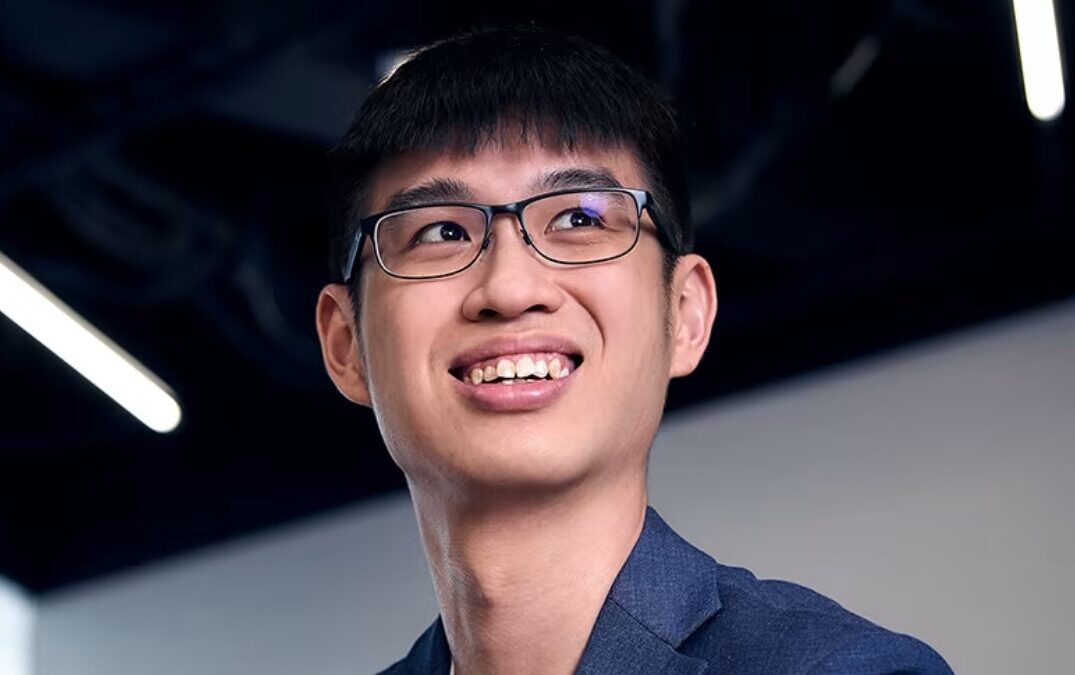

Qin En Looi is an inspiring founder turned investor with a remarkable journey, full of unexpected turns, and packed with insights on transitioning from founding a successful startup to becoming a venture capitalist.

In this conversation, we delved into Qin En’s early life, the founding and growth of his company, Glints, and his transition to venture capital, shedding light on the realities and challenges of each phase.

Listen to the full podcast episode and review the transcript here.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Early Life in Singapore

Qin En was born and raised in Singapore, a place he fondly remembers as fostering a rigorous academic environment. Growing up with “tiger parents,” both educators, instilled in him the importance of academics.

His father, a university professor, and his mother, a middle school Mandarin teacher, emphasized the need for academic excellence. This upbringing shaped the first 18 years of his life, leading him to pursue opportunities beyond the borders of Singapore.

The Leap to Stanford and Military Service

Singapore’s meritocratic scholarship program enabled Qin En to attend Stanford University. However, before he could embark on this academic journey, he had to complete two years of mandatory military service.

During this time, the seeds of entrepreneurship were sown. Along with two friends, Qin En started what began as a side project and eventually blossomed into Glints, a Series D company that has raised more than US$80M.

Founding Glints

Glints began out of a sense of frustration during military service. Qin En and his friends sought mental challenges, leading them to startup internships.

Realizing a broader need, they began connecting fellow peers with startups, thus creating a platform that served both small startups and eager young interns.

Interestingly, the name Glints is a mashup of “global internships,” reflecting its origins. At the time, Qin En and his friends had full-ride scholarships and were ready to go to top colleges in the US such as Stanford, UC Berkeley, and Wharton.

Despite initial intentions to keep it as a project, a serendipitous meeting with an angel investor provided the funding needed to turn Glints into a full-fledged business. The first challenge? Incorporating the company—something Qin En and his co-founders had no prior experience with.

Growth and Business Model Evolution

Glints’ business model went through several pivots. Initially focused on product-led growth and self-serve SaaS, they discovered this approach didn’t resonate well in the Southeast Asian market.

The hypothesis – which turned out false – was that an employer would pick up a credit card, key in their information, and start paying a few hundred bucks a month for Glints’ products.

Glints’ biggest challenge was distributing the product. As Qin En opines, the product-led business model was better suited for more mature Western markets like the US and Europe, where SaaS is a lot more common.

He realized they needed a more sell-in approach to build distribution, sales, and marketing channels actively. The breakthrough came when they shifted to a service model, filling job vacancies for companies and charging a contingency fee.

This model proved more effective, reflecting the market’s preference for hands-on services over self-serve platforms. It also became the primary revenue source. Today, Glints is one of the largest recruitment platforms in Southeast Asia and has offices all across the region.

Raise Capital Smarter, Not Harder

- AI Investor Matching: Get instantly connected with the right investors

- Pitch & Financial Model Tools: Sharpen your story with battle-tested frameworks

- Proven Results: Founders are closing 3× faster using StartupFundraising.com

The Challenges of Fundraising

Fundraising for Glints was an arduous journey. Qin En described it as a series of false starts, cold emails, and endless pitches. Despite the initial narrative-driven investment, focusing on the founders’ stories and background, convincing investors remained challenging.

Not only were Qin En and his co-founders early in the ecosystem, but they were also among the first in Southeast Asia to raise venture capital at such a young age.

However, persistence paid off as they eventually secured investors who believed in their vision and helped refine their pitch and business strategy. Qin En remembers how their investor coached them on pitch decks, data rooms, and financial forecasts.

As Qin En explains, recruitment may not be a 100x-overnight business, but it is one of the things that companies need on an ongoing basis. They tend to expand their hiring needs in bull markets, so volumes increase.

Even during downturns, people need to find opportunities. That’s what makes the business resilient against macroeconomic conditions.

Turning Points and Lessons Learned

A significant turning point for Glints was expanding into Indonesia, Southeast Asia’s largest economy. Qin En and his co-founders had started out in Singapore, but they quickly realized that it was a small, saturated market.

The move to the largest economy in Southeast Asia, with 230 million people, unlocked substantial growth potential and solidified its market position. However, not all moments were triumphant.

Internal disagreements among co-founders about the company’s direction led Qin En to step down. Though painful, this experience taught him invaluable lessons about collaboration and leadership. In retrospect, Qin En concedes that he could have been less individualistic and more collaborative and open.

In his opinion, co-founder arrangements, structures, and their relationship with one another are crucial. When presented with the opportunity to raise funding, entrepreneurs tend to grab the offer.

However, it is more important for them to get to know their co-founders and ensure they have the right chemistry. That’s a factor Qin En takes into consideration now that he is on the opposite side of the table as an investor.

Transition to Venture Capital

After leaving Glints, Qin En joined BCG Digital Ventures, working with Fortune 500 companies and gaining experience in the corporate world. BCG Digital Ventures was a great place for him to leverage his founder experience and apply it in a corporate setting.

At that point, the bull market was in its 2019 to 2021 uptrend, and plenty of corporations were hungry to build ventures. Going from the zero-to-one process was an interesting experience.

A connection unexpectedly presented the opportunity to transition to venture capital. Skeptical at first, Qin En was pleasantly surprised by Saison Capital, a Japanese corporate venture capital fund’s agility and founder focus.

Qin En recalls being hesitant at first because of the misconceptions formed during his days at Glints. CVCs are generally known to be slow and bureaucratic and forge partnerships with the parent company before the startup is ready.

One of the first questions he asked at his interviews was whether it took six months to write a $100K check. Delays like these mean that being non-competitive as an early stage investor to entrepreneurs, a lesson Qin En had learned well during his time as a founder.

Eventually, however, he was convinced that the fund would be a great platform for him to come back into the ecosystem and support and partner with founders, especially at the pre-seed and seed stages.

Investing with Saison Capital

At Saison Capital, Qin En also set up a Web3 and digital assets early-stage venture fund, diving deep into the world of decentralized finance (DeFi), NFTs, and real-world assets (RWA). He aims to be the investor he never had, offering not just capital but mentorship and support.

As Qin En explains, Saison Capital’s parent company is Credit Saison, the second largest credit card company in Japan. Around 10 years ago, the company expanded into emerging markets like India, Southeast Asia, and, most recently, Latin America on the debt and equity front.

On the equity front, this fund was established in 2019 to make early-stage and seed investments.

Storytelling is everything that Qin En Looi was able to master. Being able to capture the essence of what you are doing in 15 to 20 slides is the key. For a winning deck, take a look at the pitch deck template created by Silicon Valley legend Peter Thiel (see it here), where the most critical slides are highlighted.

Remember to unlock the pitch deck template that is being used by founders around the world to raise millions below.

Insights on the Venture Capital Landscape

Qin En shared insightful observations about the venture capital landscape. He noted a common misalignment between large fund managers and actual performance, challenging the notion that bigger funds always yield better returns.

Qin En’s experience reviewing hundreds of funds worldwide revealed that brand and size do not necessarily correlate with success. Saison Capital is unique because it makes both direct investments and fund-of-fund investments.

To date, they have reviewed more than 300 funds, Web2 and Web3, worldwide. Saison Capital has invested in 15 funds globally and has a couple more in the pipeline. At the same time, getting returns is challenging.

For fund managers who raise outsized funds, especially in Southeast Asia, it is challenging to deliver returns to limited partners. As Qin En explains, a fund raising more than $500M in Southeast Asia will probably need at least eight or ten unicorns to return that fund.

Smaller fund managers instead are motivated to optimize for exits in order to earn carry, and interests are aligned with LPs.

Advice for Aspiring Entrepreneurs

For aspiring entrepreneurs, Qin En emphasizes the importance of carefully choosing co-founders and ensuring a strong, collaborative relationship before taking on funding. He compares the co-founder relationship to a marriage, underscoring the need for mutual understanding and alignment.

Qin En also opines that one of the myths is that a great product should sell for itself. The first lesson for any founder to learn is to be able to sell their product. He recalls making the effort to learn cold calling in spite of the fear of rejection. Conclusion

Qin En Looi’s journey from a young entrepreneur in Singapore to a seasoned investor offers a wealth of lessons for anyone navigating the startup and venture capital worlds. His story underscores the importance of resilience, adaptability, and the value of supportive partnerships.

As he continues to support the next generation of founders, Qin En remains a testament to the power of perseverance and the impact of thoughtful mentorship.

Listen to the full podcast episode to know more, including:

- Qin En Looi, born and raised in Singapore, began his journey under strict academic expectations.

- At 18, he co-founded Glints during his military service, transforming it into a leading recruitment platform in Southeast Asia.

- Glints’ initial success was driven by its ability to connect startups with young, eager interns during Singapore’s nascent startup scene.

- A pivotal moment for Glints was shifting from self-serve SaaS to a service-based recruitment model, significantly boosting revenue.

- Despite early struggles with fundraising, mentorship from strategic investors helped shape Glints’ growth and narrative.

- Qin En Looi transitioned to Boston Consulting Group to build ventures for large corporations before moving into venture capital.

- As an investor with Saison Capital, he leverages his entrepreneurial experiences to support and guide early-stage startups, particularly in emerging markets.

SUBSCRIBE ON:

Keep in mind that storytelling is everything in fundraising. In this regard, for a winning pitch deck to help you, take a look at the template created by Peter Thiel, the Silicon Valley legend (see it here), which I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

Facebook Comments