Jeff White is the co-founder and CEO of Gravy Analytics which is the leading provider of real-world location intelligence for marketers. The company has raised over $20 million from investors such as Gannett, Spring Lake Equity Partners, and Loeb Global Ventures. Prior to this, he co-founded Blue Canopy (acquired by Jacobs) and GovWin (acquired Deltek).

In this episode you will learn:

- The importance of strengthening your handle on finance

- What scares Jeff most about entrepreneurs as an investor

- The science behind asking for help

- What to do when your bootstrapped company can’t afford to pay everyone

- The double-edged sword of entrepreneurial focus

- How to know when your startup is a success

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

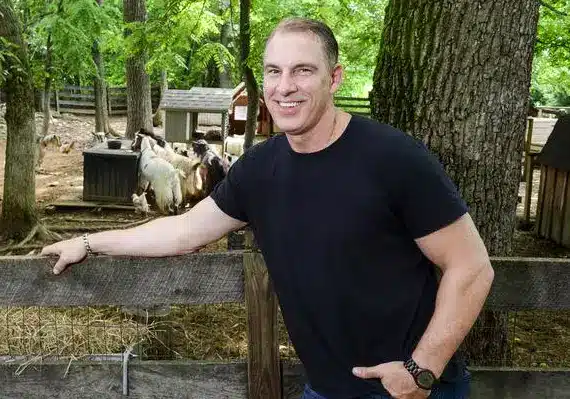

About Jeff White:

Jeff White is the Founder and Chief Executive Officer of Gravy. Gravy is a very popular utility that helps users find local events and things to do nearby. The app sorts events based on your mood, thus making it easy to choose one that meets your interests and what you feel like doing. Prior to founding Gravy, Jeff founded several companies and led them to successful exits. These companies include mySBX (sold to Deltek in 2009) and Blue Canopy (sold to a private investment firm in 2007).

Jeff has over two decades of experience leading successful companies and was awarded the DC Technology Entrepreneur of the Year in 2011. As the Founder of mySBX, Jeff leveraged the latest web and social media technology to build an award-winning platform that grew more 100% year over year. As the Founder of Blue Canopy, Jeff led the company to receive two Inc. 500 awards for being one of the Top 500 Fastest-Growing Private Companies in America, with the lowest growth year being 98%.

Jeff is passionate about building real products for real people and loves to start with a blank canvas (or whiteboard). Jeff strives to never “fall in love” with his creations by balancing them with the honest user and customer feedback.

Jeff currently lives outside of Washington, DC with his family and mentors other DC-area entrepreneurs.

Connect with Jeff White:

* * *

FULL TRANSCRIPTION OF THE INTERVIEW:

Alejandro: Alrighty. Hello everyone, and welcome to the DealMakers show. Today we have a very interesting founder, a founder that has done already two exits, that is on his way to building his next really big company. Very interesting, thematic what he has of doing stuff with big data dislocations. He’ll be able to tell us better than I do. So without further ado, Jeff White, welcome to the show.

Jeff White: I appreciate you having me. Thank you.

Alejandro: Originally born and raised outside of Washington, D.C. How was life growing up there?

Jeff White: I can tell you, for those that follow baseball, we grew up without a baseball team, but now we can say we’re the home of the World Series Champion, Washington Nationals.

Alejandro: Good stuff.

Jeff White: It’s an interesting place. It’s a place where politics seems to dominate the landscape and blot out the sun, but there’s a very, very thriving tech community here in Northern Virginia, outside of Washington, D.C.

Alejandro: Very nice. I see, as well, that you were attracted to engineering, to resolving problems, and all of that stuff, so tell us a bit about this.

Jeff White: Sure. Obviously, by pedigree, I have an engineering degree, and a computer science degree, and I got my MBA. But more importantly, it’s always been about retrying to apply technology to solve business problems that I, frankly, have been experiencing in my own professional life. So every business, at least that I have ever started, has always been around applying principles of taking data and creating solutions to operational everyday problems that I had experienced as part of my professional career.

Alejandro: Very cool. Something very interesting here is that you did a little bit of Corporate America before going at it as a founder. The question here is, do you think entrepreneurs are born with it, or they’re formed over time?

Jeff White: Clearly, they have to be a little crazy.

[Laughter]

Alejandro: Of course.

Jeff White: Somebody once told me logic has no place for entrepreneurship because if you knew the odds, you wouldn’t do it.

Alejandro: Yeah. That’s it.

Jeff White: My trajectory was maybe a little unique because I always thought I was going to be a corporate executive. I wanted to be on the track to be CEO. After getting my MBA, my professional career was always about rounding out my experience in sales and marketing, getting finance, operational experience because I wanted to be a CEO. I will never forget the day that it hit me. I won’t name this company, but I was at one of the largest companies working. Somebody actually came around to our offices and started counting the ceiling tiles in our office because dependent on your grade and depending on your level, you’re only allowed so many ceiling tiles. They were going to reorganize our building and floors and everything else based upon that. I’m like, “Wow. That is no place for strategy here.”

Alejandro: Wow.

Jeff White: I’m in the wrong place and never looked back from that moment on.

Alejandro: That’s amazing. From this corporate experience, you did Caterpillar, you also did AT&T; you did six years in Caterpillar and then two years in AT&T. What did you learn from these two experiences?

Jeff White: The genesis of my first business was built on the back of trying to solve managerial and operational issues that I was doing with those companies. They all had different lenses by which we applied the problem set to, but one of the things I learned is nothing is done without people. No matter how smart you are, no matter how agile you are, no matter how great you are at finance, whatever it is, without a great team, your results are always going to be very sub-optimal.

Alejandro: Yeah.

Jeff White: I learned a great lesson from a Harvard business case. It’s a business principle called U2D2, which is basically, in a nutshell, formulation of managing people through operational discipline. That’s part of my biggest takeaway from both of those experiences is that you can’t do anything without a great team around you.

Alejandro: Yeah. Absolutely. Let’s talk about how you started to incubate the thought of maybe taking off from Corporate America and going at it on your own. You were already at it for like eight years in Corporate America. It’s comfortable. You get the nice paycheck. You know you’re going to have food on the table and all that good stuff. Why did you decide to complicate your life with entrepreneurship? How did that come to knock on your door?

Jeff White: Yeah. It’s a fantastic question. In some cases, I think opportunity knocks on many people’s doors, and they choose not to hear it or answer it. But, in some cases, it’s probably always knocking.

Alejandro: Yeah.

Jeff White: In my particular story, I was at AT&T, and some of the biggest challenges that we were facing at the time were around supplier management. We were outsourcing everything into these various parts of the world and recognizing that we were struggling to manage the next cube over, much less the next continent over. What got me was the engineering side of me is that my ability to address that problem and make a meaningful dent into that problem was never going to come back on the back of my job, which had daily operational responsibilities. I needed to extract myself from that to attack the problem. I had kids. I had a family. I had a mortgage, and decided at that moment I could not resist trying to attack that problem with all of my heart. And I couldn’t do that and maintain my day job at the same time.

Alejandro: Wow. How was the conversation with your wife?

Jeff White: It didn’t go over so well. Somebody once told me, “How do you know when you don’t call yourself an early-stage startup, and I always said, “It’s when your wife stops telling you to go out and get a job.”

[Laughter]

Jeff White: But times were tough. In that first business, in fact, we were growing so fast, we were doubling in size every year. Our lowest growth-rate year in all of the years at Blue Canopy was like 98%. A fast, rapid growing business consumes capital. This is where I had to learn a valuable lesson on cash flow management. We were growing so fast cash couldn’t keep up. I couldn’t finance the business to fund my growth, and I effectively sold myself into a cash position. I’ll never forget sitting around with the leadership team and the other managers there. There was only one check to go around to pay somebody’s mortgage. We looked at each other. We all put our mortgage in the hat, and we said, “Whose is due first? Whose is most behind?” Those are the ones that got paid. So there were tough times, and I’ll never forget sitting there thinking, “I signed up for this. My family didn’t.” In those tenuous moments is where the crucible of courage gets built because they were all in at that point.

Alejandro: Yeah. That’s what builds culture at the end of the day, those types of moments. Right, Jeff?

Jeff White: Yeah. That’s for sure.

Alejandro: Let’s talk about the incubation of the idea of Blue Canopy. How did you come across this idea, and tell us, how did you bring it to life?

Jeff White: Sure. Blue Canopy was born on the back. As I said, we were struggling to manage supplier relationships across many different continents. What I started to realize and apply and how I did my job was a concept taken out of the Toyota supply chain around creating visibility and transparency. The aha moment I had was when I started to look at IT projects, just like how an automobile is made. It’s still from beginning to end, taking raw materials, whether that’s labor hours and code, dealt me to a final-end product and realizing that along the way, we were sub optimizers and no visibility. So I started creating methodologies and software that started to instrument a lot of those. That was the moment that I said, “This becomes such a big problem that a lot of companies were experiencing that it seemed to be something I couldn’t stop thinking about and wanting to address. That’s what compelled me to start Blue Canopy.

Alejandro: Let’s talk about the founding team. How did you get the band together?

Jeff White: It was making sure that I rounded out skill sets that I inherently didn’t possess in myself. One was finance. One of the founding partners brought that expertise to the table. The other one was around people and operational. That partner came to the table. We formed the three-legged stool, which had a very stable foundation that posed us for growth going forward.

Alejandro: So how were you guys making money then?

Jeff White: We weren’t. We were three guys and a napkin at that point and a big idea, but we felt very confident that the problem persisted on many facets across many industries. At that point, we threw logic to the wind and jumped in.

Alejandro: I understand that the growth was on a whole other level. Tell us what it’s like when you’re in a rocket ship like that?

Jeff White: Scary. As I said, it’s scary for a multitude of reasons because, obviously, when you have an organization growing so fast, and it’s also dependent upon practitioners to put the software and processes in place. You’re stretching all facets of the business — operational, getting the right people, getting them trained, getting in front of clients. Finance was really a struggle. As I said, we were growing so fast, financing the business became a challenge to finance the growth. So every single thing that possibly could be strained was.

Alejandro: How did you guys capitalize the business?

Jeff White: We bootstrapped it 100%. We were fortunate to get some significant contracts out of the gate, some things that gave us fuel very early on into our launch. We got partnered with Gartner, and Gartner started to take our software and institutionalize that as part of their benchmarking practice for our first relationships. We completely bootstrapped the whole thing.

Alejandro: Obviously, you were bootstrapping, and it is incredible growth. Why did you decide to sell?

Jeff White: I got bit on the software narcotic. We were a company that was doing both services and software. The software, to me, seemed like a much better scalable business. So what I originally set out to do was I wanted to sell the services piece of the business and keep the software. It became my passion building the tool. Not necessarily training the practitioners to use the tool. And set out to sell the services piece that went along with it. One thing led to another. As part of the process, we got hooked up with a private equity firm. They liked the business and kept it together and bought majority interest, which gave us liquidity, an exit path, and still allowed us to ride along the way with the next chapter of the business.

Alejandro: Very nice. So how long did it take until you guys were able to close that deal?

Jeff White: It seemed like forever. It was probably a process of, I’ll say, 18 months in the making. But, as you know, the closer you get to the finish line, sometimes, the further off it seems.

Alejandro: Yeah.

Jeff White: It was a long, arduous process along the way because, at the same time, you’re still trying to run the business and maintain your growth rates and not get distracted.

Alejandro: Yeah, and it took you no time to start your next rodeo. So tell us about GovWin.

Jeff White: It’s funny you should ask because the thing that was keeping me up at night at Blue Canopy was, I had supply chain dislocation of supply and demand. I had on one side of my business, people who were ready to go out, deploy, get on customer contracts, but were delayed because of various cycles. You’ve got contractional cycles, billing cycles, whatever that the customer wasn’t ready for us to go. So I was eaten up cost and profit for people sitting on the bench. On the other side of my business, I had discrete resources that I needed from a subcontract point of view to fulfill work that I wasn’t going to hire, that I couldn’t find them. I’m like, “This is an enormous supply and demand dislocation in the marketplace. There should be a better way to do this.” And I started looking around, and there wasn’t. So I took what was keeping me up at night, and I said, “What if there was a platform that effectively did at the time what eBay did for people selling consumer goods to one another? I said, “Why couldn’t I do that for subcontract labor?” So I built a platform, became GovWin. It was about trying to create fluidity to supply and demand curve around subcontract labor.

Alejandro: Very nice. Was there a point in time where you said, “Okay, here’s the idea. Here’s what I think this could be. Now, it’s my time to let go of being in your other baby because you’re jumping from baby to baby.

Jeff White: I will tell you; I had a significant exit clause penalty if I were to leave before my two years were up with the PE firm. This idea, and I still remember to this day, I woke up in the middle of the night with the entirety of the vision of GovWin. In fact, that night — this is probably like 2:00 or 3:00 in the morning. I got up. I reserved the URLs. I built the business plan. I did my first pitch deck that night. Walked into the private equity firm who now was running the business of Blue Canopy and said, “I’ll pay the penalty. I got to go do this.”

Alejandro: Wow.

Jeff White: It just all came together. Literally, one of my favorite lines in business is, “Never confuse a clear vision with a short distance.”

Alejandro: Yeah.

Jeff White: At that moment, that night, I had such a clear vision that I didn’t care the distance. I had to go.

Alejandro: Wow. So then, what happened next?

Jeff White: I was fired.

[Laughter]

Jeff White: It is ironic because the business pains that I had lived in managing Blue Canopy, the acquirer clearly now was suffering those same pains. When I went and presented it to him, he pulled out a drawer and goes, “I’ve been thinking, you’re way farther along than I am, but I’ve been thinking something similar. I’ll waive your exit penalty if you allow me to participate, and we can build it together.” And that’s what we did.

Alejandro: Wow. So what was the process of putting together the founding team here?

Jeff White: In this particular case, it was me. We had a mutual friend that we knew that was interested in building a tech platform. We went out; I met with him, and together, we built out the team. It was a very small team. I think seven of us came together to build that company.

Alejandro: Really, really nice. What was the profile of the seven that came together?

Jeff White: There was a CTO product guy. I had a frontend team of two, a backend team of two, and then I had an architect that brought it all together. Then when we eventually sold, a short time later — I had a couple of salespeople by that point.

Alejandro: It was literally 18 months after you got started with the business, and the company got acquired. You went from 0 to 6,000 customers during that time. How were you guys making money?

Jeff White: It was a subscription model. We had a lot of upsell charges that people could do if they wanted to showcase themselves. But what we realized is, I think maybe it goes back to the engineer in me, is that problems exist in many cases. Sometimes, a better mousetrap is good. It’s not always enough, but it gives you the opportunity to launch something pretty special. In this case, that problem was shocking at how much it persisted at all levels across all companies. There was an enormity of supply and demand dislocations in the marketplace that allowed our tool, our platform to hit the market at the right time.

Alejandro: So why 18 months, Jeff? Why not continue with the business?

Jeff White: Everybody asks me that. “Did you sell too early?” There may be some truth to that. I think at that time, I always knew when I launched this business, there was one logical buyer that would be — if I had designed the perfect spec of a buyer, it would be this buyer. That company was a company called Deltek, a publicly-traded company. I always knew they would be the ideal spec. They got preemptive and predatory in the process. They came and, frankly, made an offer that I/board could not refuse. So we took it to the board and sold it.

Alejandro: And 10x for investors, so not bad at all.

Jeff White: Yeah. 10x in 18 months on invested capital. We did pretty well.

Alejandro: Not bad. Then you started with your next one, Gravy. Gravy Analytics. I’m wondering if you came up with the name, maybe at Thanksgiving, while eating the turkey, pouring gravy on it. [Laughter] Tell us how you came up with this concept.

Jeff White: Again, it goes back to understanding big dislocations in the market. In this particular case, think back to 2011. What I looked at and what I saw was big macro trends: mobile. I know it sounds patently obvious today, in 2011, I think the iPhone was still just a baby. So this transformation in the impact that smartphones would have on us as part of our daily lives wasn’t that evident then. I knew that’s where I wanted to be. I wanted to do something in mobile. In particular, I started looking at the power location data and how that would transform our lives. What I had been doing at that point, 15, 20 years with web cookies and understanding movement patterns across digital web footprints. I said that was going to be really powerful. I looked around the space, and at the time, Google, and Yahoo, and AOL, and Facebook, and others. No one was taking advantage of that to great success. I was like, “That’s where I want to be.” That was the compelling, broad thought. I wasn’t sure where it was going to take me, but I knew that even a dummy like me had launched something in that kind of space, I could create something, I think.

Alejandro: Obviously, with Gravy Analytics, it’s a company where perhaps a lot of lessons you’ve been able to learn because you’ve been at it for quite a while with it. I know, as well, that you went through a pivot here. Tell us about that.

Jeff White: Yeah. Eight years to date is the longest I’ve ever run a company. The thesis of what this business always has been was where you go is who you are. Unlike the digital world where your footprints, aka cookies, tell websites you visit, a little bit about yourself, we thought the most powerful signal of who we are as individuals were not the websites we visit, but the places we visit and the events we attend. We launched with a platform to collect and aggregate all of the events that occur every day across the U.S. All those places, restaurants, theaters, dining, and all that, that exist in the commercial world, if we could intersect your visits to those things, we could learn so much more about you as an individual than a web cookie could ever tell us. That was the out-of-the-box thesis. Prior to 2016, our path to get there was to take some technology that we had developed, embed it into third-party applications. We had partners like eBay, Marriott, USA Today, and others and harvest that information in a very aggregated, [0:23:05] and provide those insights back to those people who have licensed our SDK. So it was effectively an enterprise sort of data deal where we had to go sell each eBay, and each Marriott, and others to embed our technology in their app. It was going okay. We were on a trajectory by the end of 2016 to be able to observe on a monthly basis about 10 million people. So think of it like a large panel. The aha moment, and what transformed this business was, we took a step back and said, “Why are we being so hard to do business with? Why are we going out and selling each individual customer when the entirety of the platform, the analytics it can provide is so much more powerful than the individual licensing of the software.” We said, “Let’s open it up.” So we effectively open-sourced it. We launched something called the Geo-Signals Cloud, and in one month’s time, we went on that trajectory of 10 million users to 200 million users.

Alejandro: Wow.

Jeff White: It entirely changed our business.

Alejandro: That’s unbelievable. Up until that point, had you guys raised any money?

Jeff White: Yeah, too much. I think at that point, I think we had raised — we had finished our Series A. The entirety of the total raise — don’t quote me on this, but I’ll say through a couple of rounds, we did a Series C, did a Series A. It was probably around 15, 20 million there, and we had been at it now for six years give or take.

Alejandro: What was the discussion like with the investors when you told them you had to go into a different direction than the one that you presented to them for their investment?

Jeff White: In this case, it was a little easier to sell because it wasn’t taking anything that we had done and thrown it away. We were taking the platform we had built and repackaging it a little different, and hopefully, put in a much bigger and scalable [0:25:12]. Fortunately, that bet paid off. My conversation might have been a little different subsequent to that had it not, but I had a very supportive both a) board and b) investors that — this is true probably of lessons learned with going back to the original question you asked me about building strong teams. Part of the strongest team for an entrepreneur was going to be their finance partners and their board, whether that be an advisory board or a board of directors. In this case, even to this day, I had very strong team members there that were a) patient and b) great partners to help me through that transition.

Alejandro: So when you’re presenting something like this, or when you’re looking at doing a pivot, maybe there are a lot of people in line that are maybe not at the product/market fit, maybe thinking about doing the pivot, maybe they’ve raised some money. How should they approach the discussion with their investors?

Jeff White: Well, it’s funny. As an investor, and I know you can speak very acutely to this, as well. There’s the old adage, and it’s there for a reason is, you bet the jockey, not the horse. It’s a double-edged sword because a great entrepreneur is one with nose to the grindstone, dig it all out, beat their head up against the wall until it finally breaks down, and they plow through every obstacle. That’s a great, great character trait. But also, as a great character trait is the ability to have so your vision doesn’t blind you. That you can actually pivot, make the slight tweaks along the way, or maybe some large pivots along the way that takes what is a core construct and makes it into something that you otherwise would have missed had you been so singularly focused on what you were doing.

Alejandro: Yeah. Makes complete sense. Here, how have you also grown the team?

Jeff White: We’re growing like crazy. In fact, we’re in new offices here. We first moved in about a year and a half ago. We thought the office was cavernous, and we would never outgrow it. Now, we’re looking for additional space. I’ve been fortunate through my previous exits to both a) have the ability to surround myself with some great team members. I have a fantastic team with complementing skill sets that I don’t necessarily profess to be very good at. A great CMO, a great CFO, a CTO that I worked with many times in my past. Two great GMs that are running our business both on the commercial side and doing some public sector things. Then a great supply-side partner. The fortunate thing about this is, almost all of them I’ve either known from my past, worked together in my past, or it’s such a one-degree of separation that we’ve been able to come together and build a really well-classed team.

Alejandro: Very nice. Why do you think that with this company, you’ve stuck around for so long?

Jeff White: [Laughter] They haven’t figured me out yet to get rid of me. We’re still having fun. We were probably a little too early to market, so I believe this company got its launch in 2016 with that pivot. It’s transformed our both scale — we’re growing at really significant rates right now, and we’ve only just begun. So this is a fun ride. I look forward to doing it as long as I can. It’s a space that’s still changing. My lead architects will tell me the technologies that we’re working on today didn’t exist two years ago. So the technology refresh is so fast-paced, it’s keeping things very interesting.

Alejandro: Where do you think that your space is going as a whole, Jeff?

Jeff White: That’s a good question. I don’t think mobile’s going out of style. I think it’s only going to continue to disrupt our lives. I was on a call the other day with an industry analyst who told me no one buys TVs anymore. So, it was a little bit of a hyperbole, of course, but I think if you looked at whether it be media consumption, workplace productivity, and spending time with your family and friends. Everything is centered around a mobile-first environment now. I believe we’ve only begun to unlock the next phases of what that looks like.

Alejandro: Very nice. One of the questions that I typically ask the folks that come on the show is — here, Jeff, your experience and track record are remarkable. You’re at it for the third time. Obviously, it comes with the ups and downs. You have a lot of lessons that you’ve learned along the way. As you’re looking back and let’s say you have the opportunity to have a chat with your younger self, with that younger Jeff that was about to take the leap of faith, with a mortgage, with kids, with everything from AT&T, if you had the opportunity to go back in time and sit down with that younger Jeff, what would be that one piece of business advice that you would give to your younger self and why?

Jeff White: Go get a job. No, I’m kidding. I probably have made every mistake there was to make, but the largest thing I wish I had learned way earlier on is, look at what you don’t do well and tightly shore up that weakness. In my case, my biggest weakness was always finance. I knew product, I knew tech, I knew operations, I knew sales and marketing. Finance, because of my experience, was probably my weakest blind spot. Fortunately, I was able to shore that up pretty quickly in my first endeavor. But man, you can never, ever underestimate because to a growing business, cash is oxygen. If you don’t manage it, the room gets pretty tight quickly.

Alejandro: Yeah. It’s interesting, when you were sharing this, what came up for me is you don’t know what you don’t know. Right? Especially for the people that are going at it for the first time and the ones that are listening, I remember when I started my first company, I thought I knew everything. Until I actually made the mistakes, until I saw I was not as good at certain things, I needed to bring in people. So how do you that there’s stuff there that you don’t know? Or you may be meeting other people so that you are not actually ending up making the mistake.

Jeff White: That’s very well put, and I think you’re right. The first thing is, be vulnerable. As an investor, one of the characteristics that scares me from entrepreneurs is those that think they know it all and that are afraid to listen. One of the expressions that I use a lot: there’s no man more blind than one that will not see. To be vulnerable with yourself, understand what you don’t know, and work your tail off to shore up those gaps. But you can’t be expected to know everything. You can’t be expected to foresee everything. Know that you’re going to make mistakes. Know that you’re going to skin your knees along the way. I tell everybody on my team, even to today, we’re trying to launch a big company, or whatever, assume things are going to go wrong. It’s okay, but learn from it quickly, and don’t make the same mistake twice.

Alejandro: To that extent, Jeff, when you’re making a mistake, and obviously, I’ve made a ton, and you’ve made a ton too. We’re all human. What does the reflection process look like for you so that you are able to learn, pick yourself up, and keep moving?

Jeff White: This goes back to me. This is one of my skills that I do, but I keep a journal, believe it or not. Every day I write down in the journal. Sometimes, it’s prayers for hope. Other times, it is lessons learned, but I use that for reflection. People learn in different ways. I will continuously look backwards and see the lessons learned that I codified. Maybe it’s the engineer in me. I have to codify things down as I write them. It imprints it in my brain, and it makes it easy for me to go back and remember what was going on. What did I learn? Who did I go to? That’s the other big thing that I’ve learned is don’t ever be afraid to ask for help. There are a lot of studies around people and the endorphins that get released in their brain when two things happen. One, you use their name. That’s one. But two, people like to be asked for help, and if you show the respect to somebody to value both their opinion and advice, know that you’re not the first person that’s ever been through this. You’ve built platforms that help people do this. Kudos to you. I was never smart enough to do that. But there’s a willing community of both mentors or first-degree or second-degree relationships that would love to help.

Alejandro: I completely agree with you, and especially founders that have been there. I think that the pay-it-forward mentality for founders that have been there and have done it, it’s real.

Jeff White: Indeed.

Alejandro: Jeff, for the folks that are listening, what is the best way for them to reach out and say hi?

Jeff White: First off, I live on LinkedIn. It’s easy to find me there. You can go to GravyAnalytics.com and learn more about our company and find ways to contact me there as well. But, hey, kudos to people like you, who give back to the community. I, myself, feel it’s a give-to-get model. So as much as I can give in return, I’m happy to help out any of your listeners.

Alejandro: Amazing. Thank you so much, Jeff. Really appreciate it. Thank you for being on the DealMakers show today. It has been an honor.

Jeff White: Thank you, sir.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments