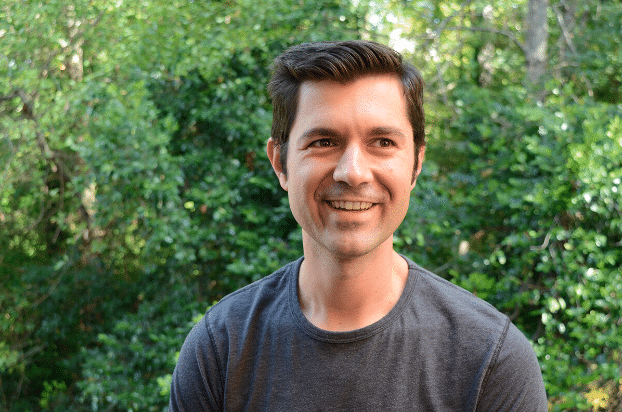

AJ Piplica has raised some serious money for his startup that could be a part of a new era of transportation and social interaction. The venture, Hermeus has attracted funding from top-tier investors like Sam Altman, Peter Thiel’s Founders Fund, In-Q-Tel, and Khosla Ventures.

In this episode, you will learn:

- Startup fundraising

- Scaling company culture

- AJ Piplica’s top advice before launching a business

SUBSCRIBE ON:

For a winning deck, take a look at the pitch deck template created by Silicon Valley legend, Peter Thiel (see it here) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

*FREE DOWNLOAD*

The Ultimate Guide To Pitch Decks

Moreover, I also provided a commentary on a pitch deck from an Uber competitor that has raised over $400 million (see it here).

Remember to unlock for free the pitch deck template that is being used by founders around the world to raise millions below.

About AJ Piplica:

A.J. Piplica is the founder and Chief Executive Officer of Hermeus Corporation, where he leads a team focused on connecting the globe through the development of the world’s fastest passenger aircraft.

Prior to founding Hermeus, Piplica served as CEO of Generation Orbit Launch Services, Inc. In this capacity, he led the inception and development of the X-60A, a US Air Force X-plane.

Piplica has a strong background in aerospace systems design, including spacecraft; launch vehicles, and hypersonic aircraft. He holds both Master’s and Bachelor’s degrees from the Georgia Institute of Technology focused on aerodynamics and fluid mechanics, supplemented by a certificate in entrepreneurship.

See How I Can Help You With Your Fundraising Or Acquisition Efforts

Connect with AJ Piplica:

Read the Full Transcription of the Interview:

Alejandro: Alright, hello everyone and welcome to the deal maker show. So today. We have a very exciting fun that we’re gonna be talking about racing in covid we’re gonna be talking about building scaling. Running out of runway with like term sheets falling apart I mean it’s gonna be full of adrenaline today. So hopefully you’re all ready to get inspired so without fartherdo. Let’s welcome our guest today aj piplic I welcome to the show.

AJ Piplica: Hey good morning Lara how are you.

Alejandro: Very well very well so give us a little bit of a walk through memory lane a j so how was life growing up, tell us about being born in port in portchester and then going all the way to Tampa what.

AJ Piplica: Oh yeah so yeah I was born up in up in New York I grew up there in the kind of white plains area moved down to Florida when I was around 6 with my parents. Um, funny enough I found out just a few years ago I thought I thought we moved from my dad’s job. Ah, turned out. We moved for a startup that failed a couple months later so I guess I had entrepreneurship in my blood I didn’t even know it? Um, but yeah I grew up in the Tampa Bay area down in Florida went to high school down there. Um, and came up to georgia tech for for college in 2005 um, focused in aerospace engineering kind of always like building things and and really always like the future and and Airospace for me was kind of the the nexus of you know technology and and people and and you know really got me excited I wouldn’t say that I knew exactly what I was getting myself into and you know showed up first day of ah introduction to aerospace and. Everybody’s listing off all their favorite airplanes and I’m like I watched http://startrek once it was cool. Um, but yeah, no grew on me very quickly did a couple co-op tours down at Nasa Johnson space center down in Houston Texas worked on everything from the. Shuttle wing leading edge impact detection system all the way through ah lunar lander plume andingement figuring out where dust goes when you land on the moon to understanding the aerothermal environment around the space shuttle when it’s reentering and and that experience really got me kind of hooked into aerodynamics and and Hypersonic specifically. Um, you continue that through undergrad and move forward to working at a company called Spaceworks here in Atlanta after I graduated while I was while I was doing my master’s work and did a lot of work and hypersonics worked on a number of reusable launch vehicle programs and hypersonic aircraft development programs. In the early stages and that kind of really solidified. You know the fact that think hypersonics was was really where my passion line and then where I wanted to you know p apply my trade. Um, and yeah you know had an opportunity there to. Ah, you know grow outside of of just engineering into the business world. You know an opportunity to to run a subsidiary company called generation orbit and it took a couple years to get the company off the ground and they’ll build it up to you know about 20 people or so and. Ah, did did quite a bit of a bit of development there on the x six a hypersonic flight test bed so took ah.

Alejandro: And and at what point at what point do you realize because I mean obviously here you are you know you’ve been at it now in in the corporate world for for you know more than a decade and you know making that leap of faith into entrepreneurship is not Easy. You know it takes quite a bit. So So what was that process like for you.

AJ Piplica: Yeah, yeah, so you know I think ah my time at generation orbit was was really formative for me. It was from ah from a management perspective I had all the responsibilities of a startup founder without really the the risk. So it was it was it was an entrepreneurial experience given that kind of it. It was within the confines of another company. So I think that that really gave me the chance to explore and learn through how how to be you know a professional that’s leading a company. Um. And you know how to hire. Ah, how to build a team how to execute how to sell all of those things had opportunities to learn and and like frankly fail a lot along the way and that I think really kind of helped helped kind of form who who I became you know as we. Ah, you know left generation orbit and and went to found hermeus but you know it was that is that generation orbit where I found and and met my cofounders and I hired all of them from from different places throughout the commercial space world and I learned so much from them given that you know I’d never worked at Spacex or or blue origin. Um, but together you know for about 3 years building generation orbits. You know we had the opportunity to be in the trenches together build a company builds builds a you know product and really drive. Ah a really strong bond that I think gave us gave all of us the confidence that you know we could. Jump off a cliff together and and try to build an airplane on on the way down when it came to hermeus. So yeah I think it was it became pretty clear to all of us that there there really isn’t a technical problem that we couldn’t solve. Um, we just needed to make sure that we’re solving the right ones. Ah together and and yeah I think we we found that in in Hermius.

Alejandro: And how did you land into knowing that you were solving the right problem and how did it become show evident to you all that you needed to to get started and get to work on this. So.

AJ Piplica: Yeah, so there were kind of 3 major things that that we that we noticed when it came to to founding hermia so number one we realized that the technology necessary to build a hypersonic aircraft was mature enough at least at the component level to get started. Today. It was really an engineering challenge. Not a science science challenge. So at mack five at least I don’t I don’t think these assumptions hold if you go much faster frankly, even much slower but but in the none to None range. You don’t need to invent new materials. Don’t need to invent a new propulsion cycle or anything like that. The trick is really how you design the fully integrated system to be able to to fly the mission so you know that that realization I think was was pretty clear and you know applying. You know to the different markets that that we had ahead of us. So obviously like you know flying passengers is the ah you know the long-term goal for for what we want to do and that has guided every decision that we’ve made along the way. It’s pretty easy to take a look at um, you know the the passenger market between. Major cities that are that are near the coasts both in the atlantic ocean and the pacific ocean and understand that like yes that that market is very very large and can sustain not just one company building highs speed airplanes but probably many so that that was that was like. Quite obvious. There’s there was a point where I think when when we’re pitching I can’t remember if it was our our seed round or our series a but we used to have a chart in our pitch deck that was like this is the market for hypersonic passenger travel and ah we ended up taking it out because everybody we get to that chart and everybody’s like this is obvious keep going. So the the next real question that kind of came back to the beginning was like okay if the market is obvious. What’s what’s the challenge here and and this is kind of like maybe heretical for an engineer to say but like the the technology problems are hard but the financial problems are harder and that’s really where you know the key to the whole kingdom here is is. How you bridge the financial value of death from you know, being able to raise say hundreds of millions of dollars to bring in the billions of dollars that are necessary to design build certify and produce. Um, you know a new aircraft that that’s never been built before. Um. And yeah, we weren’t we realized we weren’t just going to raise billions of dollars of private capital to do it. We needed in another way and and you know none of the 4 of us are billionaires to start out with so we had to do it the hard way and that meant solving really important problems for customers. But the pieces of technology that we were building along the way and the the military or defense applications for.

AJ Piplica: Ah, specifically autonomous hypersonic aircraft is is where we found that solution and we realized that you know that gave us I think a good a good truckk of confidence that that we could get there at the end of the day and then finally on the private capital side. We’d seen massive amounts of capital going to a wide range of different aerospace projects where we’re in this crazy. Aerospace renaissance today not just in hypersonics. But in launch and satellites and ev tall hydrogen aircraft sustainable aviation fuels all of these these great things people used to ask me like what decade. Do. You wish you lived in and my answer used to be the 50 s but it’s now. Um, it’s definitely now. There’s there’s really no better time to to live and work in in the airspace world than than right now. So you know those 3 things together the technology the defense market and and private capital being available. We’re ruled the 3 things that drove us to to found the company when we did.

Alejandro: And in terms of the business model for the people that are listening to really get it. What ended up being the business model here. How do you? How do you guys make money.

AJ Piplica: Sure so it kind of changes that evolves over time but kind of like lay out the the road map here from tech d risking and then from a kind of build it back up on the business side so you the the long-term product that we want to build is is an aircraft called halcyon so. It’s a. Passenger aircraft carries about 20 people crosses the atlantic ocean in about 90 minutes so the business model for that one is is very much like ah you know an airline oe air and aircraft oe like boeing or an Airbus where you’re building aircraft you sell them to airlines airlines operate them and you support maintenance along the way. Um.

Alejandro: Wow 19 minutes so that’s 90 minutes compared to how long does it take now for the people listening 7 hour wow at some bull you and then please please keep going keep going. You were saying.

AJ Piplica: About seven seven hours yeah yeah Yeah, um so you know in order to get there. Yeah, we we be naive to try and just build a you know 20 passenger mock None aircraft right? Off the bat. So the the first step for us is is building an aircraft that can. Get up to mok 5 and get back so something that can that can be go to high speed and and be reusable that aircraft is called quarterorse. So we’re in the in the process of of designing building that aircraft right now and testing the propulsion system for it but the business model around it is None of flight tests. So it’s ah it’s very expensive to. Ah, get data from you know, mock None plus flight conditions I think the going rate today is somewhere between none for None flight where you might get seconds of data and you don’t get your payload back. So um, if ah if you can bring reusability to the game there. And allow researchers and and people ah you know, developing technology to to fly in hypersonic conditions if they can do that more frequently and significantly less expensively. Then there’s a pretty good business there so that for us is is more of a services model where we build the aircraft we operate the aircraft. Ourselves for research and development purposes and then you know the product that’s delivered at the end of the day to our customers is is the data so kind of it’s it’s almost like a a launch services model where instead of putting a payload norbit. We’re putting a payload in a particular flag condition but giving it back to to our customers. Um. And then the the next step for us is ah, kind of the the bridge between quarterors and and halcyon is an aircraft called dark horse so we haven’t talked too much about what it is but but really it is it is focused on proving out the long duration high-speed flight challenges. So yeah, while quarterhorse just gets up to high speed and comes back dark horse will actually Cruise. Um, and with that. Well we’ll have kind of proven out all the all the things that are necessary to you go develop halcyon but dark horse you know has some really unique defense applications and the business model for that. Can you know range from you know, a couple of different couple different things. Ah, that we haven’t quite decided on yet. So but you know we’ll eventually bridge from kind of owner operator from at the quarterhorse level to you know oem and and maintainer at the calcon level.

Alejandro: And in terms of I mean you were alluding to this earlier I mean obviously you guys went at this and and you were you were not like billionaires right? So I mean how have you gone about them capitalizing the business. How much have you rate.

AJ Piplica: Yeah, so yeah, so yeah we’ve obviously relied pretty heavily on on venture capital and and we’ve got a really fantastic group of investors who’ve who’ve joined the team over the course of the past three years so to date we’ve raised about none you know names on our on our cap table include costla ventures so they let our sea drowns canan partners let our series a and Sam Altman let our series b along the way that also had other or other firms joined qely sorry including Inkytel and Rayon Technologies ventures as well as a number of other small firms and individual investors. So yeah, over the past three years we’ve been really really lucky with with the partners that have have decided join us on this journey.

Alejandro: And very lucky too on the seat round because you guys were about a month away from turning the lights off. So so what happened there? What happened there without term sheet falling apart.

AJ Piplica: None oh yeah, so yeah, you know building a startup and fundraising around it is is very much an emotional roller coaster. And yeah, there’s there’s a specific week that I remember very vividly. Ah, where you know we we just brought in a group of advisors Rob Myerson who formerly ran blue origin Rob Weiss who ran skunk workss at Lockheed Martin keith Mazbak who’s been all over the intelligence community and George neils he used to run the fa commercial space transportation office. So some like. Incredibly respected people who um, you know we had somehow convinced ah you know to join us as as advisors. So we gotten everybody together is you know, really really great couple days and you know we were negotiating a term sheet at the time for our seed round investment and so we went from this really big high to. At the end of the meeting I got an email that the firm that we were working with was was pulling out. So just a huge huge low and at this point we were maybe one or two months away from you know, running out of you know the the runway that we had you know, negotiated with our families at the time you know before we had any money so you know. Quit our relatively good paying jobs and gave ourselves six months to approve some of these hypotheses that that we had correct and we’re getting pretty darn close to the to the end of the line there and um, we we kind of had to take ah a mental health day and during that day. We we kind of decided to take a little. Ah. Page out of the airbnb playbook. So if you kind of go back and look ah airbnb before they were airbnb that as we know them today. They’re again trying to like keep the company going and and they came up with this idea for Obama owes which is like a serial to like you sell and make money to keep the keep their dream going. So. Ah, for us, we kind of so this myself and and 3 other co-founders broke up into 2 groups Mike Mike and myself ah hashed out a business model for a homon cart. So my my dad had had gotten a a leg of Homon Serrano at Christmas time from his company and. Yeah, my mom didn’t want it in the house so she sent it up to us and you know that that kept the 4 of us fed and and alive for a couple months as we’re going through this process and we realized hey the margins on Homon Serrano and and Homon Embetico are are actually quite good. So um, yeah, we we like designed out a cart There’s a whole you know, spreadsheet model for.

AJ Piplica: ah you know ah we figured out. We learned a lot more about permitting in pimont park here in Atlanta for services than we ever thought we would building a hypersonic airplane company but it turns out can actually be a pretty good business and in the meantime Glenn and Skyler were off working a separate thing. Always good to diversify. Ah, so their their thing that they were pursuing was basically putting a hot tub in the back of a truck and driving it around people kind of like the you know pedal taverns that you have in different places and they had just been up to Nashville so their idea was called get Wet Nashville and yeah so good thing that that only lasted a day and I think the day after that we got a call from. Ah. Folks at at costla venture saying hey we’d love for you guys to come out and and chat with the team so that was a crazy roller coastaster of of a week and you know that ended up being ah you know being the folks who who let our seed round and you know talk about bring it down to the wire. We close the rounds. Ah, like the dollars hit our bank account I think like six thirty Pm on the last day of that like last month of the six months so like mortgage payments are due the next day student loan payments to do the next day were like ready to submit job applications. It was about as down to the wire as you could imagine I was like.

Alejandro: Wow.

AJ Piplica: I was on stage pitching at a pitch competition at the time. Ah and which I actually lost So Um, and which is funny because the the folks who did it which was Revolution Rise of the rest of steep cases fund. They actually ended up investing later in the seed round. But yeah, so it was it was. Definitely an emotional roller coaster. But very glad to to get that done get some money in the bank and get rolling.

Alejandro: And all that money that you guys have raised so you so you were alluding to it one ah 20000000 plus how has it been like for an aerospace same type of company like what is the what is that journey from going from one cycle to the other you know and and and how do the expectations vary from one cycle to.

AJ Piplica: So yeah. Sure. So um, you know I think the way that I’ve I’ve kind of learned to think about it is really really from a perspective of of risk so you know as as you’re raising capital for a very hardware-intensive company that you know is not going to have a product for for some time like you’ll need to raise multiple rounds of of capital.

Alejandro: Next next.

AJ Piplica: Ah, before you’re able to get a product out to customers. Um, really requires that at each stage you’re buying down significant risk and there’s kind of 3 main categories for risk from a venture capital perspective. There’s there’s team risk. There’s tech risk and there’s market risk and and usually investors are willing to take one out of those 3 um, and yeah for a deep tech startup that place is going to be in the technology. So that means you can’t have market risk and you can’t have team risk so for us that that’s kind of how it laid out like the technology and and demonstrating that you know what we wanted to do was was possible and that it could work is really where the the risk lies. So. And at each stage you know where we raised capital from our seed route or series a and and now to our series b each of those those chunks of capital came in with a plan for hey this is a technical risk that we’re going to buy down with with what we’re bringing in this is where we’ll be when we’re done with it and this is why you know this will get us to a point where we’ve reduced enough risk. To raise the next round of capital so in our seed rounds. You know that technical d risk was demonstrating that the architecture for the engine that we’re building works so you know taking an off-thes shelf gas turb engine integrating a ah ram burner on the back of it and and showing that you know you could. Operate over the full range of you know, not moving on the ground to you know mock 4 to 5 up up at high altitude doing that at subscale was was kind of what we had had laid out to do and we did that in about nine months with none during the seed round and and that you know led to our our series a which focused on kind of demonstrating the. Ah, government market piece of that as as well as scaling up the engine technology to you know scale that can actually fly and then now with our series b it’s taking that engine technology putting it into an aircraft and and actually demonstrating it in in flight and of course continuing to you know scale things on the team and and the business side as well. So. Yeah, you know each each time you’re you’re up in the ante in terms of you know the the stakes the risk and everything and it really forces. You know you as an individual as a founder and as a team to to kind of look in the mirror and say what do I need to do to grow and and be successful at this and most of the answer to that is like. Try and fail a lot along the way. Um, and you know surround yourself with ah yeah, with with people who are you know like number None better at you better than you at at as as many of the things in in your repertoire as you can get and and folks are committed to the you know the long term vision of the company.

Alejandro: Um, and how was racing in covid.

AJ Piplica: Yeah, raising ah, raising capital for an aerospace company like a transportation company in the in the middle of a global pandemic ah was ah was quite a hoot I think so we we started in February of 2020 which is kind of right before you know everything kind of locked down here in the United States and we got through you know the none round of pitches and and right at the end of it we had like we’re in San Francisco we’re based in Atlanta. So yeah, we’re traveling out to San Francisco and even over the course of a week we went from you know in-person meetings. Everything like regular to by the end of the week Ah everything was virtual which which was kind of crazy. So luckily we had completed all the the testing and everything that we needed to do ahead of that. But um, yeah, so now we we transition from ah you know in person to you know the entire world was was virtual. Yeah, there was. A part of our pitch where we used to say like you wouldn’t make an investment like this over Zoom would you we stopped saying that because yeah, everything everything in kind of how investing was done and and the world changed. So yeah, we we kind of pulled back a little bit as ah, you know the the pandemic started to to ramp up and and we all kind of. Figured out what what was going on and and how the world was going to be um and kind of refactored what we were you what we’re pitching for and and you know what the next step for the for the company was and you went back out later in 2020 toward the next the third third Quarter yeah lit lither quarter. Um. And yeah I think over the course of the process. We I think had like 69 nos um, which yeah you kind of get used to that you have to develop a a pretty thick skin and you know try to extract as much kind of feedback and value and and you know be introspective about what you but you hear back from folks and iterate based on based on that. Um, but it only takes one yes at the end of the day and and that yes was from ah you know rich boyle and his and his team at at Canin And Partners so yeah they’re very excited about about what we’re building and you know just like just like Kosa ventures who you know had had. Multiple experiences with deep tech airspace companies in the past from starbuck or skybox imaging to rocket lab. They kind of understood you know both the amount of capital that’s required for these things. How long they take what the risks are and we kind of spoke the same language which is very much very much the same with with rich and and cainan. So um. Yeah, you know, very very happy to get there at the end of the day and I think it was ah you know October twenty twenty um I was ah my my wife was due with the none child at the time and it was like all right guys we need to close this before I’m a dad and yeah, so thankfully we we did get that done as well. I didn’t have to do too much.

AJ Piplica: Emailing well delivery. But yeah, yeah, and you know since then it’s it’s been nothing but nothing but growth.

Alejandro: Now for the people that are listening to really get an understanding or perhaps the scope and size of the company I mean anything that you can share on maybe like number of employees or anything else that you feel comfortable sharing.

AJ Piplica: Yeah, so we’re we’re about about None or so at this point here and in 2022 and you know we’re going to get up to around None or so by the end of the year and you know assuming you know things go kind of green lights to Malibu as as fast as we as we expect and we’re prepared for you know the company could. Ah, kind of continue to double on an annual basis. So you know at the beginning of 2020 we were None people None people. So just in that year I think we we doubled and then in 2021 we tripled? um. And you know again, you know doubling this year so yeah quite quite a bit of growth and and that’s you know, always been a challenge to kind of scale. Ah you know, kind of the culture and everything as as things grow. Ah yeah, there’s there’s no real easy solution.

Alejandro: And how do you scale culture.

AJ Piplica: Other than kind of being authentic, being honest about it talking about it a lot but by all, but but more than anything living it like you can write whatever nice words up on the wall that that you want that define the culture that you want to have but. I’ll you know hearken back to Ben Horowitz’s second book which is you know what you do is who you are and you know there are only so many ways that a company can you know take actions. But when it comes to the culture. You know it’s it’s like who you hire who you promote who you let go. And and how you kind of you know, help people grow within the culture that you want and you know for us we were very very deliberate upfront about kind of defining the culture that we wanted you know from an engineering perspective. You know, very hardware- focusedcu vertically integrated pushing to integrated hardware and software systems as quickly as possible. Testing iterating. You know, not sitting in analysis land for you know for years and years and then doing so you know with ah you know, kind of elements of speed really strong decision making that’s grounded in none principles and system level understanding. Driving accountability to the to the very lowest levels in the company and doing in in doing so distributing. The context is necessary to make good decisions at at those levels. Um, all of that kind of pulls together and you know at the end of the day. It’s it’s like literally making sure you you were doing the things that that you want to be and and of course it’s it’s talking about it as well. And. And sharing stories. And yes we have a number of different parables that we’ve kind of you know, written that kind of embody the the culture that that we’re trying to build and you know there’s you know all of our conference rooms here are names kind of silly things that nobody knows about but they’re they’re good little icebreakers like we have. We have one called wou. So. People come in for the none time for like an interview. They’re like why is this conference room called wu it’s like well we always want to remind ourselves to celebrate the little wins along the way. So yeah, so all sorts of things like that some some little things but at at the end of the day. it’s it’s it’s what you do.

Alejandro: Now in terms of um, you know the future here I mean imagine that you go to sleep tonight and you wake up in a world where the vision is fully realized for the company I mean what? what does that world look like.

AJ Piplica: Well I’m definitely waking up in my own bed and not on an airplane I could tell you that um no I think ah one of the things that they you know again at the beginning really really drove us to go out and and take these risks and and go try and achieve this was that the implications if we were successful. Massive. So if you like you look back in history at at when transportation networks have accelerated when rome built out their roads when we switched from sail power to steam power marine shipping when you know went from or when China put in high-speed rail and none century. They’re all accompanied by. Massive social and economic growth. So social growth from exchanging of ideas building stronger relationships and bonds between people more quickly from an economic standpoint like multiple single digit points of gdp growth in the affected regions now we haven’t had an acceleration of transportation at a global level since the dawn of the jet age. You know, 70 you know, sixty seventy years ago now we’ve been moving around the world at Bach point None which means there’s like this latent potential to humanity that can be unlocked if we can move around the world faster and I think we’ve all seen as we’ve gone through this. Um you know this pandemic over over the past couple of years that you know really kind of going to you know, live with live with this for a while um the face-to-face interaction really matters. You know there’s there. There is definitely a lot that is lost and in you know, working over a you know Zoom or a teams call or whatever and you know it’s through those face-to-face interactions that that we grow the most as as human beings and and as a species. Um. And you know that is a world that I want to live in and that I want my children to live in. You’re not to mention even you know the the national security applications of the technology. It can be ah, an immense deterrent. You know to to large-scale conflict and yeah, we. As we’ve seen with with what’s going on in in Ukraine right now we’re probably going to need more and more of that going forward. So yeah, if we can solve defense problems accelerate the world and and unlock the potential of humanity that’s something worth pursuing.

Alejandro: Now Imagine Aj that I put you in a time machine and I bring you and I fly you back in time. Okay, and I and there you go there, you go and I fly you back in time and to a moment where you know you’re able to have a chat with your younger self and then you’re able to tell that younger self.

AJ Piplica: Oh that That’s the next that’s the next product.

Alejandro: Or share with that younger self one piece of advice before launching a business. What would that be and why.

AJ Piplica: Oh man. Well I think I think in my case specifically I would have said go build more while you’re while you’re in school go explore more like I I did I did a little bit but um. You know I see the opportunities that young folks have today you know folks who are coming in as as interns and you know the the ability to kind of spread your wings and and try all of these different things in different areas I mean I kind of iterated a little bit but not nearly as much as as I think I could have and that that. Breath of experience is so so critical and I got a lot of that when I was at spaceworks because I you know got to work on concept development for all these different things. Not just you know aircraft and and rockets but electric propulsion systems and all these crazy things. Um, but was at the conceptual level I wasn’t it wasn’t building or designing you know anything that was going to happen in the in the real world. Um. So you know I always encourage students today like take on as many as many challenges as you can where you’re going to go from you know concept on the back of a napkin to something moving in the realw world because through those kind of full lifecycle projects. That’s how you really learn how to engineer and and design. Ah, good systems that are going to be robust and and how to do so in in a collaborative and and team environment. And yeah, that’s something that’s I definitely wish that that I’d done more ahead of head of starting company

Alejandro: And Aj for the people that are listening. What is the best way for them to reach out to say hi.

AJ Piplica: Oh Twitter yeah, so you can find me on Twitter I think it’s at ajplica. Um, and yeah, if ah if folks are you know, interested in in working on hypersonic airplanes here in the states. Um, absolutely you know, check out the careers page at the on ah on the hermeus website. You were always growing and I was looking for really talented folks who want to have a major impact and change the world.

Alejandro: Its amazing. Well thank you so much. A J for being on the dealmakerr show. It has been an honor to have you with us you.

AJ Piplica: Pleasure. Thanks so much.

* * *

If you like the show, make sure that you hit that subscribe button. If you can leave a review as well, that would be fantastic. And if you got any value either from this episode or from the show itself, share it with a friend. Perhaps they will also appreciate it. Also, remember, if you need any help, whether it is with your fundraising efforts or with selling your business, you can reach me at [email protected]

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Google Podcasts | Spotify | Stitcher | TuneIn | RSS | More

Facebook Comments