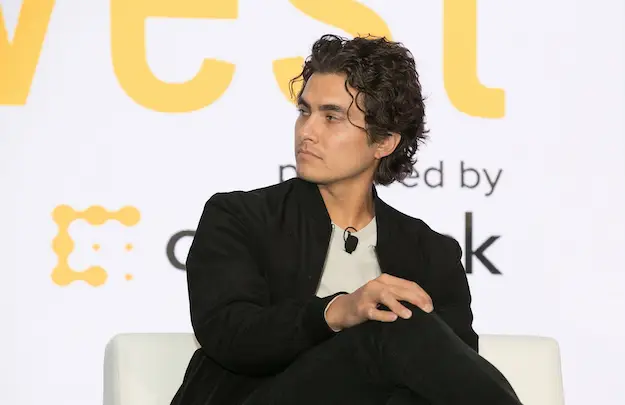

Chase Lochmiller is the co-founder and CEO of Crusoe Energy Systems which is on a mission to help the oil industry reduce routine flaring of natural gas. The company has raised so far $75 million from investors like Founders Fund, Bain Capital, Winklevoss Capital, Pathfinder, Polychain, Wicklow Capital, KCK, and Upper90 to name a few.

In this episode you will learn:

- How Chase self-funded this venture to get it off the ground

- Their fundraising rounds and financing which has raised more than $75M

- The notable investors they’ve raised money from

- Chase’s top advice before starting a company

- Who they are looking to hire now

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About Chase Lochmiller:

Chase Lochmiller is the cofounder and CEO of Crusoe Energy Systems which is on a mission to help the oil industry reduce routine flaring of natural gas.

Before Crusoe Energy Systems, Chase Lochmiller was Polychain’s portfolio manager and head of trade execution. He joined when they had $25 million under management and then he left when the business had over $1 billion under management.

Prior to Polychain, Chase Lochmiller worked at Jump Trading, where he was a quantitative researcher and trader, developing and managing a portfolio of proprietary trading strategies.

Chase Lochmiller was also a managing director and the head of algorithmic trading at GETCO, where they routinely traded over 10% of the daily volume in the US stock market.

Chase Lochmiller holds bachelor’s degrees from MIT in Mathematics and Physics and a master’s degree from Stanford in Computer Science with a focus on Artificial Intelligence.

Connect with Chase Lochmiller:

* * *

FULL TRANSCRIPTION OF THE INTERVIEW:

Alejandro: Alrighty. Hello everyone, and welcome to the DealMakers show. Today we have a very interesting founder that we’re going to be interviewing today. Very interesting because, obviously, building and scaling a company is like going and reaching the peak of the mountain. It’s all about the journey, but this is definitely someone that not only operating and executing and being on that journey, but also, he has actually climbed Mount Everest. It doesn’t get better than that. So without further ado, let’s welcome our guest today. Chase Lochmiller, welcome to the show.

Chase Lochmiller: Thank you, Alejandro. I appreciate you having me.

Alejandro: Originally, you were born in Denver, Colorado. So how was life growing up there?

Chase Lochmiller: Growing up in Denver was great. In the Denver area, it’s really beautiful right there at the foothills of the Rocky Mountains. I grew up around the mountains and spent a lot of time in the mountains. Mountaineering became a hobby over the course of time, and it was something that I enjoyed doing. One of my life dreams was to climb Mount Everest, which, as you mentioned, I was successful in doing in 2018.

Alejandro: Were you always into math and physics? Was there anyone in your family also that was like this, or anyone in your family that was an entrepreneur that perhaps led you to what you’re doing today with that entrepreneur mentality. Tell us who influenced you on those fronts?

Chase Lochmiller: I always had an affinity for math. It’s just something I loved doing when I was a kid. It drove me to study math as an undergraduate. At MIT, I studied math and physics. It was something I was super passionate about, and I liked the problem-solving aspect of it. From there, I got into the world of quantitative finance, which is building these large-scale machine learning algorithms to produce price forecasts for various securities. Then, I developed a bunch of different algorithms that would capitalize on those predictions in an automated fashion. I spent about ten years of my career doing this. In doing so, when you’re doing this research, you spend a lot of compute resources training those large-scale machine learning algorithms. That was what I was super-interesting in after leaving University.

Alejandro: How did you develop the love for that, Chase? Was there anyone in your family that was into any of this stuff, or how did you get the influence for this?

Chase Lochmiller: Not really. From the time I was very young, I loved solving math problems. It sounds kind of bizarre, but when I was five years old, I would come home from school. I was really obsessed with solving those sheets of 100 multiplication problems, and I’d make my mom time me, and I’d try to get faster times. It was something I really loved when I was a kid.

Alejandro: Very cool. Obviously, you get into predictive models and into machine learning after school. I guess, especially now, there’s a lot of hype and a lot of noise around machine learning and AI. So, what is machine learning, and what does it look like when that transitions into AI?

Chase Lochmiller: Sure. Machine learning — these are all different terms for basically building these predictive models, statistical influencer. What you’re doing when you’re solving one of these problems is, you’re taking a very large data set, and depending on the structure of that data set will determine what type of algorithm that you’ll typically use. But you’ll take a very large data set, and then you’ll try to attach some structure to that data set so that when you see new data that’s drawn from a similar resource, you can actually infer what that new data means. This can range from taking a whole bunch of pictures and taking labels on those pictures and then determining what’s in those pictures, and you teach your computer to understand what’s in a picture, so that when they see a new picture, they can say, “I’ve seen a million pictures of cats before. In this picture, I recognize that I see a cat as well.” It’s that type of problem that you’re solving. In the case of financial modeling, what you’re doing is, you’re taking these very large time series of historical data, price and trade information, how things are moving relative to one another, and you’re analyzing that very large dataset in a very large time series. Then you’re trying to create new price predictions based on new data streams. That was the problem that I was focused on solving for about the first ten years of my career.

Alejandro: Got it. Then you land in Stanford. So, why Stanford?

Chase Lochmiller: Stanford is a great university, and they have a fantastic computer science department. I did the first part of my Master’s Degree at Stanford online. They have a great program called Stanford Center for Professional Development. I was able to do it part-time when I was working. I liked the intellectual challenge of continuing to sharpen my skills, particularly in computer science. There is a lot of innovation happening at Stanford. It’s a really cool place. It’s a cool environment, just by virtue of where it sits. It’s right at the heart of Silicon Valley. There’s a very entrepreneurial culture there, which is really infectious. A lot of the professors there are entrepreneurs themselves. It’s not uncommon for people to do a short stint as a professor, and then they go and start a company. They sell the company, and then they come back again. It’s a really unique place. As far as it relates to artificial intelligence, I think a lot of the discoveries and a lot of the new work — Stanford has been a big part of a lot of those things. You look at things like the Google Brain project or the self-driving car project. All of those were originally Stanford projects that then spun out and became Google projects. It’s a really great environment, great professors, great students, and a cool place to learn.

Alejandro: You were mentioning many projects that come out of Stanford, and that are transformed into giants. In this case, Stanford is a very entrepreneurial-driven type of ecosystem. And here, rather than starting your own thing, you went at it with an existing team, the Polychain folks that were involved in crypto. Why crypto?

Chase Lochmiller: Yeah. I was involved in this quantitative-trading world for a long time. I got super-fascinated by the digital asset cryptocurrency space. Creating a new form of money and a new form of value really fascinated me — that you could have something that’s inherently digitally scarce. When you think about digital objects, you think about something like a pdf file. Inherently, that’s not scarce because I can take that file, and I can copy it from one place on my hard drive to another place on my hard drive. I can have two copies. What you have with blockchains and cryptocurrencies is that you can actually create a digitally scarce and unique object that can actually transfer value and transfer wealth between two parties anywhere on the internet. To me, that was a unique and fascinating innovation. I got to know Olaf Carlson-Wee, who is the founder of Polychain. He and I got along very well. I joined him as an early partner at Polychain in early 2017. It was an exciting time to be involved with the cryptocurrency landscape. There was quite a bit of hype to it, maybe a little bit too much for where it was at that point. Fundamentally, I’m still very much a strong believer in the ability of these new technologies to disrupt a lot of different things, money, chief among them.

Alejandro: When you started, they had something like 25 million, and in their management, and something like a billion when you left. So, why did you leave when you were at such a peak?

Chase Lochmiller: That’s a good question. I left in early 2018. I think fundamentally, there were certain things that I wanted to do, and we decided to go our separate ways. Fundamentally, I was interested in building a business that wasn’t involved in managing money. I worked as a quant portfolio manager for a long period of time. That’s focused on generating PnL and generating returns for people — a similar mentality of Polychain. I think at my core, I was excited about doing something more entrepreneurial where I could build a tangible business that wasn’t just seeking out returns.

Alejandro: And what a way to shift gears, Chase. You decide to go and climb Mount Everest. Unbelievable! How did you come up with this idea?

Chase Lochmiller: Climbing Mount Everest has always been a childhood dream of mine. I grew up near the mountains in Colorado and spent a lot of time there growing up. I had a teacher in middle school, and her husband was a guy named Eric Weiner. Eric was actually the first blind man to climb the Seven Summits, which are the highest peaks on each of the seven continents. He did it blind. That was always a very inspiring story to me having gotten to know Eric. I was like, “That’s something that I want to do.” I started climbing some bigger peaks after I graduated from college. I had always been involved in the mountaineering scene as a hobby. I tried once climbing Mount Everest in 2014. In 2014, there was a big avalanche that occurred just above the Khumbu Icefall, just above basecamp. I was at basecamp at the time when it happened. It happened in the middle of the night, and tragically 15 Sherpas died in this accident. After that happened, they shut down the mountain to the entire climbing community. We ended up canceling our expedition and going home. But I still had a strong personal desire to go back. Seeing it firsthand, it was something that kept me up thinking about it all the time. In 2018, I decided to go back. It felt like a very nice transition for me where I could be completely unplugged in the Himalayas. Honestly, it was a transformative experience for me, personally. I had a lot of time alone to think, meditate, and to think about what I really wanted to do next, and what I wanted my impact on the world to be. Fundamentally, it was all about wanting to build a business that would help people in some way, shape, or form. What I’m most excited about is the way in which the power of artificial intelligence can influence humanity and benefit humanity in a positive fashion.

Alejandro: We’ll continue talking about the business, but I want to dig in a little bit deeper on the Mount Everest experience. How long were you there from the moment you landed to the moment you actually touched the peak?

Chase Lochmiller: I think we got there the first week of April, around April 5th. We summited on May 18th, 2018.

Alejandro: Wow. This is kind of also like entrepreneurship. On the way up, I’m sure you had some thoughts about giving up. How were those voices interacting with one another inside your head during that experience?

Chase Lochmiller: It was definitely a challenge, the long expedition. You’re doing a lot of preparation. It’s a very interesting challenge because it’s more than just a physical challenge. It’s a mental challenge too. You’re always preparing for the next thing. Honestly, it’s very similar to entrepreneurship, as you alluded to. You always have to be thinking ahead and planning ahead, looking at the weather forecast, and thinking about what you’re going to eat, thinking about how you’re going to move your gear around to effectively execute your goals. Like I said, in 2014, I think it was eye-opening to me because it gave my climbing partner and me insight into what our strategy was and what we really wanted to do. We actually changed our strategy quite a bit when we came back in 2018, after what we saw with the Khumbu Icefall. The Khumbu Icefall is the highest risk area on the mountain. We really wanted to avoid that. A lot of the bigger commercial expeditions tend to do between two and three climatization trips up the mountain. You typically go up to Camp 1, and then you come back to basecamp. Then you rest there. Then you go up to Camp 1, up to Camp 2. You spend a couple of days on the mountain, and then you come back to basecamp. Basecamp is about 17,500 feet. Camp 1 is about 20,000 feet. Camp 2 is about 22,000 to 23,000 feet. You’re exposing yourself to higher and higher altitudes so that your body can climatize and get used to these higher altitudes with lower oxygen levels. Each of those climatization trips, you have to pass through this high-risk zone called the Khumbu Icefall. A typical commercial expedition will involve between six and eight trips through the Khumbu Icefall. We wanted to just reduce our risk on that front. So what we did was, we planned out this whole other way where we went and climbed this other peak that was nearby that we viewed as a lower-risk climb than going through the Khumbu Icefall called Island Peak. We spent a good deal at the summit there, which is a little over 6,000 meters. We planned it out where we had one very long climatization trip on Mount Everest so that we could store gear, and we could get ourselves climatized. We only did one climatization trip, and then we did our summit push. To me, this was a fun planning effort. A lot of thought went into it, and a lot of preparation went into it. You can never prepare for everything. When we were on our final summit push, I had some issues with my oxygen mask not working very well, which we used starting at Camp 3. From Camp 3 to Camp 4, it exhausted me because it wasn’t working properly. I was able to fix it when we were resting at Camp 4. Camp 4 is 8,000 meters. It’s the start of what’s called the Death Zone, which is above 8,000 meters. You should try to minimize the amount of time that you’re spending. On our final summit push, we set out around 10:00 pm, and it took us a little while. We were moving a bit slower than we had planned. Mentally, there was a lot of thoughts that were going around in my head at this point of like, “Should I turn around? Do I want to keep going?” But I think having the comradery of my climbing partner there, a gentleman named Will Sayer. Just talking to him and his excitement was contagious. It reinvigorated me and got me re-inspired to push through and make it up to the summit. I think, also, once the sun came up, too, there was this new level of energy that re-energized us. We got up to the summit. We had a very, very beautiful summit day. We spent about an hour on the summit. It was beautiful blue skies, no wind, and just an incredible sight to behold from the top of the world up there. Then, of course, getting to the top is only half the battle. There’s a statistic — I don’t know how accurate it is, but they always say that 80% of the accidents happen on the way down versus the way up. People tend to let their guard down. They feel like their mission’s been accomplished. We were able to successfully navigate the down path, as well.

Alejandro: Wow! What an amazing experience, Chase! Definitely, it resonates with the life of an entrepreneur and the entrepreneurial journey. In this case, you go back home after conquering your dream, one of your dreams. Then you have a chat with who is now your co-founder. He was dealing with some stuff; you met him in high school. Tell us about those problems that he started to share with you and how you guys started to envision the future together.

Chase Lochmiller: Sure. My co-founder is a gentleman named Cully Cavness. Cully and I went to high school together in Denver. Cully came from a family that was involved in oil and gas. His father and his grandfather both worked in the industry. He went and studied geology at Middlebury College. He was a Watson Fellow traveling around the world studying global energy resources, everything from geothermal assets in places to coal power plants in China, and just the whole spectrum of renewables and hydrocarbon fuels. After that, he’s worked primarily in the energy sector. He worked on the investment banking side of the oil and gas markets with a boutique investment bank called Petrie Partners. Most recently, he was working as the Vice President of Finance Operations at an upstream oil and gas company called Highlands Natural Resources. While he was there, they had a position in the Denver-Julesburg Basin where they had drilled two great horizontal wells. It was a step-out area, which means a new discovery, almost. It’s a new area of the basin that’s being produced. They got these wells; they drove these wells, and they were online and operating and producing oil. They were really excited about it and felt like they had accomplished the hard part, which was landing those two horizontal wells in the Marcellus Shale. An issue came up where their gas offtake has fallen through. A lot of people don’t know this, but depending on various oil-rich or gas-rich areas, oil companies will drill wells in different areas that had different economic profiles. There are certain basins that are very oil-heavy places where the focus is trying to extract oil and make money from the oil production. Then there are other places like the Marcellus Shale, which is in the Eastern United States. It’s purely a gas plain. So you’re focused on trying to extract natural gas. The Denver-Julesburg Basin is an oil-heavy area, and similarly, you have the Permian Basin in West Texas, the Bakken in North Dakota and Eastern Montana. Their goal was to produce oil, but with that oil production, they actually produced a tremendous amount of natural gas as a byproduct. That byproduct became a nuisance for them where they didn’t have a pipeline to take that gas away from their site. If you don’t have a pipeline, and you’re producing oil, you can take the oil and put it on the back of a truck, and you can transport it to an oil refinery. But if you’re producing natural gas, and you don’t have access to a pipeline, you’re limited on what you can actually do to transport the gas. Typically, what companies do is something called flaring. Flaring is the process where they burn the associated natural gas onsite into the atmosphere with no beneficial use, and it creates a very large emissions footprint, and society as a whole isn’t able to benefit from any of this. It’s literally just being set on fire. When you look at this problem, it’s large in scope. There are about 14.5 billion cubic feet per day that get burned in this capacity around the globe. There are over a billion cubic feet a day that get burned in the United States, where we’re a first-world country. We have emission restrictions and this and that and the other. It is crazy that the U.S. is one of the largest offenders of flaring. But when you look at that from a power perspective, 14.5 billion cubic feet sounds like a really big number but putting it as something tangible if you could convert that into power using natural gas-fired power production or power plants, you’re talking about enough power to power the whole continent of Africa. This is a really substantial power resource. Cully was dealing with this challenge firsthand operating an upstream oil and gas company where he was having to burn this gas. He was getting pressure from a number of different places. He started looking at alternatives saying, “If I don’t have access to a pipeline, is there someone I can sell the gas to?”

“No, there’s no buyer.”

“Is there someone I can give the gas to?”

“No. There’s no service that you can give the gas to.”

“Okay. Is there someone I could pay to take this gas off my hands just so I’m elevated of this nuisance so that I can continue focusing on producing oil?”

There really weren’t any good options. After I came back from Mount Everest, we went on a climbing trip together up in the Rockies. He came to me with this problem. We started discussing it. My whole career, I had been focused on, between training large-scale machine learning models and working the Blockchain and cryptocurrency space where the consensus mechanism, in order to process and validate transactions on the Bitcoin network, for instance, called Proof of Work. It’s a very computationally-intensive process. In both of those aspects of my career, I had been focused on very computationally-intensive processing. He came to me with this problem. We put our heads together, and we came up with this idea of “What if we could take this very energy-demanding resource and compute and bring it directly to this very over-supply of energy nuisance and problem in the oil industry, which is flare gas, could we potentially solve one problem as another problem’s solution? That’s what we did. We started a company called Crusoe Energy. Crusoe builds these mobile modular data centers that consume flared gas onsite at the oil well. We’re now able to utilize the gas to power these very energy-intensive data centers.

Alejandro: Very nice. How are you guys making money?

Chase Lochmiller: We started the business around the first compute application that we were focused on, which was mining Bitcoin. Mining Bitcoin was a very unique application because 1) it creates an instant customer for us. Right now, the early business development for us was mostly focused on selling to an oil and gas company where we can find unique gas opportunities where they have excess gas and flaring issues. We can take the gas and solve a problem for them, enable them to produce their oil in a cleaner and more environmentally-friendly capacity. There are certain regulatory constraints that they’re under, as well, and help provide regulatory relief in that sense. Then on the compute side, mining Bitcoin enabled us to plug directly into this very large customer that is the decentralized global payment network in the Bitcoin network. When you’re mining, you get rewarded by the network for this validation in securing the network, so you’re validating transactions and securing transactions that are occurring on the network. You earn what’s called a block reward. That was our initial form of revenue stream. We also generate service fees from the oil and gas companies for providing the service of fire mitigation at their locations. As we’ve gotten bigger and as we’ve grown, we now have 22 data centers operating out in the oil fields and with a plan for quite a few more here in 2020. We’re hoping to get to 60 by the end of the year. As we’ve grown and as we’ve developed, we’re adding more functionality, and we’re building out other types of compute applications that can be supported directly in the oil field — things like training large-scale neuro-networks. We’re building high-performance compute artificial intelligence cloud to support those types of compute applications, and we’re able to do it at a very low cost because the primary cost associated with compute is energy.

Alejandro: Got it. For this, you had incredible high conviction. Talking about going into it, you went into it like the full leap of faith, all the way in. You literally covered the entire seed round of this. Is that right?

Chase Lochmiller: Yeah. I was super excited about this idea. I thought it was an awesome project to work on. It was a very unique thing because it’s very rare where you can have transactions occur where you have multiple people winning. This was the situation where you have a win, win, win where the oil companies are winning because they’re able to produce their oil at a more environmentally-friendly fashion, a more regulatory compliant fashion, and more efficiently. So it’s a win for them. It was a win for us because we’re able to produce some of the cheapest power in the entire world, which enables us to produce some of the cheapest compute in the entire world and reduce the cost of innovation more broadly. It’s also a win for the environment because we’re able to dramatically reduce the emissions footprint associated with producing oil. That’s something we’re very proud of as well. I was a big believer in this early-on, and I was excited about it. In order to get our initial datacenter built and the first pilot unit up and off the ground, I funded the first $600,000 of equity capital to get the business off the ground. This was a great setup for us because it enabled us to execute without having to worry about collecting a bunch of different small checks from a small friends-and-family round or a small seed round, and we could focus on just executing. We started the company in the summer of 2018. We had designed and rolled out our first datacenter. We got our first oil and gas partner in the Powder River Basin in Wyoming. We installed the datacenter just after New Year’s Day. We started on January 2nd, 2019. It was an interesting day. It was -17 the first day we arrived. It was really cold and a harsh environment.

Alejandro: For sure. How much capital have you guys raised to date, Chase?

Chase Lochmiller: Today, as a follow-on to that, we raised a 4.5-million-dollar seed round, which was basically the first time we took external capital. Then we raised a 30-million-dollar Series A at the end of 2019 and a 40-million-dollar project financing facility with a group called Upper90. Between all of those things, it’s a little over 75 million dollars. Our business is pretty CapEx intensive, so we’ve had to do equipment-lending as well. When you bring that in, it’s about another 20 million dollars.

Alejandro: Got it. So, obviously, you’ve got very sophisticated people. You’ve got Founders Fund; you’ve got Bain. What have you learned about fundraising?

Chase Lochmiller: What have I learned about fundraising? To me, it’s going through this whole process of entrepreneurship. It was incredible to see that if you have a great idea that solves a big problem. It’s incredible that the capital formation process exists, and you can get the capital together to make that idea happen. It’s hard work. A lot of it is having a good idea, having a good plan to execute that idea, and having a very clear path to execute that idea. Then, obviously, good storytelling is a major component of it.

Alejandro: Storytelling, for sure. Actually, this ties into the next question that I want to ask you that I typically ask the guests that come on the show — what a remarkable journey personally and professionally, too, as a founder, especially. Knowing what you know now if you had the opportunity to go back in time and have a chat with that younger Chase, and you had the opportunity to give that younger Chase one piece of business advice before launching a business, what would that be and why knowing what you know now?

Chase Lochmiller: What would it be, and why? That’s a good question. People always talk about how much work it is and making sure you’re ready for that. My wife and I had our first child in 2019. I look back on it, and I think — I’m very happy that I started the business before we had a kid because it was so time-consuming to start a business. Once I was already in it, we had a kid, and that’s incredibly time-consuming. It’s a great process, but it takes a lot of time and effort. I don’t know if I would have started a company right after having a kid. I was happy that I was already into it, and there was no way around it, but being prepared for the amount of work and the amount of commitment that you have to exhibit to make something successful I think is something I didn’t really fully grasp until I was deep into it.

Alejandro: I hear you. I hear you, Chase. For the folks that are listening, what is the best way for them to reach out and say hi?

Chase Lochmiller: We have info@ crusoeenergy.com. That’s a great way to reach out. We’re always interested in business development partnerships or new customers. We’re also hiring. We’re looking for talented distributive systems engineers to help us build a low-cost type of finance compute cloud of the future and many different roles that are available here at Crusoe.

Alejandro: Amazing! Chase, thank you so much for being on the DealMakers show today.

Chase Lochmiller: Thanks for having me, Alejandro.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at al*******@**************rs.com.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More

Facebook Comments