?

Mario Schlosser: and

Mario Schlosser: Yeah, yeah that’s a great so great question. and

Mario Schlosser: i I mean, I think the the biggest thing really is that it’s very clear that people who go through various crises and somehow navigate them that requires a degree of luck certainly in every crisis. At some point, get used to managing crises. And it’s always astounding to me how much humans can value too. And I don’t mean in any way, by the way, to compare being in the trenches of Silicon Valley to being like in the trenches of Ukraine or whatever. It’s not the same at all, obviously. yeah and But you know ah trying to ah fire your best friends from your startup, whatever, or trying to,

Mario Schlosser: and you get money when you almost run out of it, which happened many times to Oscar. I mean, we really were a very quite close to worrying. We gotta try to post him a jet court here, or whatever else, and at various points in time, going back to us all the way as early as December 2015, when we came very close to it, um you know the Affordable Care Act almost got shut down when Trump got elected and all these things. When you navigate these things somehow, you then eventually get used to it. And and and that is a good thing to tell your younger self, even me today, i I was, we had an Oscar alumni event this week, and it was like 65 people or so from Oscar. And I think among those 60 people, there was something like 40 startups of these folks leaving Oscar and then starting their own companies, which I find amazing. I mean, that’s really, there’s no better sign of a company’s culture if people leave the company and then start companies with by themselves. Way better than going to work for an insurance company of of another kind or whatever.

Mario Schlosser: and And so we collected all these photos for that. And so I saw myself from these photos, you know, five years back, 10 years back, whatever, different hair colors still less gray and whatever. And some I just remembered, I almost can’t imagine anymore from today’s point of view, even how to get through some of those difficult moments that some of these photos were taken in, you know, like, again, bad open enrollment periods, bad growth, bad cost blowout and whatever. But we did get through it. And and so Just chilling out about that, I think, is a good one. there’s this This playful attitude what I mentioned before, somehow you have to maintain. And that’s also the reason, clearly, why people and know do their best work for Nobel Prizes. And they’re going to know me to start companies that are winning Nobel Prizes. soon It’s not the same.

Mario Schlosser: um But why didn’t they best work when they at a young age? Because the the you your own bar for failure goes up so much, and I think the best entrepreneurs just have a complete disregard for that. Whenever you think of Musk, and I certainly think he’s a complete crazy person recently and in what he says and what he does, that is the thing that’s amazing about that guy, that he just is like, all right, I’m going to put all the chips back on the table all the time.

Mario Schlosser: If you know can live that way yeah um and and and live with the consequences, so that doesn’t always go well. In some sense, that’s a that’s that’s an interesting way to do it. and And you don’t need to blow yourself up all the time and the the in and the streets wherever else. But I really do think that we’re given so much growing up in the Western rich worlds, um having yeah know good educations, at least know you and I, that we almost owe it to ah people around us to say, yeah, let me take a bit more risk than than than maybe others can. Let me take others with with me then as well. right like Then you can try to create jobs and mentor people in the company and the startup you have and things like that. But don’t forget that, that like just let me go through it playfully yeah and not worry about how I feel. How I feel. It’s my job to feel bad about this and get through it.

Alejandro Cremades: I love it. I love it. so Mario, for the people that are listening that would love to reach out and say, hi, what is the best way for the to-do show?

Mario Schlosser: Very simple Mario at high Oscar.com. That’s my email.

Alejandro Cremades: Amazing. Easy enough. Well, hey, Mario, thank you so much for being on the Deal Maker Show today. It has been an absolute honor to have you with us.

Mario Schlosser: Thanks Alejandro. Super fun.

*****

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments